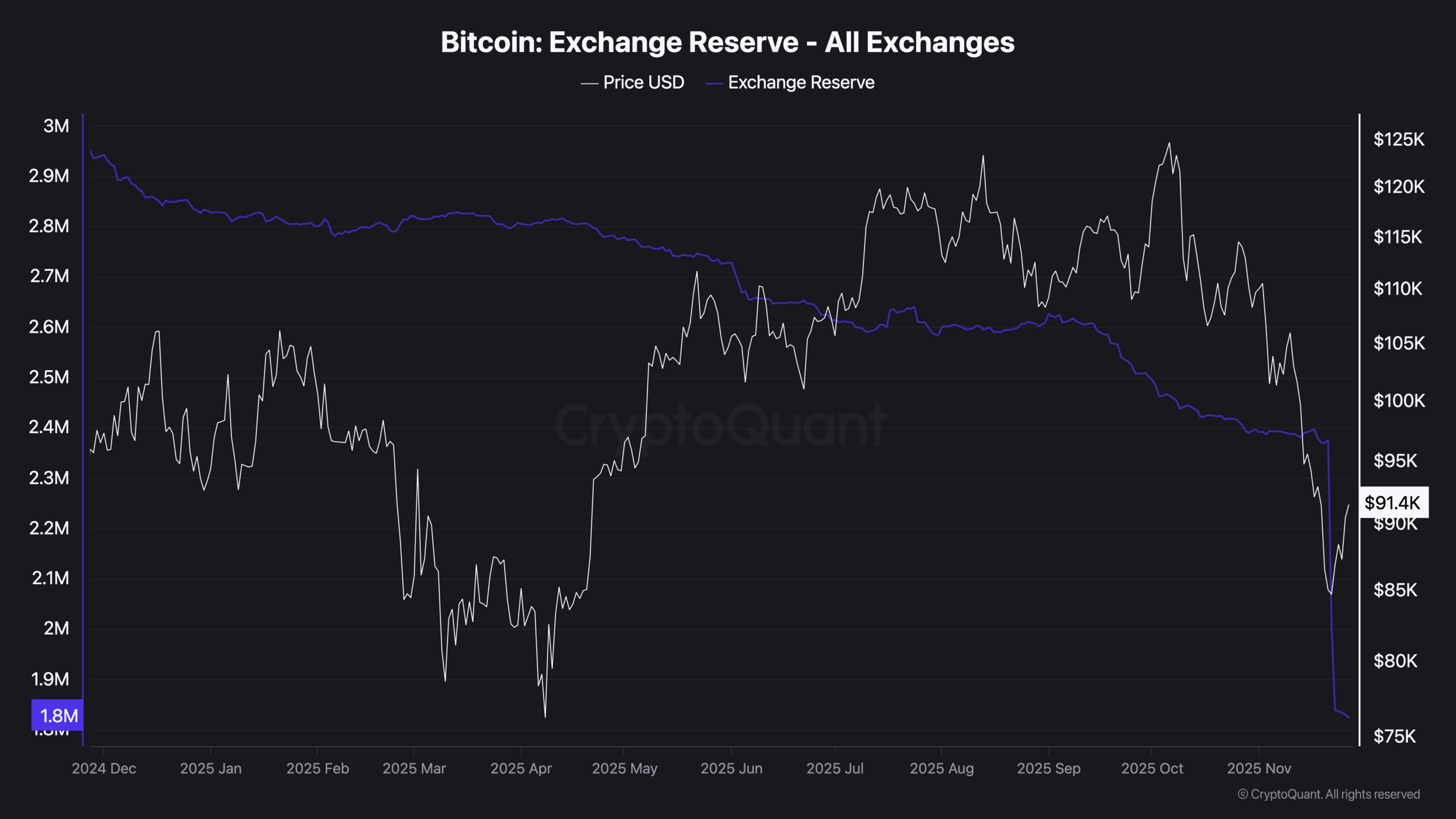

In the annals of financial folly, a most curious spectacle has unfolded: between the 21st and 27th of November, 2025, the vaults of Bitcoin exchanges were pillaged with a zeal worthy of the most audacious highwaymen. Data from the ever-vigilant CryptoQuant reveals a plunder of 580,000 BTC, leaving a mere 1.82 million in the coffers. One can only imagine the consternation of the exchange custodians, their ledgers now as bare as a baronet’s promises.

At the time of this scribbling, Bitcoin hovers near $91,700, a figure that has seen a 6% ascent in the past day, though it remains a shade diminished over the week. This modest recovery follows a precipitous tumble below $81,000, a fall as graceless as a debutante tripping at her first ball. Yet, the coin still languishes 27% below its October zenith of $126,000, a summit now as distant as a forgotten New Year’s resolution.

The Great Wallet Exodus: A Flight to Safety or Mere Caprice?

The exodus from exchanges has been as relentless as a Waugh novel’s wit. The recent acceleration, however, suggests that the grandees of the crypto realm have spirited their BTC into the safety of custody or the icy embrace of cold storage. One wonders if they are preparing for a rally or merely indulging in a fit of financial pique.

Meanwhile, Santiment’s on-chain sleuths report the emergence of 91 new wallets, each plump with at least 100 BTC, since November 11. The smaller fry, alas, are dwindling, a testament to the retail investor’s waning enthusiasm. It seems the hoi polloi have grown weary of this crypto charade.

As CryptoPotato has duly noted, a key derivatives metric on Binance has plunged to depths unseen since the halcyon days of yore (or, more precisely, nearly two years ago). This suggests a frenzy of selling from leveraged positions, a financial bloodletting of the most dramatic sort.

Derivatives: A Market in Repentance

The aggregated funding rate for BTC has turned as negative as a Waugh protagonist’s outlook, now standing at -0.0007. This indicates a retreat from long positions in the futures market, as shorts proliferate like gossip at a country house party. Longs, it seems, are being closed with the haste of a guest fleeing a dull soirée.

The Coinbase premium, too, remains in the red at -0.0135, though it has clawed its way back from more dire straits earlier in the month. According to the sage Daan Crypto Trades,

“Spot selling pressure is easing significantly compared to the 2 weeks prior.”

Price Zones: The Financial Tea Leaves

Daan Crypto Trades, ever the astute observer, has identified the $89,000 to $91,000 range as a zone of peculiar interest. It has served as both bulwark and barrier in cycles past, and now BTC finds itself ensconced within its bounds. One can only hope it does not dither like a hesitant suitor.

Captain Faibik, another of our financial seers, notes the formation of a descending broadening wedge on the 4-hour chart. With the air of a soothsayer, he declares the price “has likely bottomed out,” though he adds the caveat that bulls must reclaim $100,000 for any hope of a robust ascent. One imagines them girding their loins for the effort.

Lennaert Snyder, never one to mince words, describes $93,000 as a “make or break” level, a Rubicon that will determine whether the trend reverses or continues its downward spiral. One can almost hear the collective holding of breath.

And so, dear reader, we find ourselves at the precipice of another crypto drama, replete with vanishing coins, wary whales, and analysts clutching at charts like lifelines. Whether this portends a rally or merely another act in the farce remains to be seen. Until then, we shall watch with the detached amusement of a Waugh protagonist, martini in hand. 🍸

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

- Why Microstrategy’s Stock is Outpacing Bitcoin: 4 Surprising Reasons Revealed!

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- USD CNY PREDICTION

- Flipster’s Bold Leap: Zero-Spread Crypto Trading Unveiled! 🚀

2025-11-27 13:05