In a delightful twist of financial fate, Solana and XRP ETFs are basking in the glow of perpetual inflows-think of it as the financial equivalent of a party that refuses to end-while Bitcoin and Ethereum ETFs are busy hemorrhaging cash faster than a dropped champagne glass at a palace ball. Cheers! 🥂💸

- The darlings of the digital realm, Solana and XRP, keep charming investors with their irresistible allure; meanwhile, Bitcoin and Ethereum politely purge their portfolios with three and four days of continuous outflows. How quaint!

- Bitcoin and Ethereum ETFs succumbed to a veritable flood of red ink, pulling nearly $670 million out of the coffers on November 14 alone-because apparently, everyone decided gold was too last season.

- Solana’s momentum refuses to wane, and XRP decided to make a dramatic entrance with a stunning $243 million inflow, just in time to steal the limelight from the hemorrhaging giants.

Bitcoin (BTC) ETFs gouged out $492.11 million-no use crying over spilled blockchain. Ethereum (ETH) was not far behind, with $177.90 million in redemptions-because nothing says ‘trust me’ like a collective exit stage left. Solana (SOL), that resilient sprout, posted a modest $12.04 million in inflows, entertaining hopes of staying afloat amid the chaos. And XRP? Its second day of trading brought in a hearty $243 million for its debut-showing that not all that glitters is liquidated.

Bitcoin and Ethereum ETF bloodbath continues-grab your popcorn!

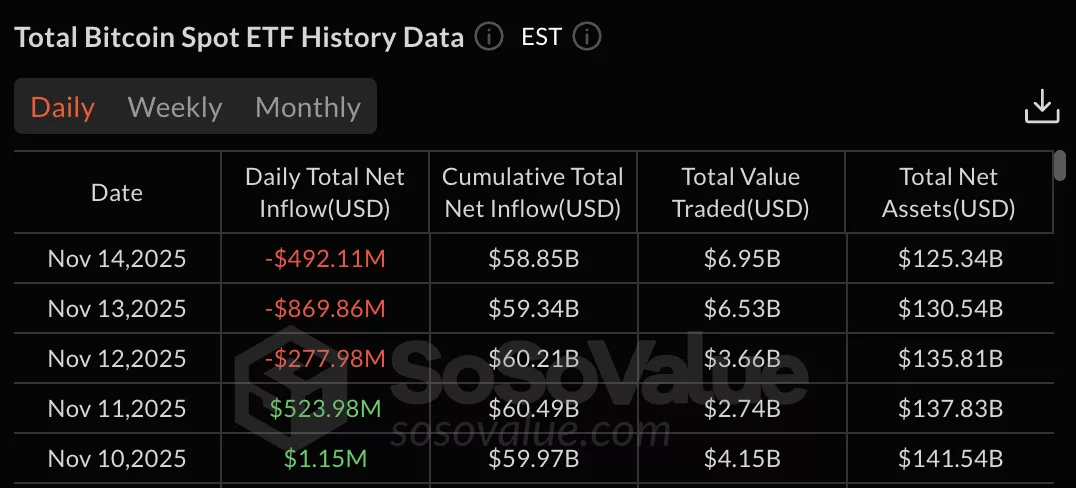

Data from the illustrious SoSo Value reveals Bitcoin spot ETFs have embraced their inner drama queens, with three days of relentless withdrawals. November 13 was the pièce de résistance, with a staggering $869.86 million exit-surely a record in the art of financial heartbreak.

Following closely was November 14, bleeding out $492.11 million, and November 12, with $277.98 million-a veritable massacre. Prior to this, a brief warm spell of inflows on November 11 ($523.98 million) and November 10 ($1.15 million) provided false hope.

All in all, Bitcoin ETFs have amassed a dizzying $58.85 billion in total net inflows, with total management assets reaching an impressive $125.34 billion-because apparently, people really do love watching their money vanish.

Ethereum, not to be outdone in the tragedy department, suffered four days of outflows-no poetic license needed here. The biggest hit was $259.72 million on November 13, with cumulative withdrawals reaching proportions that would make even the staunchest hodler weep. Yet, despite this, Ethereum’s total net inflows sit at a respectable $13.13 billion-proof that even in chaos, there’s a silver lining.

Solana sprinting ahead; XRP’s grand entrance-oh, the drama!

Solana’s ETFs, that miraculous phoenix, have diligently amassed $12.04 million on November 14, adding to earlier inflows like a dedicated leprechaun chasing rainbows. Their total net inflow? A tidy $382.05 million-well done, Solana! Total assets under management now sit at $541.31 million-because who wouldn’t want to bet on the little guy?

XRP, after its silent debut, exploded onto the scene with $243.05 million inflows-proof that sometimes, silence is not only golden but also highly liquid. Its total assets after just two days? A modest $248.16 million-an impressive feat in the art of sudden appearances.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- Brent Oil Forecast

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- EUR HKD PREDICTION

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

2025-11-15 18:19