While the total market cap has taken a holiday to the fourth week of decline and the market has lost nearly $1 trillion in November, data reveal a notable divergence in how investors are withdrawing capital. Mid- and low-cap assets show a surprisingly positive signal. 🤷♂️

What is this signal, and what does it mean in the current context? The following report provides a detailed explanation. (Spoiler: it’s probably not the end of the world. Or is it?) 🕵️♀️

3 Positive Signals for Altcoins as the Market Becomes Most Pessimistic

The market sentiment index has been in a state of extreme fear, which is not surprising given the current climate of uncertainty and existential dread. 🧠😱 Even so, several positive signals still emerge, acting as glimmers of hope for altcoins. (Glimmers, mind you. Not a full-blown fireworks show.) 🎇

First, a report from CryptoQuant compares the market-cap performance of Bitcoin, large caps, and mid- and small-cap altcoins. It shows significant resilience in the lower-cap segment. (Who knew?) 🤔

According to the comparative market-cap chart, Bitcoin experienced the sharpest drop in November. Large caps, which include the top 20 altcoins, also fell, but to a lesser extent. Mid- and small-cap altcoins declined only slightly and suffered less damage. (Astonishing, really. Who knew the underdogs could outlast the giants?) 🦸♂️

“Large caps are struggling, but not as much as BTC, while mid-small caps are showing real resilience,” analyst Darkfost noted. (Or as I like to call it, “The Great Altcoin Comeback Tour.”) 🎭

In fact, the chart shows that only the market caps of Bitcoin and large caps have formed new all-time highs. Mid- and low-cap assets have yet to return to their late-2024 peaks. From a psychological perspective, once altcoins drop too deeply – often losing 80-90% of value – holders tend to view their assets as “already lost.” They then have little motivation to panic sell. (A lesson in human behavior, if nothing else.) 🧠

This leads to the second notable factor: a divergence between Bitcoin Dominance and OTHERS Dominance. (Because nothing says “excitement” like a chart with percentages.) 📊

Bitcoin Dominance (BTC.D) measures Bitcoin’s share of the total market cap. OTHERS Dominance (OTHERS.D) measures the share held by all altcoins excluding the top 10. (A poetic rivalry, if you ask me.) 🏆

The chart shows that in November, OTHERS.D rose from 6.6% to 7.4%. Meanwhile, BTC.D dropped from 61% to 58.8%. (A David vs. Goliath moment, but with more spreadsheets.) 📈

This divergence implies that altcoin investors are no longer as easily panic-selling, even while sitting on losses. Instead, they are holding their positions and waiting for a recovery. (A noble endeavor, if slightly masochistic.) 💪

Historically, when BTC.D declines and altcoin dominance increases, the market often transitions into an altcoin bull cycle. (Or as I call it, “The Altcoin Renaissance.”) 🎨

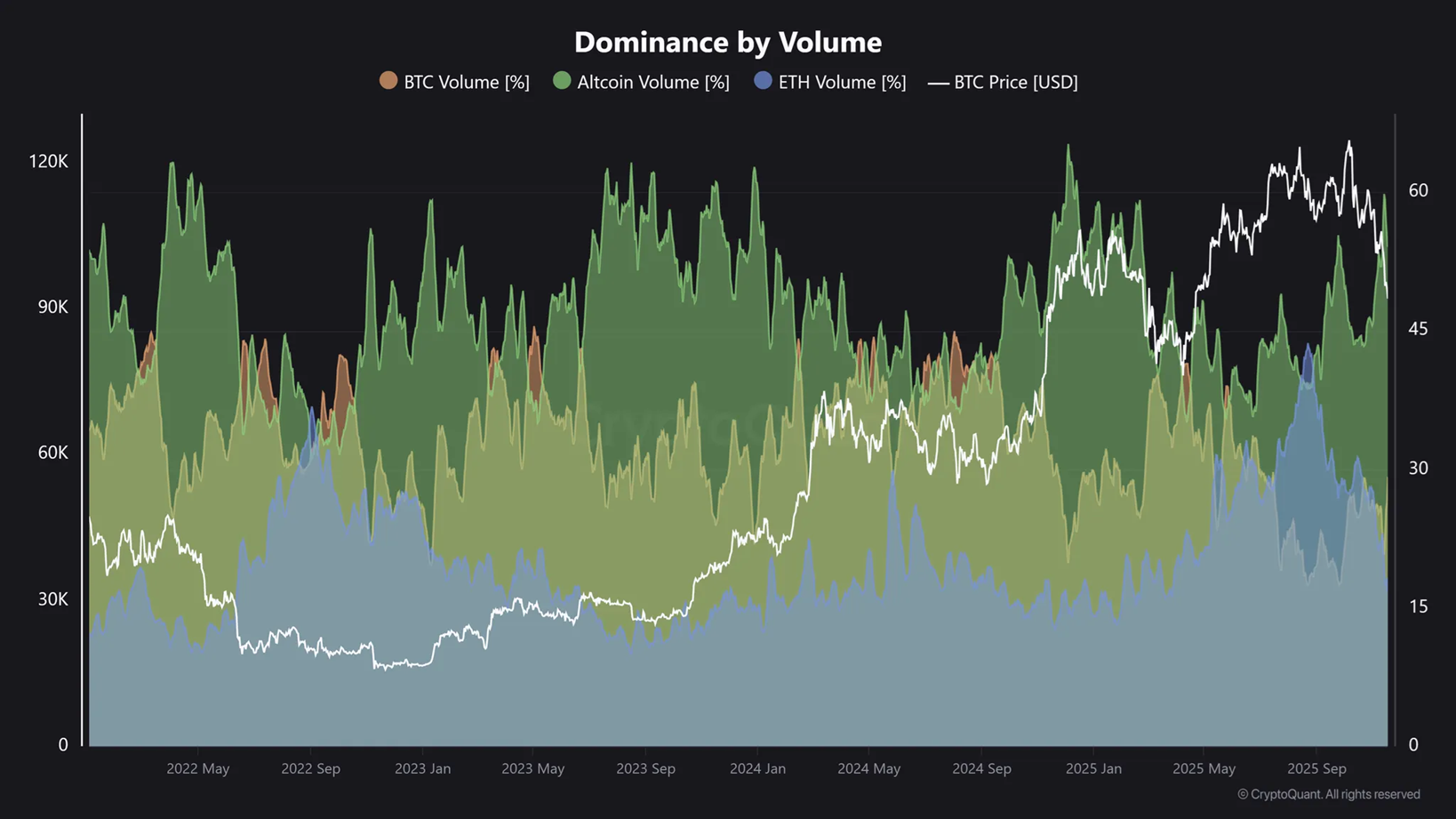

Additionally, Binance data indicate that 60% of the current trading volume now originates from altcoins. This is the highest level since early 2025. (A triumph for the underdogs, if you can call it that.) 🎉

Analyst Maartunn believes this data highlights where actual trading activity is happening. Currently, activity is concentrated heavily outside major cryptocurrencies. Altcoins have once again become highly popular trading vehicles on Binance. (A revolution in progress, one trade at a time.) 🚀

“Historically, an increased share of altcoin trading volume often coincides with increased speculation in the market,” maartunn said. (Or as I like to call it, “The Great Crypto Gamble.”) 🎰

In summary, mid- and low-cap altcoins are receiving strong liquidity inflows. They also exhibit better price performance and higher market share ratios. These factors indicate that altcoin holders hold strong expectations for a recovery from the bottom region. (Or as I like to say, “Hope is the thing with feathers.”) 🦜

Read More

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- XRP’s Little Dip: Oh, the Drama! 🎭

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-11-21 17:42