So, there you are, minding your own business, sipping your intergalactic coffee ☕, when suddenly, XRP decides to do a little bounce. Not the kind where you drop your toast and it lands butter-side up, but the kind where it rebounds from a lowly $1.95. Technical indicators (whatever those are) and some fancy ETF inflow data are now whispering sweet nothings about a “cautiously positive short-term outlook.” Cautiously positive? Sounds like my horoscope. 🌟

XRP Bounces Like a Space Hopper

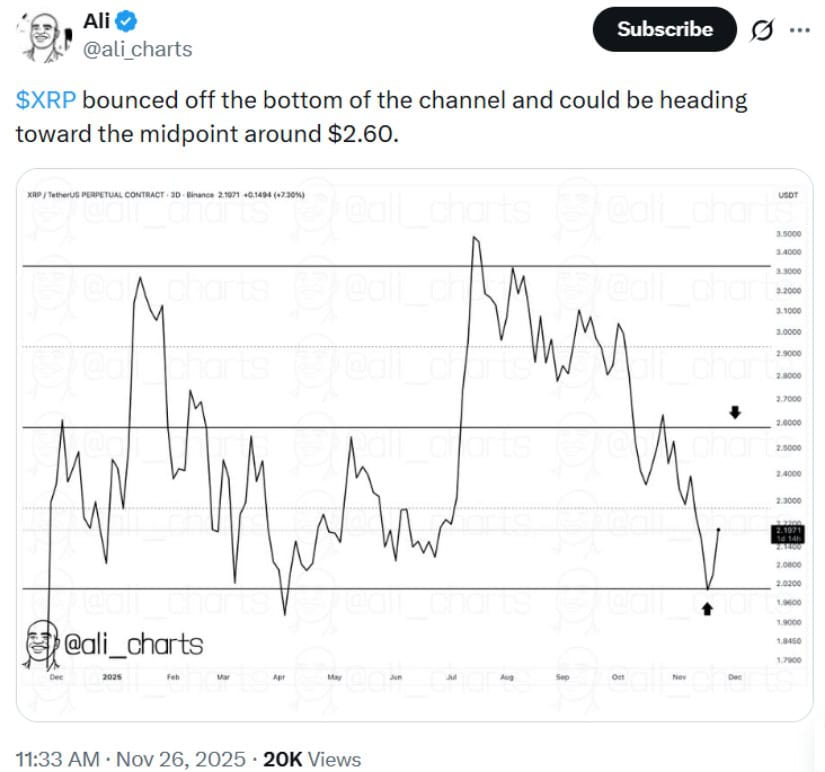

Picture this: November 26, 2025. The 3-day XRP/USDT chart on TradingView looks like a rollercoaster designed by a sadist. XRP takes a dive towards $1.97, hits the bottom of a descending channel, and then-boing-rebounds like a space hopper on a trampoline. Next thing you know, it’s back up to $2.20. 🎢

On-chain analyst Ali Martinez (probably wearing a tin foil hat) tweets: “$XRP bounced off the bottom of the channel and may test the midpoint near $2.60.” Because, you know, why not? It’s not like the universe has anything better to do. 🧑🚀

This descending channel thing? It’s like a cosmic corridor where XRP keeps bumping its head on the ceiling and stubbing its toe on the floor. The midpoint is apparently the holy grail, but only if the upward momentum doesn’t get distracted by a shiny object. 🌌

ETFs: The Institutional Party Crashers

Meanwhile, in the land of institutional investors, $164 million has flowed into XRP-related ETFs in the past week. That’s right, the big boys are throwing their hats (and money) into the ring. Does this guarantee XRP will go to the moon? Nope. But it does mean someone’s betting on it. 🎩💰

CryptoAnalystSignal (probably a robot) chimes in: “The price is moving within an ascending channel on the 1-hour timeframe, holding above key support at $2.14, which may support short-term momentum.” Translation: It’s going up, but don’t hold your breath. 🤖

And let’s not forget RippleNet, which is apparently serving over 300 banking partners worldwide. Because nothing says “utility” like a cryptocurrency being used by banks. Though, transaction volume has been as consistent as my New Year’s resolutions. 🏦

Wyckoff Reaccumulation: The Pattern of Mystery

Now, for the pièce de résistance: the Wyckoff reaccumulation pattern. It’s like a cryptic crossword puzzle for traders, promising a bullish continuation if you can just figure out what the heck it means. 🧩

ChartNerd (definitely a cool name) breaks it down:

- Phase A: Initial supply halt and buying climax. (The party starts, but someone forgot the snacks.)

- Phase B: Secondary tests of support and minor resistance breakouts. (The snacks arrive, but they’re stale.)

- Phase C: “Spring,” or temporary dip near recent lows. (Someone spills the punch.)

- Phase D: Last point of support and a potential breakout across resistance. (The party gets going again, but the neighbors complain.)

- Phase E: Upward markup if demand exceeds supply. (Everyone leaves with a hangover.)

Apparently, this reflects accumulation by larger holders, which could mean a price recovery. Or not. It’s crypto, after all. 🎉

SoSo Value’s machine-learning forecasts say XRP could hit $2.28 by November 30. But let’s be real, those projections are about as reliable as a weather forecast on Mars. 🌪️

Trading Targets: Guesswork with Fancy Names

Current trading indicators show XRP stabilizing above the 100-period moving average on the 1-hour chart. If you know what that means, congratulations. You’re either a trader or a wizard. 🧙♂️

Here are some illustrative target ranges:

- Near-term target: $2.21 (The “Eh, close enough” level)

- Secondary target: $2.28 (The “Not bad, not great” level)

- Longer-term target: $2.35 (The “Now we’re talking” level)

Remember, these are just reference points. Don’t bet your house on them. Or do. I’m not your financial advisor. 🏠

Final Musings from the Void

So, here we are. XRP is holding strong at $2.14, ETFs are throwing money around, and Wyckoff patterns are promising (maybe) a short-term upward movement. But let’s not forget: the crypto market is about as predictable as a Douglas Adams novel. 🌌

Investors, take note: support levels, inflow trends, and market volatility are your new best friends. Or worst enemies. It’s a fine line. And remember, technical signals are like horoscopes-fun to read, but don’t bet your life savings on them. 🪐

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- EUR MXN PREDICTION

- Silver Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- EUR THB PREDICTION

- GBP USD PREDICTION

- EUR HKD PREDICTION

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2025-11-27 02:38