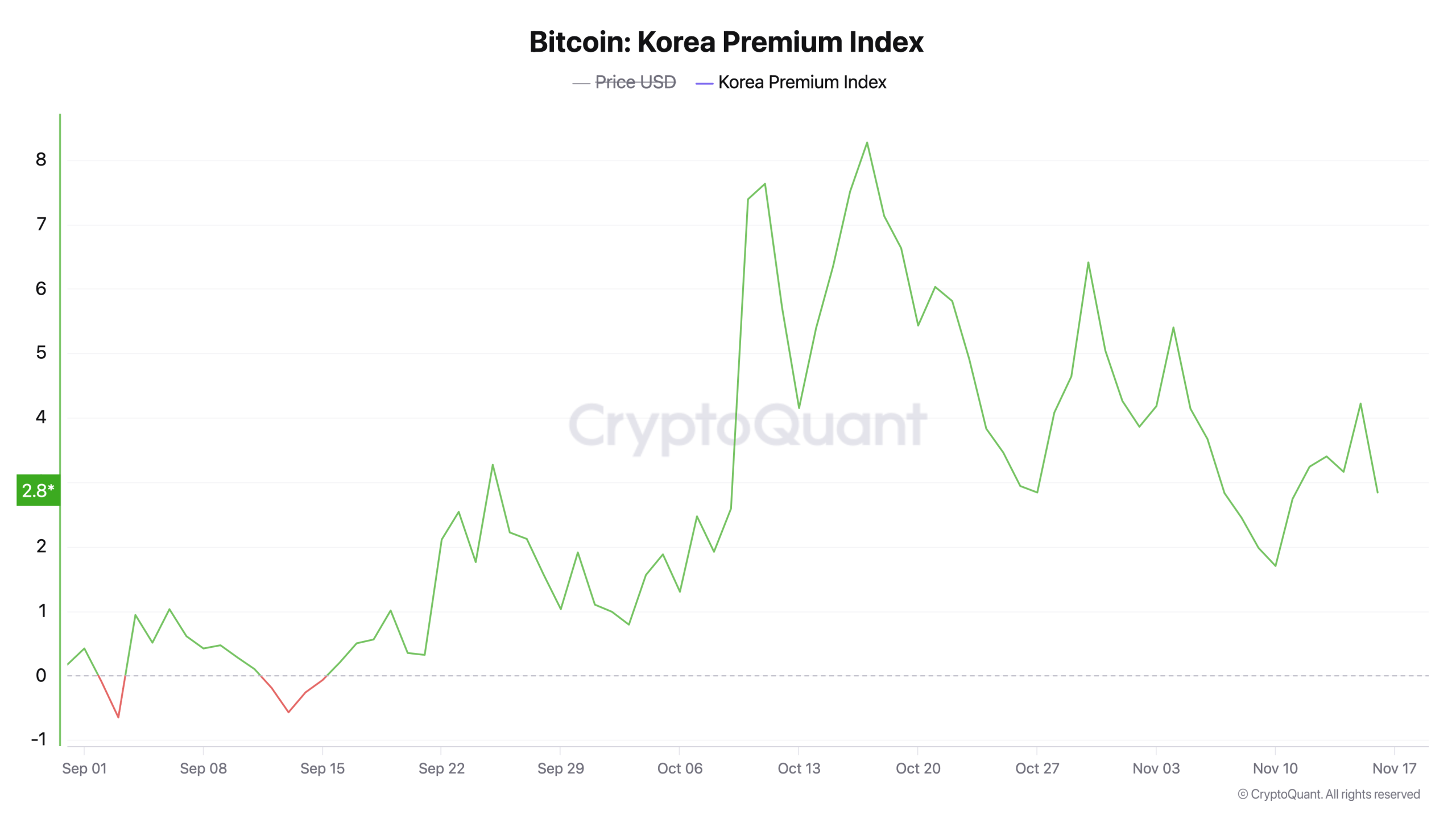

On Monday, Bitcoin waltzed between $93,029 and $95,903, a performance so lackluster it could’ve been mistaken for a hedgehog in a slow-motion car crash. Meanwhile, South Korea’s crypto market, ever the showoff, has been flaunting a premium since mid-September that peaked at 8.27%-a figure so audacious it makes the Eiffel Tower look modest. At present, BTC fetches a princely $2,413 more in Seoul than the global average, a disparity so stubborn it could outlast a Brexit negotiation. 🐢🚀

Bitcoin in Seoul: A Love Affair with Overpayment 💔

South Korea’s premium has been on a tear, and according to market data from CEX platforms (where logic goes to die), BTC now trades 2.57% higher. One must admire the dedication of Seoul’s investors-they’re paying extra not just for coins, but for the privilege of feeling superior to their global counterparts. 🎩

At precisely 12:20 p.m. Eastern time, bitcoin (BTC) was priced at $93,810, a quaint sum compared to Upbit’s $96,223 per coin. Bithumb, ever the loyal sidekick, offered $96,121. One might say the exchanges are playing a game of “Who Can Charge More?”-a contest where the loser buys the winner dinner. 🍜

Cryptoquant.com confirms the premium has been thriving since Sept. 16, 2025, like a weed in a garden of reason. By the 25th, BTC’s markup reached 3.27%, and by Oct. 17, it was 8.27%-a figure so bold it could’ve been mistaken for a tax bill. That day, while BTC fetched $108,076 globally, Seoul’s traders reveled in $116,949. Two days ago, the premium nudged past 4%, a number so small it could fit in a thimble. Still, the fire burns. 🔥

South Korea’s BTC pricing now operates as a rogue subplot in the global crypto saga, a subplot where prices are always “just right” and the global average is the villain. To add insult to injury, the won is BTC’s second-largest fiat trading pair. One wonders if the won’s inflation rate is holding hands with the premium. 💸

FAQ ❓

- What is the South Korean Bitcoin premium? It’s when BTC costs more in Seoul than anywhere else-a luxury tax for the crypto elite. 🏛️

- Why is Bitcoin more expensive there? Strong local demand and limited arbitrage channels, or as some call it, “the art of overpaying.” ☕️

- How high did the premium climb? Above 8%-a number so large it could’ve been a typo. Now it’s 2.57%, a “modest” retreat. 🙈

- Does this affect global prices? No, but it does give traders something to gossip about. Rumors of a premium hangover are exaggerated. 🤭

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Silver Rate Forecast

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

2025-11-17 22:18