So, Ethereum’s been on a rollercoaster ride, huh? Just when you thought crypto’s favorite game of musical chairs had ended, here we are-prices plummeting, wallets trembling, and everyone’s favorite meme coin (not ETH, obviously) stealing the spotlight. But guess what? Despite the market’s decision to play “hot potato” with your life savings, Ethereum’s stubbornly clinging to the $3,000 level like a toddler holding onto a deflated balloon. Analysts are probably high-fiving themselves for calling this “essential support,” but let’s be real: it’s either a masterstroke or a Hail Mary pass. Your guess is as good as mine.

Now, amid the chaos, some folks are whispering about a potential recovery. Because obviously Ethereum’s about to bounce back-because what’s a 40% drop if not a “correction”? 🤷♂️

Enter Tom Lee’s Bitmine, the crypto equivalent of a shark in a pool party. Tom Lee, the Wall Street oracle who’s been spot-on except for that one time he predicted crypto would take over the world by 2020 (spoiler: it didn’t), has been busy buying ETH like it’s going out of style. His firm, Bitmine, is basically crypto’s version of a greedy kid at a candy store: “No, I don’t care if the market’s melting down, I’m still hoarding $66 million worth of ETH. You try to feel my vibe.”

And why not? While the rest of us are panicking like we left the oven on, Bitmine’s just… there. Accumulating. Unbothered. Because nothing says “confidence” like buying $66 million in a bear market. 🤑

Bitmine’s Midlife Crisis: 21,054 ETH Later

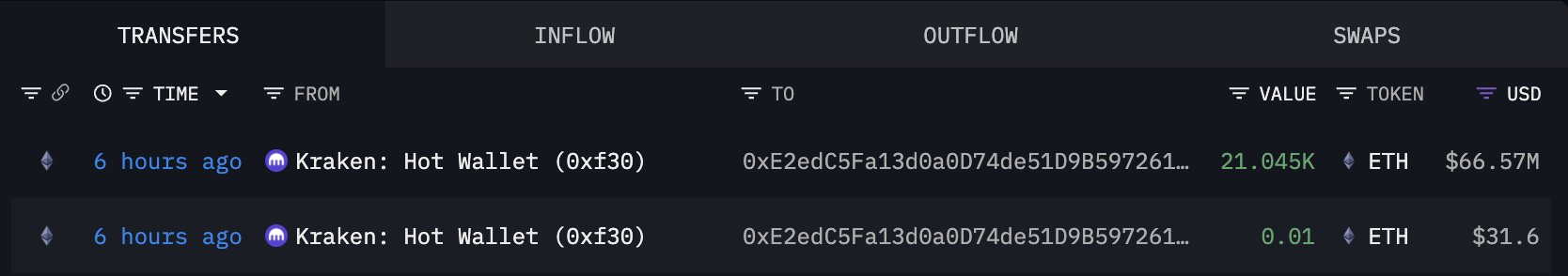

Lookonchain, the oracle of on-chain data (or just a very enthusiastic spreadsheet wizard), dropped a bombshell: Bitmine’s new wallet, 0xE2ed, just received 21,054 ETH from Kraken. That’s not just a number-it’s a middle finger to the market’s “sell everything” vibes. The wallet’s owner? Presumably Tom Lee, who’s now treating this downturn like a clearance sale at Gucci. “This is the best ETH has ever been! 20% off! Limited time only!”

Timing? Perfect. While the rest of us are crying into our stablecoins, Bitmine’s out there buying the dip like it’s a Black Friday deal. Because nothing says “long-term strategy” like ignoring the short-term panic. 🤯

And let’s be honest: this isn’t the first time Bitmine’s played the “buy the fear” card. Their playbook? Accumulate during chaos, then smile politely while the rest of us figure out how to stop checking our balances every 30 seconds. It’s a masterclass in institutional-level denial. “This dip is just noise! I’ll sell when the moon hits your eye like a big pizza pie!”

ETH’s Dance With Death: $3,000 or Bust

Ethereum’s weekly chart looks like a horror movie plot: “The Cryptocurrency That Dare Not Fall Below $3,000.” Right now, it’s clinging to that level like a climber on a crumbling cliff. The 200-week moving average is acting as a safety net-or maybe a trapdoor. Either way, it’s a level that’s been both a life raft and a red flag in the past. Think of it as crypto’s version of Russian roulette. 🎲

The candles? Chaotic. Long wicks, big swings, and volume that’s either a sign of strength or a cry for help. Honestly? It’s probably both. The market’s in a holding pattern, waiting for someone-anyone-to break the stalemate. Will it be a surprise rally? A deeper plunge? Or just a prolonged nap? Only time will tell, and honestly? Time’s running out for my sanity. 😅

But hey, if history’s any guide, Ethereum’s got a knack for turning “this is the bottom” moments into “wait, was that the bottom?” debates. So, is $3,000 the floor? The ceiling? Or just a really expensive rug pull? Buckle up, folks. The ride’s far from over. 🚀

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Whales, Wallets, and Woeful Wealth: The Curious Case of 200 Million DOGE Moves!

- XRP’s Little Dip: Oh, the Drama! 🎭

- US & UK Team Up To Save Crypto – Or Just To Keep Up With Each Other?

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

2025-11-20 05:14