Well, well, well. Here we are again, staring at the Ethereum price like it’s a magic 8-ball, hoping it’ll spit out “Outlook good.” According to the wizards of on-chain data and the latest Ethereum gossip, the price has been lounging around $3,100 like it’s on a beach vacation. Observers, meanwhile, are furiously scribbling in their notebooks, trying to predict if it’s gearing up for a wild rally or just catching some rays before another dip. 🌊📈

At the moment, ETH is chilling at roughly $3,100. Analysts-those modern-day soothsayers-reckon this could be its “consolidation base,” which is just a fancy way of saying it’s taking a breather before deciding whether to sprint or nap. Historical patterns and technical indicators are their crystal balls, but let’s be honest, they’re about as reliable as a weather forecast in Britain. ☁️🔮

Multi-Year Accumulation: Ethereum’s Secret Muscle-Building Phase 💪

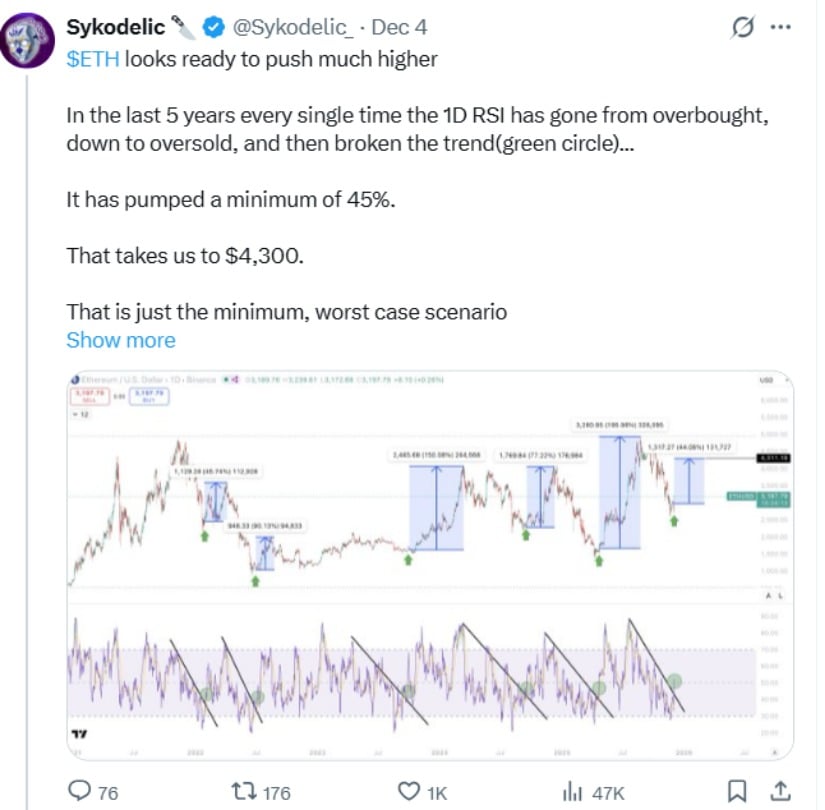

Technical analysis, the astrology of finance, tells us Ethereum has been hitting the gym on higher timeframes. Skyodelic, a crypto guru who’s spent five years studying RSI behavior (because who needs a social life?), noticed Ethereum’s Relative Strength Index (RSI) has gone from “oversold” to “meh.” His hot take? Every time this happens, Ethereum pumps by at least 45%. Sounds great, but remember, past performance is about as useful as a screen door on a submarine. 🚢🤷♂️

He quipped:

“Every single time the 1D RSI has moved from overbought to oversold and then broken the downtrend, it has historically experienced at least a 45% increase.”

Of course, this is all well and good until a regulator sneezes or the economy decides to do the cha-cha. Analysts are cautiously optimistic, tossing out numbers like $4,300 or even $6,800 if the stars align and the trading volume gods are feeling generous. But let’s not get ahead of ourselves-this is crypto, after all. 🎢💥

Long-Term Structure: $1,800, the Crypto Safety Blanket 🛡️

Zooming out to the long-term charts (because who doesn’t love a good zoom?), Ali Martinez-the Sherlock Holmes of ETH/USDT trends-spotted $1,800 as a cozy accumulation zone. It’s like Ethereum’s favorite blanket, supported by a trendline that’s been around since 2022. Ali’s take? This could be the launchpad for a rally, but only if the market doesn’t throw a tantrum. 🤔📉

Ali mused:

“Ethereum at $1,800 may serve as a long-term accumulation zone ahead of a potential rally, though this is contingent on sustained market activity and macro conditions.”

History tells us Ethereum loves a good comeback story, like rising from sub-$100 to nearly $4,800 after the 2018 bear market. But let’s not start planning the parade just yet. “Will Ethereum hit 10K?” is less of a question and more of a daydream. 🌈💭

Exchange Supply Drops: Ethereum’s Getting Exclusive 🎟️

On-chain metrics, the nerdy cousin of technical analysis, show that only 8.7%-8.9% of Ethereum’s supply is hanging out on centralized exchanges. Mister Crypto, the cool kid of blockchain analytics, points out this scarcity could mean big players are hoarding ETH like it’s limited-edition sneakers. 👟💎

“$ETH is extremely scarce. Only 9% of supply is left on exchanges,” he declared, probably while sipping a latte. ☕✨

About 40% of ETH is locked up in staking, custodial solutions, or fancy ETFs like BlackRock’s. This could mean less liquidity and more volatility, but don’t go selling your house just yet. Market dynamics are about as predictable as a cat’s mood. 🐱🤪

Short-Term Structure: Resistance is Futile… or is it? 🤖

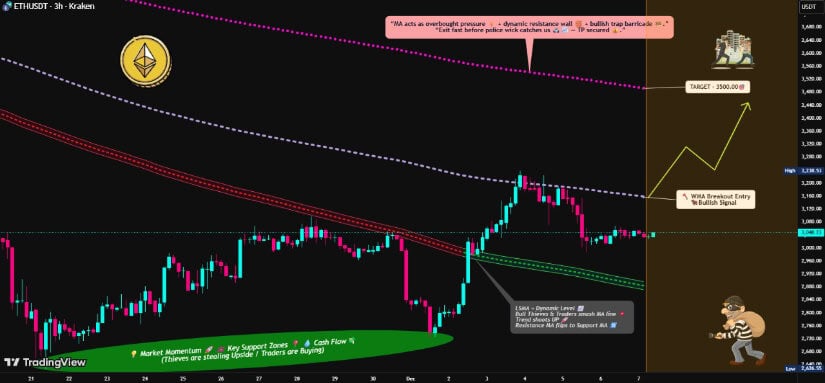

In the short term, Ethereum’s bouncing around like a ping-pong ball in a consolidation band. Traders are eyeing levels like $3,200 for entry, $2,900 for a stop-loss, and $3,500 as a target. But let’s be real, these are just educated guesses-crypto doesn’t do scripts. 🎯🤞

- Entry confirmation: ~$3,200

- Stop-loss/invalidation: ~$2,900

- Initial upside target: ~$3,500

Ethereum’s Future: A Balancing Act on a Tightrope 🎪

While the data looks promising, analysts are hedging their bets. RSI signals can fail faster than a New Year’s resolution, and accumulation zones are about as reliable as a weather app. The Ethereum forecast for 2025 and 2030? Let’s just say it’s more of a choose-your-own-adventure book than a roadmap. 📖🌍

What’s Next for Ethereum? 🕵️♂️

In the near term, if Ethereum can hold above $3,100 and keep its supply off exchanges, it might just flex its muscles. But targets like $6,800? That’s a big “if” dependent on demand, network usage, and whether the economy decides to cooperate. For now, traders and holders should keep their wits about them, because in crypto, the only certainty is uncertainty. 🧠🎢

So, there you have it. Ethereum’s price is a multi-year soap opera, complete with drama, suspense, and the occasional plot twist. Strap in, grab some popcorn, and remember: in crypto, the only thing that’s guaranteed is that nothing’s guaranteed. 🍿🚀

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- NEAR PREDICTION. NEAR cryptocurrency

- CRV PREDICTION. CRV cryptocurrency

- Crypto Chaos: Ripple’s Legal Boss Warns of an Endless Puzzle of Regulatory Nonsense

- Crypto’s Big Bet on FOMC: Will It Pay Off? 🚀💥

- TRON’s Stablecoin Chaos: Whales Wobble, Binance Falls! 🐉💸

- Dogecoin’s Dramatic Dance: Surges, Secrets & a Fed-Fueled Frenzy! 🚀🐶

2025-12-07 23:20