Now, back in ’25, there was a hullabaloo, a regular stampede of companies decidin’ to hold a bit o’ cryptocurrency on their books. Seems ol’ Trump, bless his persuasive tongue, had stirred up a right fine interest in these digital doodads. Businesses, big and small, were jumpin’ on the bandwagon, either joinin’ forces or struttin’ their stuff on the stock market.

But, bless my soul, it appears this fad, these “DATs” – Digital Asset Treasuries, they call ’em – ain’t holdin’ water so well anymore. Why, you’d think folks lost their minds watchin’ stock values tumble like a house of cards!

All About the Access, You See

Big names in this DAT game – MicroStrategy with its Bitcoin obsession, Bitmine and Ethereum, and that Solana fellow, Forward Industries – they’ve all taken a proper thumpin’ just lately.

Investors, fickle creatures that they are, are now hitin’ the sell button on these companies that were once the toast of the town. 2025 was a good year for DATs, alright, but is the party already over? Seems a likely story. 🤔

Jean-Marc Bonnefous, a fella who knows a thing or two about finances, claims these DATs caught on because they let investors dabble in crypto without havin’ to wrestle with those confounded wallets, exchanges, and blockchains. A right mess, those are!

“DATs, bein’ proper companies listed on the exchange, are a convenient and lawful way for folks with capital to buy these crypto assets without havin’ to change their usual routines one bit,” Bonnefous confided.

It all started with MicroStrategy, bless their entrepreneurial souls, way back in 2020. During those days of extra money printin’, CEO Michael Saylor had the bright idea of convertin’ some company cash into Bitcoin. A bold move, I tell ya.

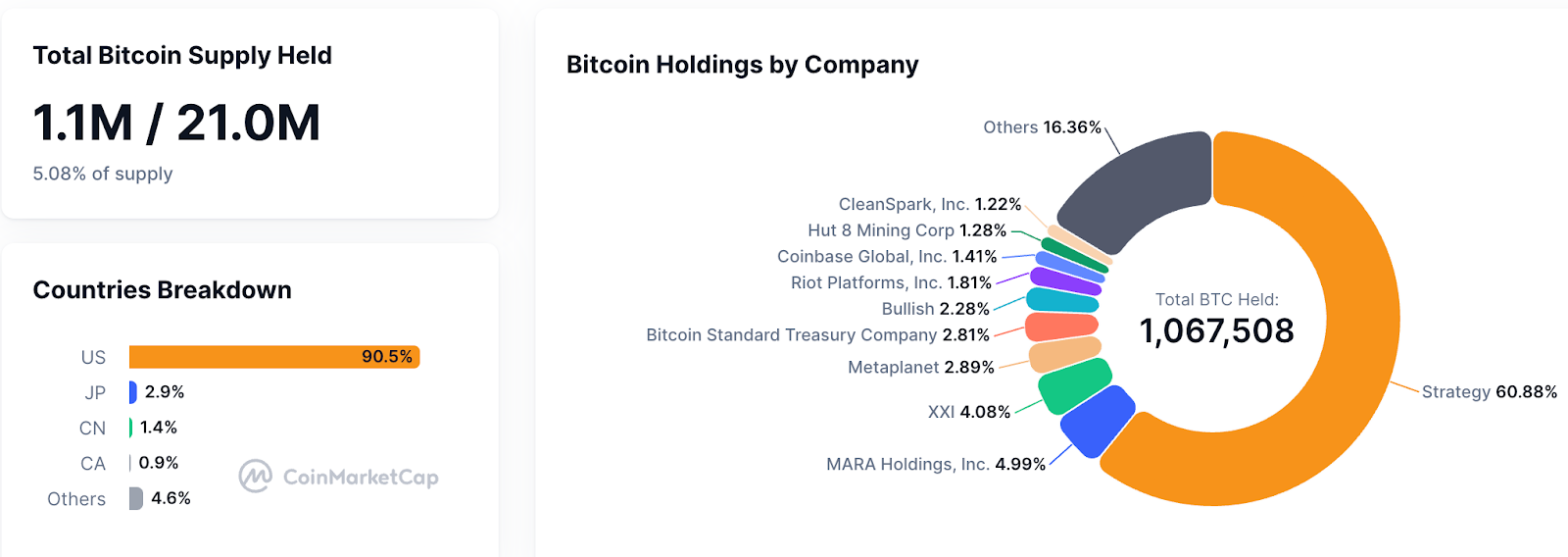

Currently, they’re holdin’ a mighty 649,870 bitcoin, bought at an average price of $74,430 apiece. A considerable investment, wouldn’t you say?

But some investors are startin’ to feel a touch of regret, seein’ as how both crypto and regular stocks are takin’ a dip. A bit of buyer’s remorse, perhaps?

Though, MicroStrategy might weather the storm better than most, given their experience in this crypto treasury business. And that’s sayin’ somethin’.

“Strategy had decades of doin’ business, strong connections, and got in on the ground floor with Bitcoin, gainin’ respect and cheap financing,” explained Maja Vujinovic of FG Nexus. “These new DATs don’t have that advantage, no sir.”

Eyeballing the Numbers, Now

Anyone lookin’ at these newer DATs ought to be payin’ attention to Net Asset Value (NAV) and Market Cap to Net-Asset-Value (mNAV) – it’s a key way to size ’em up.

“NAV tells you what the crypto is worth today, plain and simple,” says Vujinovic. “mNAV is what the market is willin’ to pay on top of that for the company’s plan, credibility, and skill.”

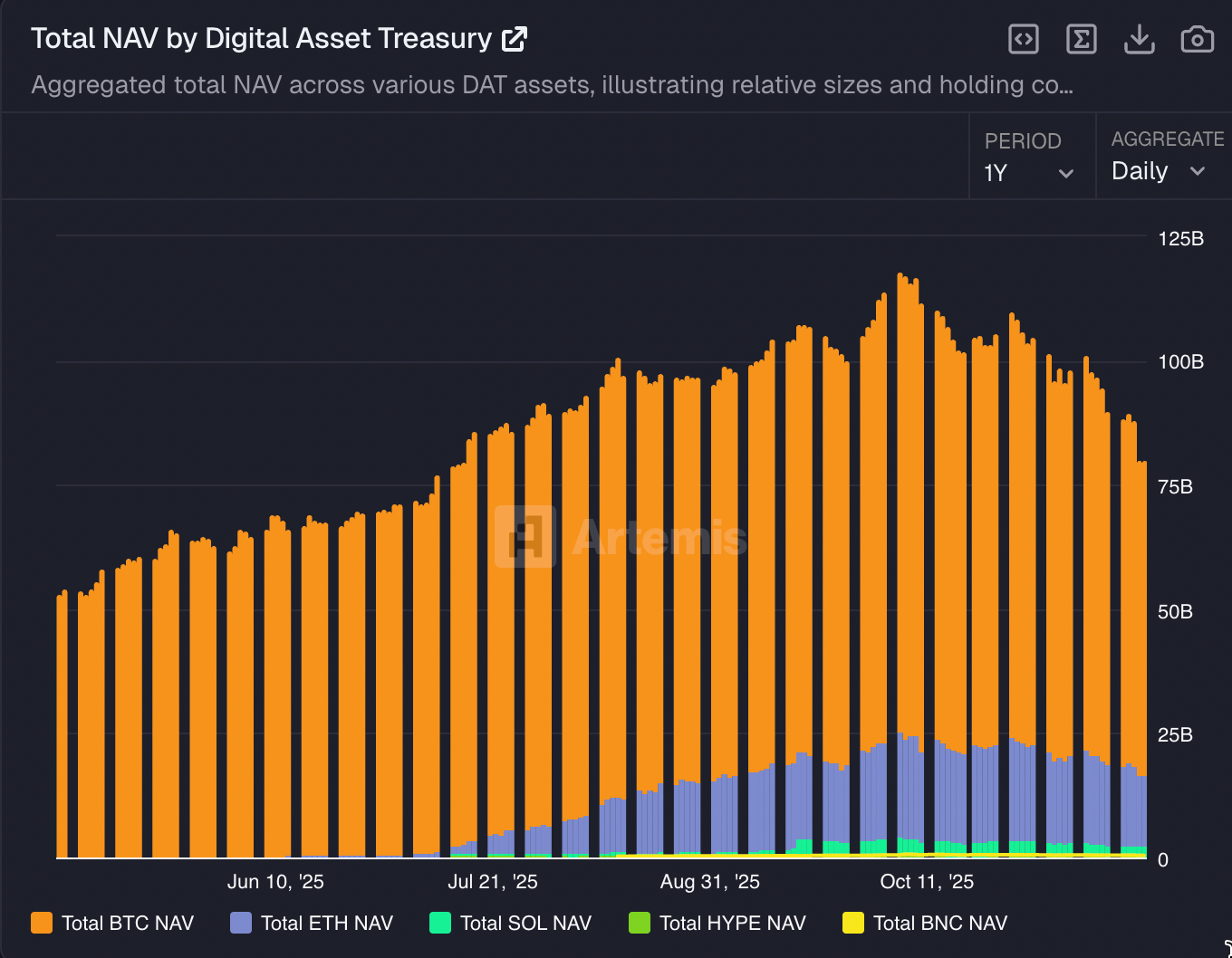

The peak o’ this DAT mania, it seems, was back on October 10th, right around the time a big ol’ liquidation wiped out $19 billion in crypto value. My stars!

A good many investors likely didn’t comprehend the sheer amount of borrowin’ goin’ on in the crypto world. It’s unregulated, you see, so folks can take 100x bets which caused quite the commotion.

Since then, the value of these assets have declined, accordin’ to some data aggregator.

Or maybe folks understood the risk just fine, and pure greed led to the rise and fall of it all. A likely tale.

“DATs are a gamble on the success of the underlying crypto ecosystems, offering investors the chance to multiply their gains,” notes Alex Bergeron of Ark Labs. “But, naturally, that gamble cuts both ways, magnifyin’ losses too.”

DATs Getting Creative

These DATs can’t just hold crypto, see, they need to actually do somethin’ to earn revenue. Otherwise, they’ll forever be sellin’ at a discount! A company’s got expenses, like wages for them high-falutin’ executives.

So, they’re gettin’ creative, findin’ ways to boost that mNAV, that forward-lookin’ market value. Now that’s smart thinkin’.

They’re borrowin’ money against their crypto, just like MicroStrategy. Since 2020, they’ve amassed a stockpile of $55 billion. Impressive, don’t you think?

And that’s probably what’ll allow Strategy to survive-they’re the originals, the O.G.s of Bitcoin holdin’.

“Strategy’s diversifications put them ahead of the pack,” states Jesse Shrader of Amboss. “But others might focus on more fruitful endeavors or pioneer new areas like makin’ a little safe yield. “

Newer DATs gotta find ways to earn money from their crypto to increase that forward-lookin’ mNAV valuation.

Lendin’ crypto, usin’ derivatives, stackin’ for yield, or acquirin’ more digital assets at a bargain-there are possibilities. And a shrewd team could figure it out for some of these opportunists.

A Touch of Caution, If You Please

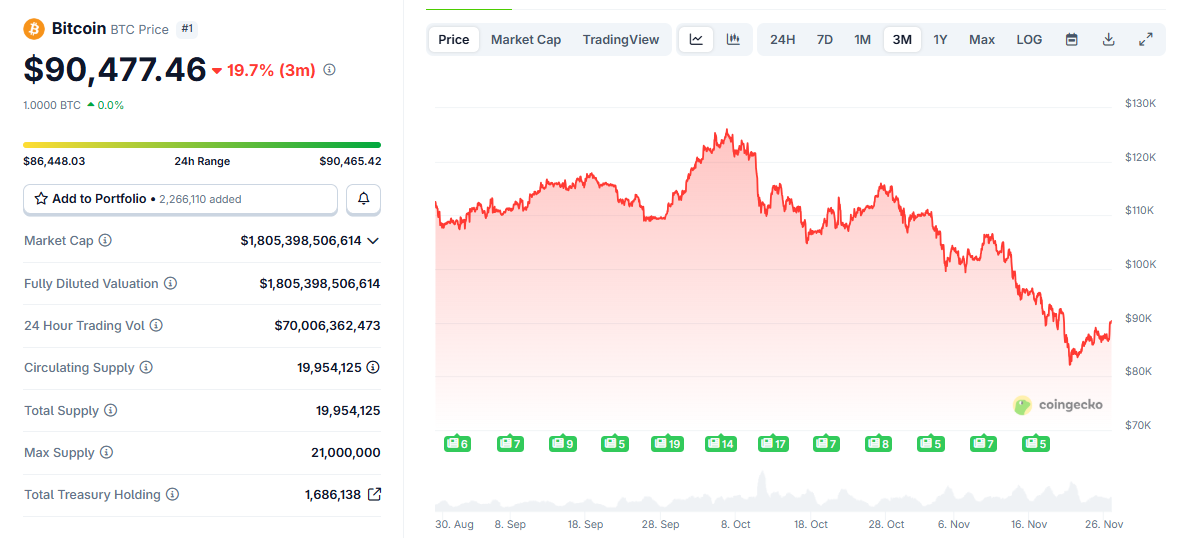

The crypto market ain’t in a particularly cheerful state, not when compared to the giddy times back in May and June. Remember that frenzy?

Now, Bitcoin’s tradin’ around $90,000, right back where it was in May. Goodness gracious!

There’s a worry that a “risk-off” mood is pervadin’ the market, folks startin’ to sell off their investments and hoardin’ cash. A cautious bunch, they are!

Crypto, and the DATs that follow, appear to be fallin’ victim to this sentiment.

“Stocks are easy to move, so new investors in crypto will add even more volatility to market events,” says Bonnefous.

Mind you, some of these DATs will likely make it through. But there might be a bit of a struggle, maybe even a few mergers as investors sort out which companies can stay afloat with sound business practices. 🧐

“The next generation of winners will be DATs that build real businesses, like earnin’ through staking or smart hedgin’,” adds Vujinovic.

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Silver Rate Forecast

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- GBP USD PREDICTION

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-11-27 03:05