Well, butter my biscuit and call me disappointed! 🥴 UNI’s been takin’ a tumble down the financial hill, and it ain’t lookin’ to stop anytime soon. Traders are sittin’ on their hands like they’ve got splinters, with open interest droppin’ faster than a lead balloon in a hurricane. Volatility? Cooler than a cucumber at a polar bear picnic. Bullish conviction? About as scarce as hen’s teeth in a fox’s den. 😏

Buyers are tryin’ to patch this leaky boat, but the indicators are hollerin’ louder than a banjo at a hoedown-further downside’s comin’ unless the market decides to wake up from its nap. 🛌

Open Interest Takes a Dive: Bears Throwin’ a Party 🎉

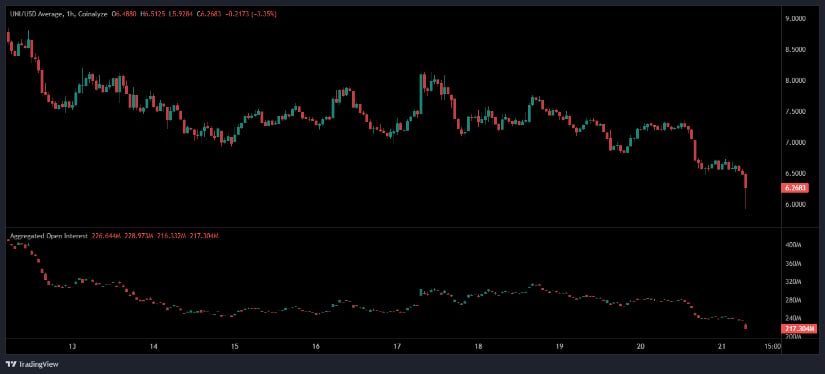

UNI/USD’s been on a sled ride straight to the bottom, slidin’ from above $8.50 to a hair’s breadth from $6.26. Every attempt to bounce back’s been about as successful as a screen door on a submarine. Lower highs? They’re stackin’ up like pancakes at a Sunday brunch, paintin’ a picture uglier than a mud fence. The real kicker came when it plunged from $6.50 to $6.20-sellin’ pressure hit harder than a ton of bricks dropped from a skyscraper. Support levels? Fragile as a porcelain teacup in a bull’s china shop. 🧨

Now, let’s talk derivatives-the fancy word for folks bettin’ on bets. Open interest shrunk from 226.6 million to 217.3 million, like a wool sweater in the dryer. Traders ain’t just sittin’ on their hands; they’re runnin’ for the hills, closin’ positions faster than a cat licks its fur. Price and open interest fallin’ in lockstep? That’s the market sayin’, “Let’s de-risk, y’all,” or maybe it’s just liquidation season. Either way, bulls are as scarce as a snowflake in July. ❄️

Volatility’s compressin’ like a spring, and sentiment’s gone defensive-traders are backin’ away slower than a politician from a tough question. This ain’t the recipe for a rebound; it’s the setup for either a slow bleed or a cliff dive if the bears decide to throw a party. 🎈

To turn this ship around, we’d need open interest to do a 180 and prices to steady up-till then, confidence is takin’ a vacation. 🏖️

24H Drop Sharp Enough to Cut Through Butter 🧈

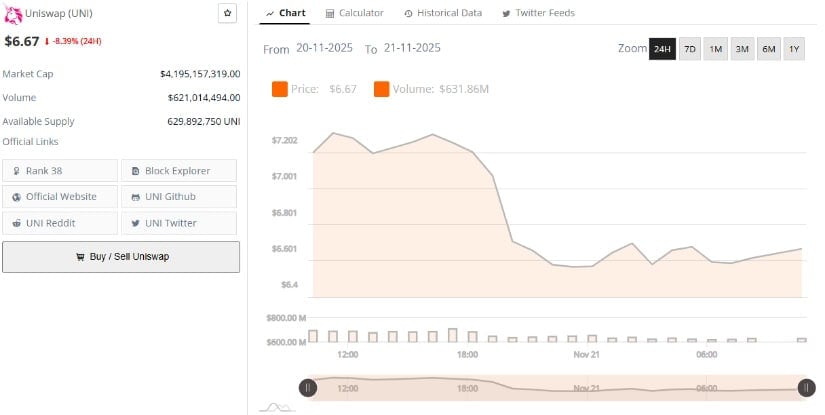

BraveNewCoin’s got UNI sittin’ pretty at $6.67, but don’t let that fool ya-it’s down 8.39% in the last 24 hours. Market cap’s at $4.19 billion, with 629.89 million tokens floatin’ around. Volume’s still kickin’ at $621 million, but let’s be honest-it’s mostly sellers dancin’ while buyers watch from the sidelines. 💃🕺

Higher-timeframe view? It’s a slide down a muddy hill, rangin’ from $6.60 to $6.00. The market’s searchin’ for a floor like a prospector huntin’ for gold. This weakness ain’t just UNI’s problem-DeFi’s feelin’ the macro blues. Sure, UNI’s still a big fish in the DeFi pond, but short-term woes are castin’ a long shadow over its long-term shine. 🌥️

TradingView’s Technicals: Bearish Enough to Make a Grizzly Blush 🐻

Over on TradingView, UNI/USDT’s sittin’ at $6.273, down 4.52% on the day. Price action’s below the Bollinger Band basis at $6.731-that’s financial speak for “things are lookin’ grim.” The rejection near $8.937 and the slide toward $4.525? That’s volatility with a seller’s twist. 🎢

Resistance is way up at $12.3, while support’s hangin’ on by a thread near $2.00. Can’t reclaim the baseline? That’s like tryin’ to climb a greased pole-ain’t happenin’. Unless UNI breaks above $6.73, it’s lookin’ at a one-way ticket to the basement. 🛤️

MACD’s singin’ the same ol’ bearish tune. Histogram’s negative at -0.055, signal line’s above the MACD line-that’s a recipe for more declines. No divergence, no crossover? Momentum’s in the bears’ corner, and they’re not givin’ it back. 🐻❄️

Read More

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- XRP’s Little Dip: Oh, the Drama! 🎭

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-11-21 19:23