In the quietude of the digital bazaar, where fortunes are made and lost with the whimsy of a child’s game, the grandees of Dogecoin have retreated into their shells. Their on-chain antics, once a spectacle of exuberance, have dwindled to a murmur, the faintest of echoes in a cavernous hall. Ali Martinez, that vigilant scribe of the blockchain, has noted with a raised eyebrow that the whales-those leviathans of the crypto sea-have ceased their splashing. Their transactions, once a torrent, now trickle like a forgotten brook.

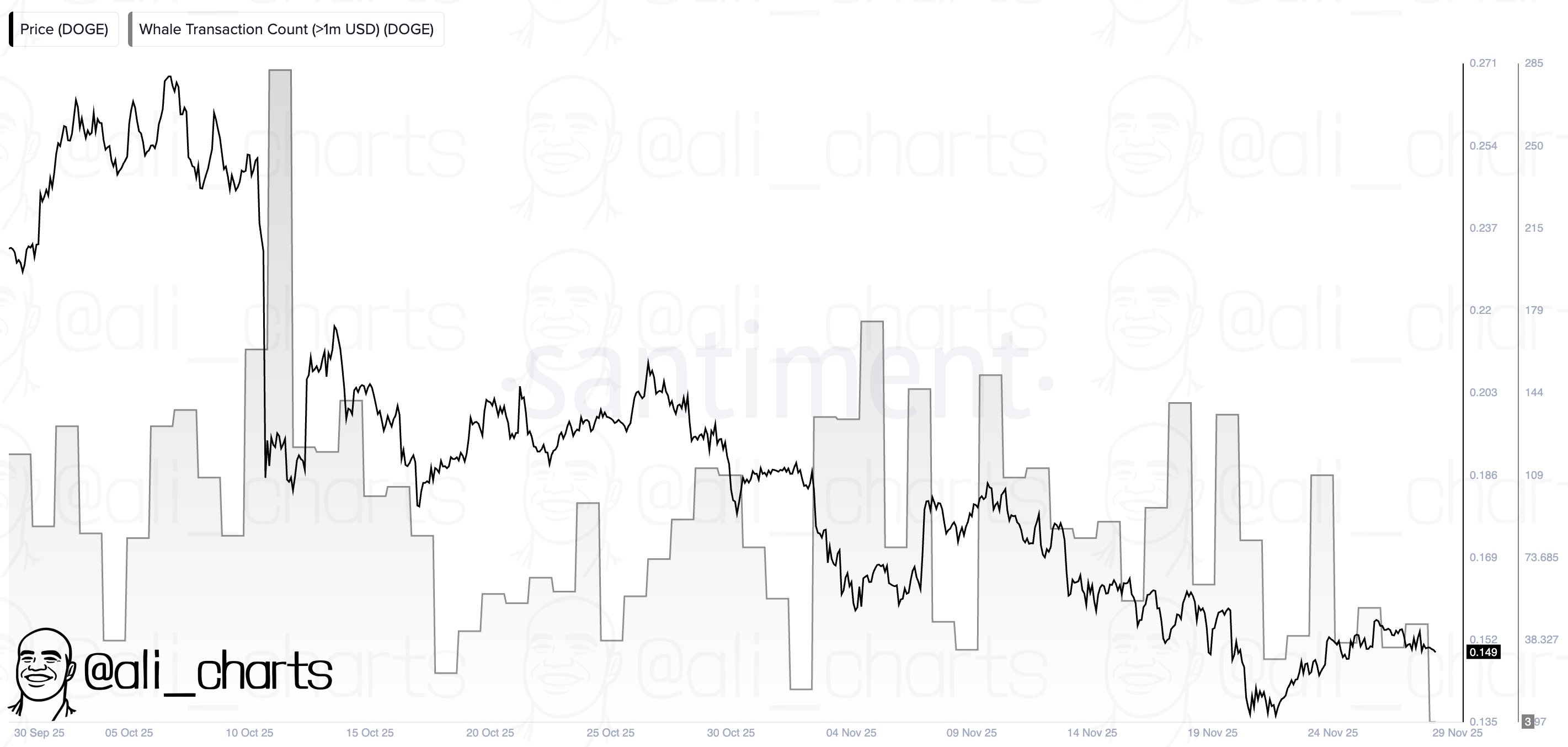

Martinez, with a flourish of his quill (or perhaps a tweet, in this modern age), shared a chart on X, a Santiment masterpiece, which reveals the sad truth: “Whale activity on the Dogecoin network has sunk to its lowest ebb in two moons.” The graph, a tragicomic ballet of price and transaction, shows the once-frequent spikes of high-value transfers in early October 2025, when the price danced near the giddy heights of $0.27. Ah, those were the days! Now, the chart lies flat, as lifeless as a fish out of water.

The Great Doge Whale Migration: A Tale of Silence and Speculation

On the fateful day of October 10, when the market crashed with the drama of a Chekhovian finale, the whales gave one last grand performance, with over 280 of them making a transaction. But then, like actors exhausted by their own theatrics, they vanished. By November 29, the whale-transaction bar had fallen to a mere 3, even as the price lingered around $0.15. One wonders if they are hibernating, or perhaps plotting their next grand entrance.

This sudden stillness has, of course, sparked the usual parlor games of speculation. CryptoGames3D, a voice from the shadows, opined with a touch of melodrama, “The whales’ retreat could mean one of two things: either they are biding their time, or they have abandoned the stage entirely. Both scenarios, alas, carry the scent of peril. With liquidity as thin as a Russian winter, even a modest sell-off could send prices tumbling like a drunken peasant.” One can almost hear the collective gasp of the market, its fragility laid bare.

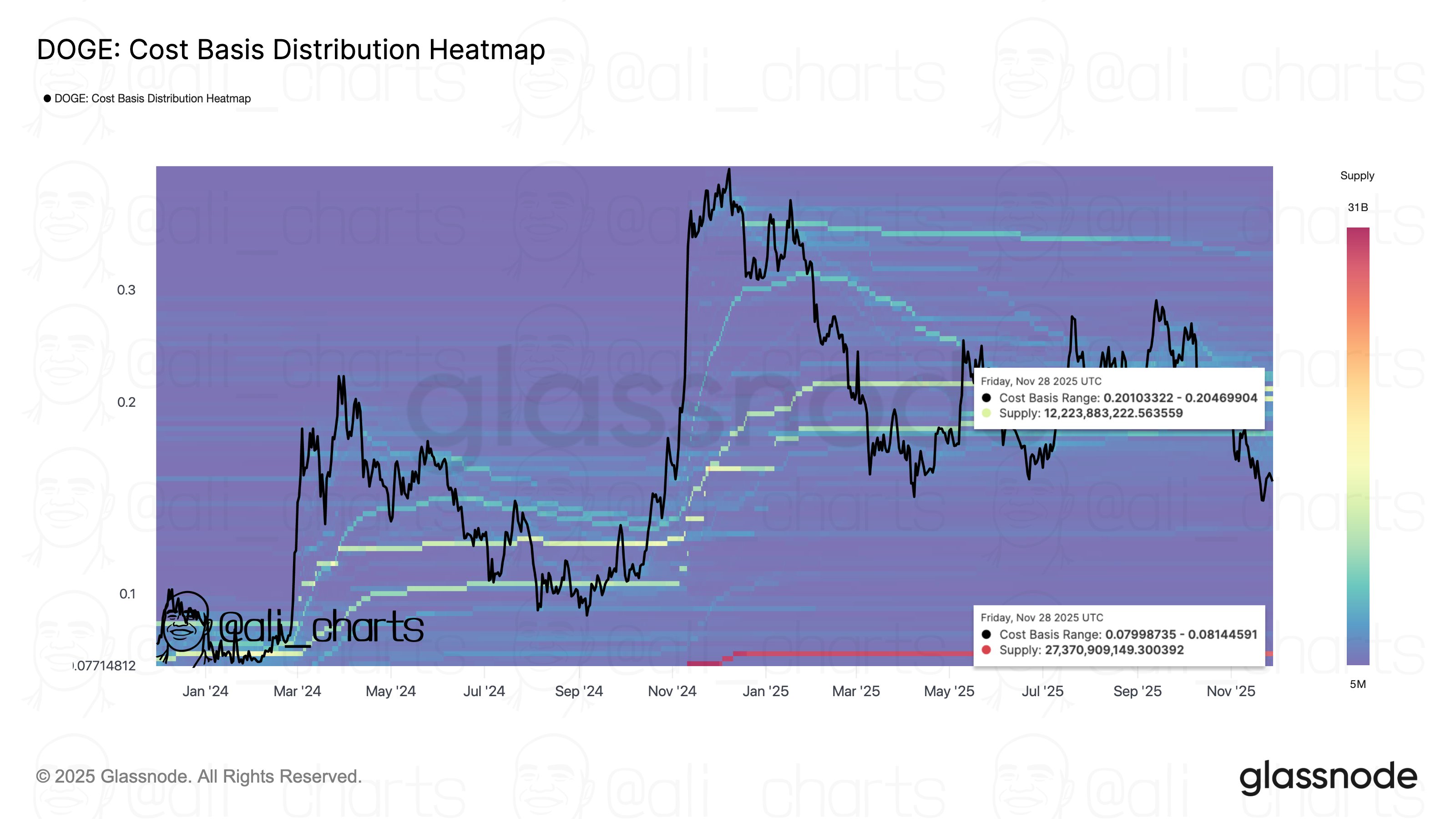

Martinez, ever the pragmatist, offered his own prognosis on November 29, outlining the “key levels for Dogecoin DOGE” with the precision of a doctor diagnosing a patient. “Support at $0.08,” he declared, “and resistance at $0.20.” These levels, mirrored in a Glassnode cost-basis distribution heatmap, reveal a dense cluster of supply around $0.08-a fortress of realized-price support. Higher up, a thinner band around $0.20 forms a formidable resistance, like a wall built by a paranoid tsar.

The heatmap, with its clusters and bands, paints a picture both tragic and comic. DOGE, that mischievous canine of the crypto world, is trapped between a rock and a hard place-a long-term holder cost basis near $0.08 and a resistance pocket around $0.20. Meanwhile, the count of $1 million-plus transfers has shrunk to a multi-month low, leaving the market in an awkward silence, like a dinner party where the guests have run out of things to say.

At the hour of this writing, DOGE trades at $0.137, a price as unremarkable as a gray sky in November. One can only wonder what the whales are thinking, if they are thinking at all. Perhaps they are sipping tea, indifferent to the drama they have left in their wake. 🍵

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR NZD PREDICTION

- OKB’s Wild 160% Ride After a Burn & a Glow-Up-Crypto or Circus? 🤡🔥

- Crypto Takes Nosedive Because Apparently, Price Indexes Are a Thing

- SEC Throws Open the Crypto ETF Gates-Finally, No More Waiting Forever!

- XRP: The Cryptocurrency That Dares to Dream (and Fail) 😅

2025-12-01 17:48