By gum! The stablecoin sector took a two-week tumble, with $1.244 billion – about 0.41% – slipping out the door like a thief in the night. That dip tags along right after the previous week, when $1.925 billion quietly vanished from the pile. When the stablecoin pool shrinks like this, it usually signals capital tiptoeing out of the crypto arena and into fiat or other corners of the market – like folks sneakin’ off to the bar for a stiff drink. 🍸

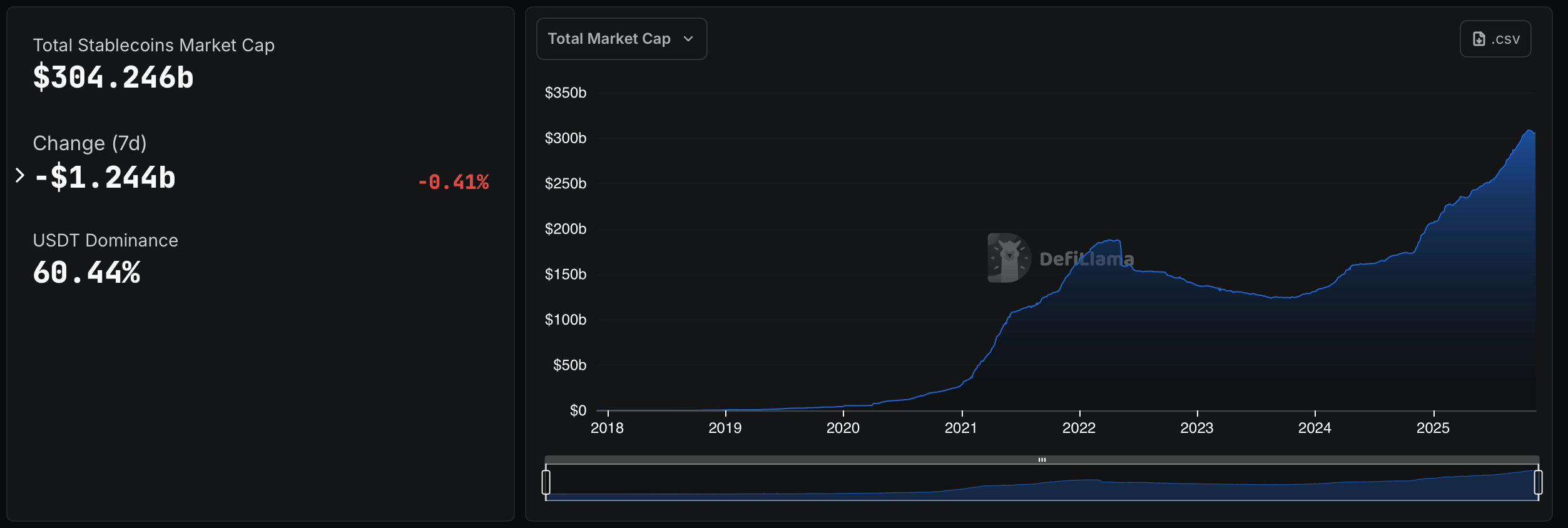

This weekend, stablecoin data from defillama.com pegs the fiat-pegged economy at $304.246 billion following the week’s 0.41% reduction. Over the past seven days, the stablecoin sector delivered a full spectrum of mood swings. Tether’s USDT, still standing tall as the heavyweight at $183.896 billion, squeezed out a modest 0.16% lift – the kind of move that barely gets a nod, like a yawn so loud it could be heard in the next county. 🐴

USDT’s valuation accounts for 60.44% of the entire $304.246 billion fiat-pegged token sector. Circle’s USDC at $74.498 billion slid 1.20%, the stablecoin equivalent of sighing loudly into a teacup. Ethena’s USDe, holding $8.094 billion, face-planted with a much higher 6.10% drop, easily one of the week’s biggest sulks. USDe took a significant hit last week as well, like a toddler learning the hard way about gravity. 🐢

Sky’s USDS at $5.747 billion dipped 0.65%, a polite little stumble. While the same project’s older stablecoin, DAI, carrying $4.851 billion, slipped 0.46%, like it stepped on a Lego. Paypal’s PYUSD stablecoin at $3.417 billion strutted through with a loud 22.20% jump, basically the only one that showed up caffeinated – kudos to the espresso gang! ☕

During the same timeframe, the Trump-backed World Liberty Financial and its stablecoin USD1 at $2.846 billion fell 1.04%, trying not to make a scene but still did, like a ghost at a séance. Blackrock’s BUIDL, worth $2.28 billion, tanked -11.62%, a full dramatic exit worthy of a slow-clap. Like USDT, Falcon Finance’s USDf at $2.003 billion squeaked out a 0.12% lift, the bare minimum of effort – “I tried, honest!” 😬

On another side of Ethena’s spectrum, the stablecoin USDtb at $1.533 billion plunged 16.30% lower, winning the “most dramatic” award by miles – a performance that’d make Shakespeare weep. Ripple’s RLUSD stablecoin at $1.089 billion glowed with a clean 3.66% increase, while Circle’s USYC at $1.077 billion topped off the chaos with a confident 9.54% rise, reminding everyone that sometimes the new kid really does have main-character energy. 🎩✨

In all, the week wrapped with the stablecoin sector looking like a cast of characters each committed to their own brand of theatrics – some tiptoeing lower, others flopping dramatically, and a few strutting with unearned confidence. Whether this capital exit cooldown becomes a trend or just a quick mood swing, the sector’s mixed signals suggest traders are still figuring out where they want their dry powder to sit next. One thing’s for sure: the crypto circus ain’t done juggling yet. 🎪

FAQ ❓

- What caused the stablecoin sector’s second weekly dip?

Capital flowed out of major stablecoins, leading to a combined $1.2B decline across the market – like folks cashing in chips at the poker table and heading home. 🃏 - Which stablecoins saw the biggest moves this week?

Tokens like USDe and USDtb posted the steepest drops, while PYUSD and USYC showed notable gains – a rollercoaster for the soul. 🎢 - How large is the stablecoin market after the latest drawdown?

Metrics from defillama.com place the sector at $304.246 billion following the $1.2B reduction – still a tidy sum, though slightly smaller than a whale’s lunch. 🐋 - What does a shrinking stablecoin market suggest for traders?

A contracting sector often signals funds shifting from crypto into fiat or other assets – folks are hedgin’ their bets like a poker pro. 🃏

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Brent Oil Forecast

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- EUR HKD PREDICTION

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

2025-11-15 19:39