Just before 9 a.m. Eastern time, Bitcoin’s price teetered on the edge of a caffeine-fueled squirrel’s back, hovering between $91,463 and $91,809 on Nov. 28, 2025. With a market cap of $1.826 trillion and $52.72 billion in 24-hour trading volume, it’s like the crypto world’s version of a high-stakes poker game-except the pot is your retirement fund.

Bitcoin Chart Outlook

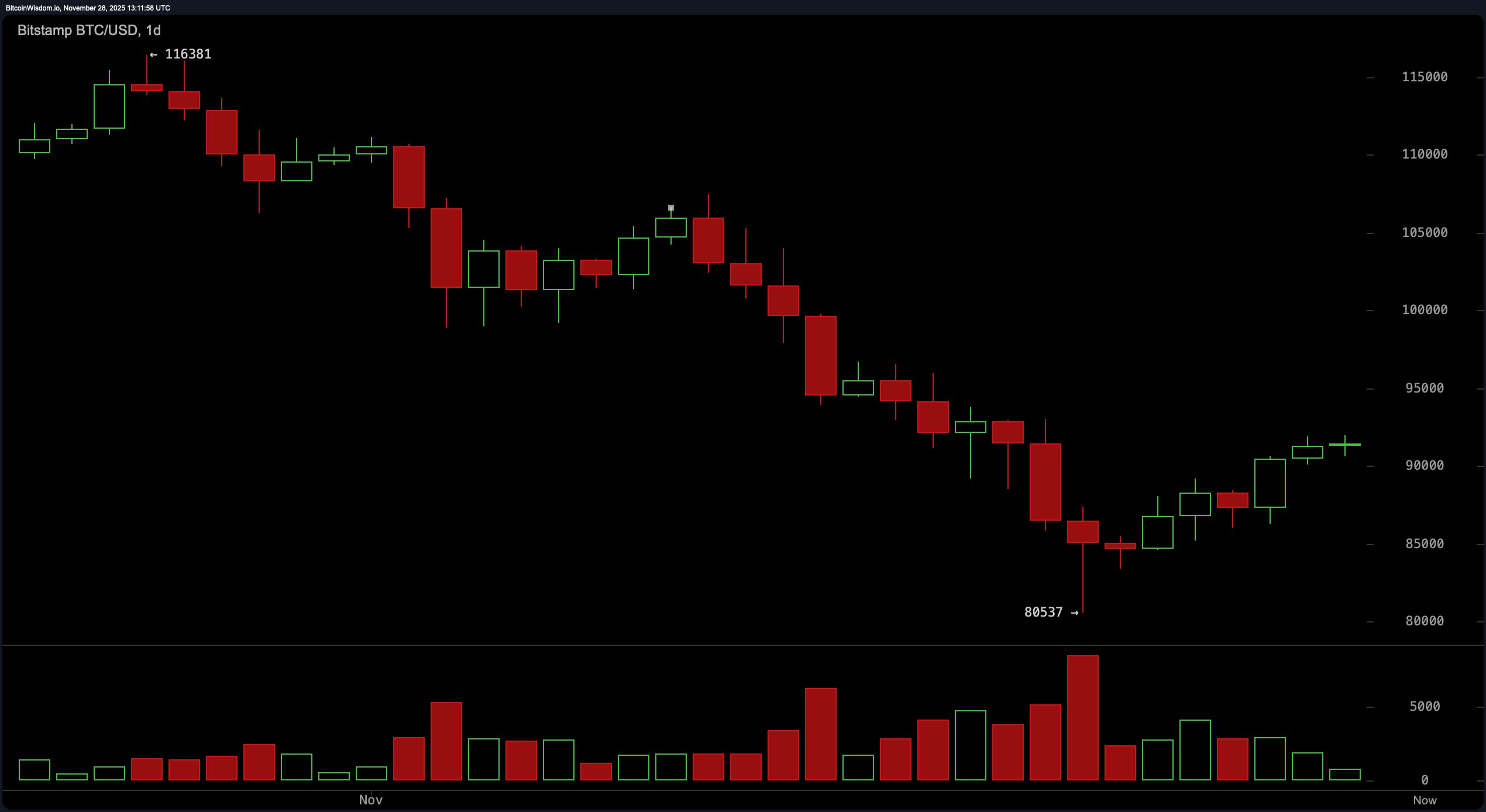

The daily chart tells a tale of resurrection. After plummeting from the lofty $116,381 peak to a local low near $80,537, Bitcoin staged a comeback so dramatic it makes a phoenix’s rebirth look lazy. Green candles stack like poker chips after a particularly lucky night at the table, with bullish volume surging as if investors finally remembered how to type “buy” on their keyboards. The magic happened around $83,000 to $85,000, where brave (or foolish) hands decided to scoop up the chaos.

Now, with Bitcoin above the $90,000 psychological barrier, the market is eyeing the $95,000 to $97,000 range like a toddler eyeing a cookie jar-equal parts excitement and dread.

The 4-hour chart? A masterclass in “I’m not panicking, I’m just… consolidating.” Bitcoin rallied from $84,157 to $92,003, then sidestepped like a tiger deciding whether the effort of the leap is worth the buffalo. A pennant is forming-think of it as a crypto flag planted on the moon of indecision. Break north of $92,200 with volume to match, and we’re looking at a potential sprint toward $95,000 to $96,000. Until then, it’s the crypto equivalent of waiting for the bus that never comes.

The 1-hour chart is a farce. Price is range-bound between $91,500 and $92,000, repeatedly slamming into a ceiling near $92,003 like it’s testing for weak spots in a haunted house. Low volume and dojis (those indecisive candlestick creatures) suggest the market is torn between “I’ve got this!” and “Wait, who am I again?” A breakout above $92,100 with volume would be the cue for a encore. Failing that? More waiting. Because patience is just fear wearing a tie.

Momentum indicators are throwing a party for one. The RSI is lounging at 41 like it’s on a hammock, the Stochastic oscillator is neutral at 55 (because why take sides?), and the CCI is slightly bearish at −25-probably just tired of the hype. The ADX is a healthy 43, suggesting the trend has legs, but whether those legs are sprinting or shuffling remains the question. The Awesome oscillator adds a neutral −10,421 reading, while momentum slips to −1,499-short-term hesitation, or just a nap? The MACD, however, plays devil’s advocate with a bullish −4,338 divergence. Confusing? Absolutely. But that’s the beauty of crypto: it’s like a choose-your-own-adventure novel written by a sleep-deprived hedge fund.

Moving averages are a split jury. The 10-period EMAs/SMA are below the current price, cheering on the bulls. But above that, it’s a red sea of resistance from $93,223 to $109,866. Think of it as a crypto version of a “you had one job” meme. This is a test of resolve for Bitcoin-either it forces a reversal or gets smothered by its own history. Either way, it’s a drama series.

Bull Verdict:

If Bitcoin breaks decisively above $92,200 with volume that doesn’t hit snooze halfway through the move, it could rocket toward $95,000 to $97,000. The structure is there: higher lows, consolidating momentum, and a breakout-ready flag. As long as it holds above $90,000, the bulls have a technical foothold-and they know it. Just don’t forget to pack a parachute.

Bear Verdict:

Should Bitcoin fumble and close below $90,000, this bullish setup will fall flat faster than a meme coin after a celebrity tweet. With most moving averages stacked above as resistance and momentum indicators refusing to pick a side, a failure to break $92,000 could send Bitcoin drifting back toward $88,000-or lower if the bears get bold. Either way, it’s a rollercoaster with no seatbelts.

FAQ ❓

- What is Bitcoin’s price today?

Bitcoin is trading at $91,463 as of Nov. 28, 2025. (Yes, it’s still here. No, you’re not dreaming.) - Is Bitcoin in an uptrend or downtrend now?

It’s recovering from a downtrend and consolidating with bullish potential. Like a hangover that’s finally found Advil. - What are the key resistance levels for Bitcoin?

Major resistance lies between $92,200 and $97,000. Cross that bridge, and you’ll feel the crypto gods watching. - What happens if Bitcoin drops below $90,000?

A close below $90,000 could weaken the current bullish structure. Buckle up-it’s a wild ride either way.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- USD ILS PREDICTION

- EUR NZD PREDICTION

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- EUR AED PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- Bitcoin Ghosts, Rogue Bankers & The Not-So-Smart Crypto Circus: This Week’s Recap Will Make You Regret Not HODLing

2025-11-28 17:40