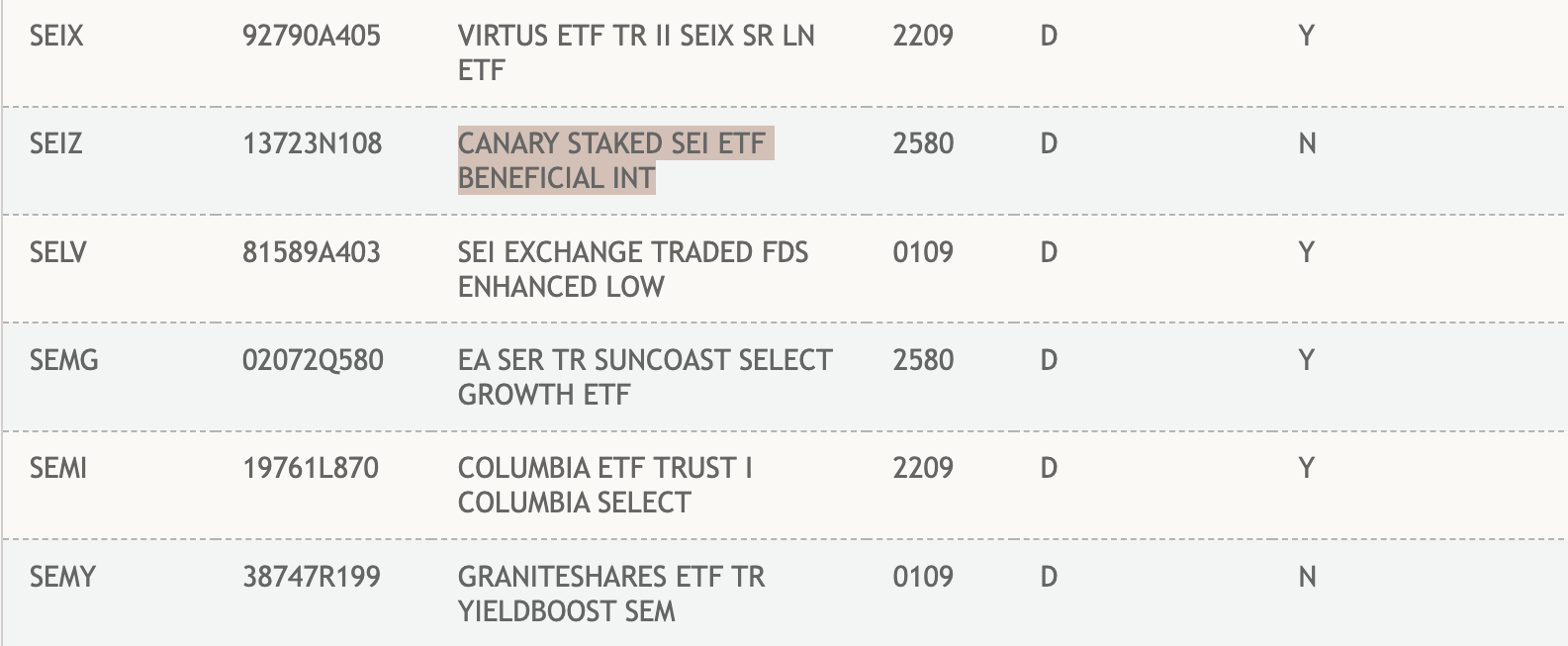

Big news, folks! 🤩 The Canary Staked SEI exchange-traded fund (ETF) has officially landed on the Depository Trust & Clearing Corporation (DTCC) platform! 📈

Now, don’t get too excited just yet – this doesn’t mean the US Securities and Exchange Commission (SEC) has given it a thumbs up 👍. But, it’s a significant milestone, and market watchers are taking it as a positive sign 🌟.

Canary’s Staked SEI ETF Joins DTCC List

According to DTCC records, the product is currently chilling in the “active and pre-launch” category 😎. This means it’s all set for future electronic trading and clearing, pending – you guessed it – SEC approval 🤔.

Now, here’s the thing: the ETF can’t be created or redeemed just yet, so it’s still non-operational 🚫. But, this listing is a standard step in the ETF deployment process, and market participants are taking it as a sign that the issuer is feeling confident 💪.

“DTCC handles the behind-the-scenes clearing and settling for most US stocks and ETFs. Meaning this puts the SEI ETF into the usual pipeline before it shows up on brokerage platforms. Once the market sentiment turns around, SEI is going to be a big runner,” an analyst noted 🏃♂️.

Canary Capital filed an S-1 earlier this year to introduce a staked SEI ETF 📝. At the time, the SEC was being super cautious about staking mechanisms in exchange-traded products 😬. But, things have changed now!

BeInCrypto reported that the US Treasury and Internal Revenue Service dropped Revenue Procedure 2025-31 📚, establishing a clear safe-harbor framework for crypto ETFs and trusts that want to engage in staking and distribute rewards to investors 🤑.

This procedure lays down some strict conditions 📝, including holding only one type of digital asset plus cash, using qualified custodians for key management, maintaining SEC-approved liquidity policies, and limiting activities to holding, staking, and redeeming assets without discretionary trading 🤝.

Moreover, these guidelines resolve prior tax ambiguities 🤔. This could potentially pave the way for SEC approval of staking-inclusive products, such as Canary’s SEI ETF 🎉.

And, it’s not just Canary – Rex-Osprey has also filed for a staked SEI ETF 🤝, and 21Shares is seeking SEC approval for an ETF focused on the SEI 🔍. This reflects broader institutional interest in gaining exposure to the Sei Network 📈.

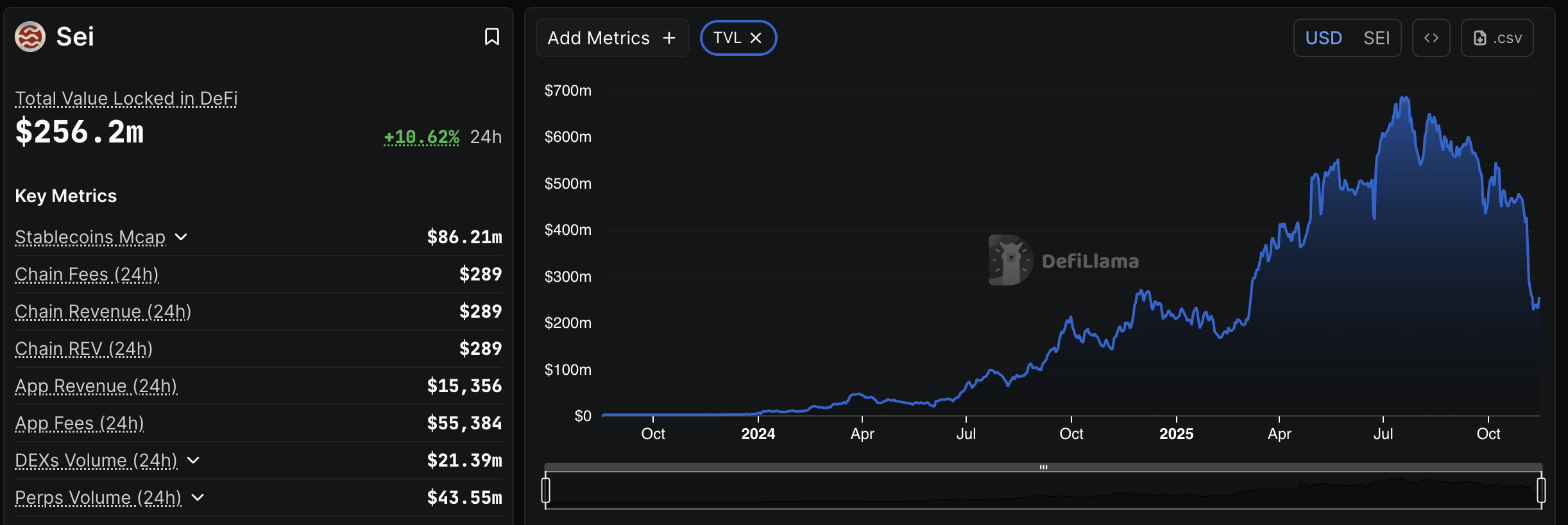

SEI Climbs in Net Flows Even as TVL Suffers

Meanwhile, Sei is experiencing some strong capital movement 💸. According to Artemis Analytics, the network currently ranks second in net flows over the past 24 hours, with inflows making up the majority 📊. This trend suggests that investors are rotating into SEI despite broader market volatility 🌪️.

Analysts are also getting optimistic about SEI’s price potential 🚀. ZAYK Charts noted that the altcoin is completing another falling-wedge cycle, arguing that a breakout could trigger a 100-150% rally 📈.

$SEI is holding on to this major support level.

Expecting a strong bounce here!

– Mister Crypto (@misterrcrypto) November 13, 2025

However, on-chain data paints a more complex picture 🤔. Figures from DefiLlama reveal a steep contraction in the network’s total value locked (TVL) during November, representing the largest decline in nearly two years 📉.

Approximately 1 billion SEI tokens have been unstaked, reflecting an accelerated rate of user exits from the ecosystem 👋.

So, for now, this listing is a procedural but meaningful signal that the pathway toward institutional SEI exposure is beginning to take shape 🌐 – against a backdrop of both recovering inflows and lingering challenges within the network 🌪️.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- BONK Falls, Pump.fun Reclaims Throne – Can BONK_FUN Fight Back?

2025-11-14 10:07