Bitcoin, darling, it’s indulged in a thrilling case of self-doubt, losing a touch of its glitter-over 35%, mind you-since the heady heights of early October. From a dazzling $126,000 pinnacle, it’s plunged into the realm of penny-pinching panic! And oh, the fickleness: liquidations, forced sales, and the collective jitters of the market crashing into the bargain bin, darling. It’s as though the self-confidence in one’s fashion choices has evaporated overnight.

Most nattily dressed analysts murmur sotto voce-it’s a bear market, of course, citing structural wardrobe faux pas and a poise-flaunting dismissal from prior graces. Yet, in the charity shop of market whims, a small but eager bunch of enthusiasts insists this is naught but a faux-culpa, a dress rehearsal for a boom, not an eternal débâcle.

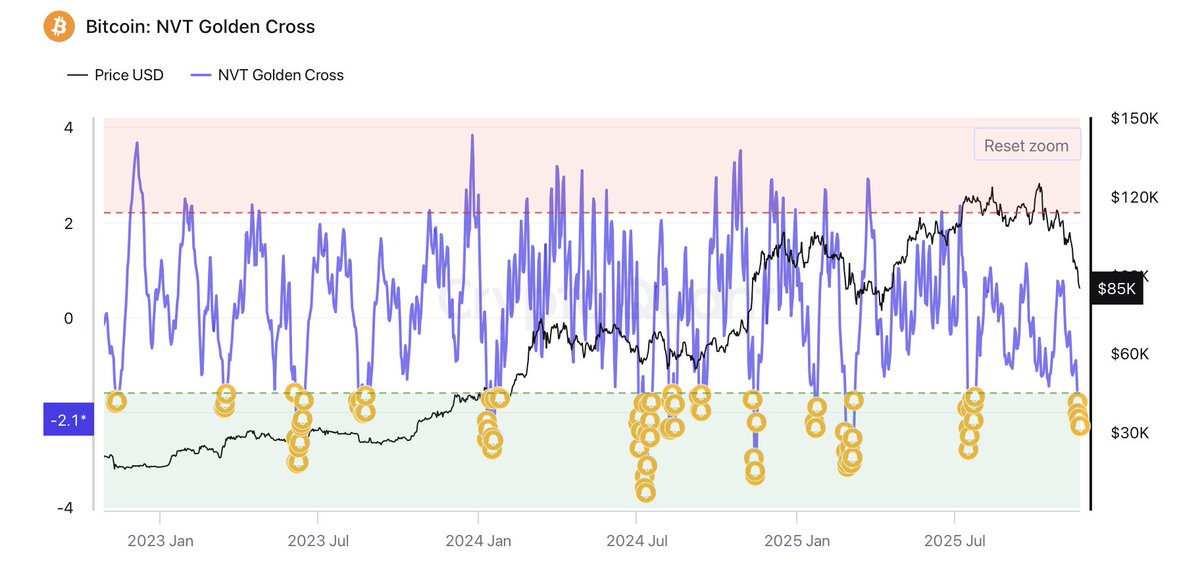

In the style of a cheeky cameo, key on-chain indicators courtesy of the astute Darkfost underscore the momentous NVT Golden Cross. This wee number appraises Bitcoin’s current valuation compared to its flurry of transactions and behind-the-scenes excitement. Lordy, history whispers sweet nothings when the NVT Golden Cross dips below -1.6-indicating, fol-de-rol, that Bitcoin might just be that beautiful misfit finally in vogue with investing fashionistas.

With this indicator coyly approaching the sobbing threshold, some opt to drape it in dollar signs rather than mourning crepe, envisaging this financial tango as a potential adrenaline-filled, long-term soirée instead of an extended blues ballad.

Metigiously called upon, a preset alert upon the NVT Golden Cross instruments a cuespiel alert for the sly operator looking for a favourable hand of cards. Of historical prominence, when this dashing fellow waltzes into negatively bold territory, it selectively becomes the belle of the ball-a short-term partner leading to rare thrills.

Traders, those zealous matchmakers of cryptocurrency soirées, frequently eye such signals to flirt with comfortable long positions or accumulate Bitcoin while prices are prudently pocket-sized. Yet, dear Darkfost, wearing the figurative monocle of caution, offers an elegantly understated warning: it’s not always the belle of the ball, particularly amid bouts of theatrical macro stress or sudden liquidations making a grand exit.

Now, we find ourselves waltzing through a particularly intricate piece: thinned liquidity, volatility playing the orchestra, and max-dismay sprung to life across the board. In such an operatic whirl, Darkfost suggests that even the most reliable arias should be performed sans leveraged risk-hazarding a powerful allegro may distort the well-rehearsed score.

The upcoming performances will be crucial; observers are poised like theater critics, eager to spot Bitcoin’s attempt to sustain its stance above precarious support or further capitulate. Whichever way it pirouettes, the market’s storyline will undeniably see its crescendo heading towards the curtain call.

Experiencing its own brand of musical interlude, Bitcoin’s 3-day chart battles to find its rhythm post one of its most precipitous descents. From an effervescent $126K summit in early October, it has plummeted to an unassuming $86K, blinking at liquidity below $85K, before mounting a cameo comeback.

The chart’s elegant backdrop now showcases bold descent, cutting below its beloved 50-day and 100-day averages, presenting them as newfound hurdles in its path. Meanwhile, the 200-day average stands stoically at $88K, serving as the custodian of order before any allure of turmoil. Following a dizzying encore of volume, this sagacious journey underscores selling panache, far from a mere liquidity shrug. Here, it echoes the broader narrative: incessantly passionate on-chain metrics and candlestick tales whispering of sneaky buyer heroics amidst key liquidity pit stops.

Yet, our Bitcoin, sashaying betwixt shadows, teeters: any flirtatious glance below the 200-day line could tempt a waltz towards the $78K-$80K zone. For market optimists, retrieving $90K is critical-heralding a shift in momentum and an encore of bullish air rather than the morose descent of fading cyclical notches.

Hence, gather close as the charts and sly cues signal restrained optimism-perhaps a prelude to a short-term flourish, should fervent buyers embrace the limelight with a graceful fortitude.

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

2025-11-25 03:19