So, Strategy decides to calm the nerves of its investors-because, you know, another exclusion from the S&P 500 Index is nothing to worry about, right? The company assures everyone that its balance sheet is still solid, even after Bitcoin  crashed down to a measly $80,000. Like, really? That’s the price we’re at now?

crashed down to a measly $80,000. Like, really? That’s the price we’re at now?

In a post on X (formerly Twitter, because who can keep up anymore?), the company states that its Bitcoin reserves, a cool 649,870 BTC worth roughly $56 billion at today’s prices, continue to “far exceed” its debt load. Yeah, sure. They claim this, despite a tough quarter for both the asset and their stock. I mean, who doesn’t like to toss around words like “far exceed” when your BTC stash is like an overinflated balloon? 😬

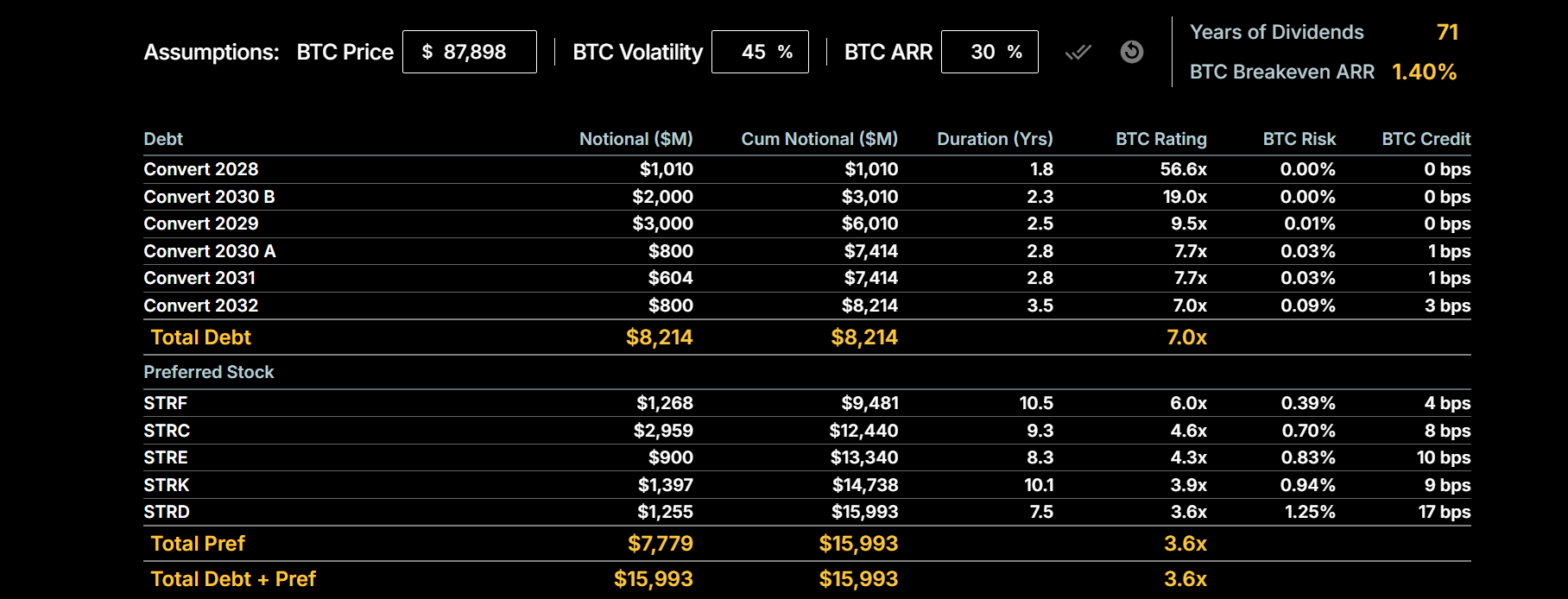

Strategy stated that even if Bitcoin drops to its average cost basis of $74,000, its BTC holdings would still cover its convertible debt by 5.9 times. But wait, it gets even better…-

– Wu Blockchain (@WuBlockchain) November 26, 2025

All good, they say. Really? At a Bitcoin price of $74,000 (pretty close to their average cost, so they’re basically sweating it out at this point), the company is confident that their BTC holdings could still cover their $8.214 billion in convertible notes by, you guessed it, 5.9 times. They call this their “BTC Rating.” Ah, the magic number that keeps the world from crumbling. If Bitcoin crashes to $25,000, the coverage would drop to 2 times. Not ideal, but it’s still way above the point where they’ll have to start selling their organs to cover the debt. 🙄

And here’s the kicker: Their full capital stack, including preferred stock series STRF, STRC, STRE, STRK, and STRD, brings their total obligations to about $15.993 billion. Data from their dashboard shows long-dated notes stretching out to 2032, with BTC coverage multiples ranging from 56× to 7×. So, basically, if you think things are dicey, just remember: 56 times coverage is a thing. Go ahead, breathe a little easier now. 😉

All is Good, Strategy Claims

The company continues its story that even with the volatility, Bitcoin’s current valuation gives them more than enough cushion. Sure, sure. You just keep telling yourself that.

MSCI’s Exclusion of Strategy

So, MSCI is going to review its index in January 2026, and if companies like Strategy, who have more than half of their assets in crypto, get the boot, they’re out. Strategy is totally in that category, so there’s a real chance they could get thrown under the bus. JPMorgan estimates that if things go south for them, funds linked to MSCI might be forced to sell off $8.8 billion in exposure. What could possibly go wrong? 🙃

And by the way, Strategy also failed to get included in the S&P 500. Crypto fans love to cry foul, claiming that financial institutions like JPMorgan are actively working against Bitcoin-heavy firms. Like, seriously? Are they that much of a threat to the establishment? Whatever. They’ve got their conspiracy theories brewing. 🍿

THE TIMELINE OF A HIT JOB

MORE PROOF of a coordinated attack against $MSTR and Digital Asset Treasury Companies.

– Adrian (@_Adrian) November 23, 2025

Some people think the delisting is part of a grand conspiracy. Maybe they’re right, maybe they’re not. But hey, a little drama never hurt anyone, right?

Bitcoin Purchase Halt

So here’s the kicker: Strategy holds 3.26% of all Bitcoin that will ever exist, but it only has $54 million in cash and more than $700 million in preferred dividend obligations every year. Not exactly the dream financial situation. To make matters worse, they paused their weekly Bitcoin purchases. Yes, they broke their six-week streak. Executive Chairman Michael Saylor, usually the king of Bitcoin updates, was eerily silent this week. Coincidence? Probably not. 🤔

But don’t worry, even if Bitcoin falls to $75K or drops to $25K (because that’s definitely happening, right?), Strategy says their balance sheet is still in the green. And that, my friends, is how you keep calm and carry on. 🧘♂️

Read More

- Brent Oil Forecast

- EUR HKD PREDICTION

- Gold Rate Forecast

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- EUR THB PREDICTION

- Silver Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- EUR MXN PREDICTION

- USD UAH PREDICTION

- GBP USD PREDICTION

2025-11-26 16:12