Oh, what a week it was, my crypto-loving friends! 🌪️ Bitcoin and Ether ETFs were left sobbing into their digital wallets, while Solana and XRP funds were doing the cha-cha slide to the bank! 🎉 Fund flows? More like a financial rollercoaster with more twists than a Mel Brooks plot! 😂

Bitcoin and Ether ETFs: Red as a Clown’s Nose, While Solana and XRP Steal the Spotlight ✨

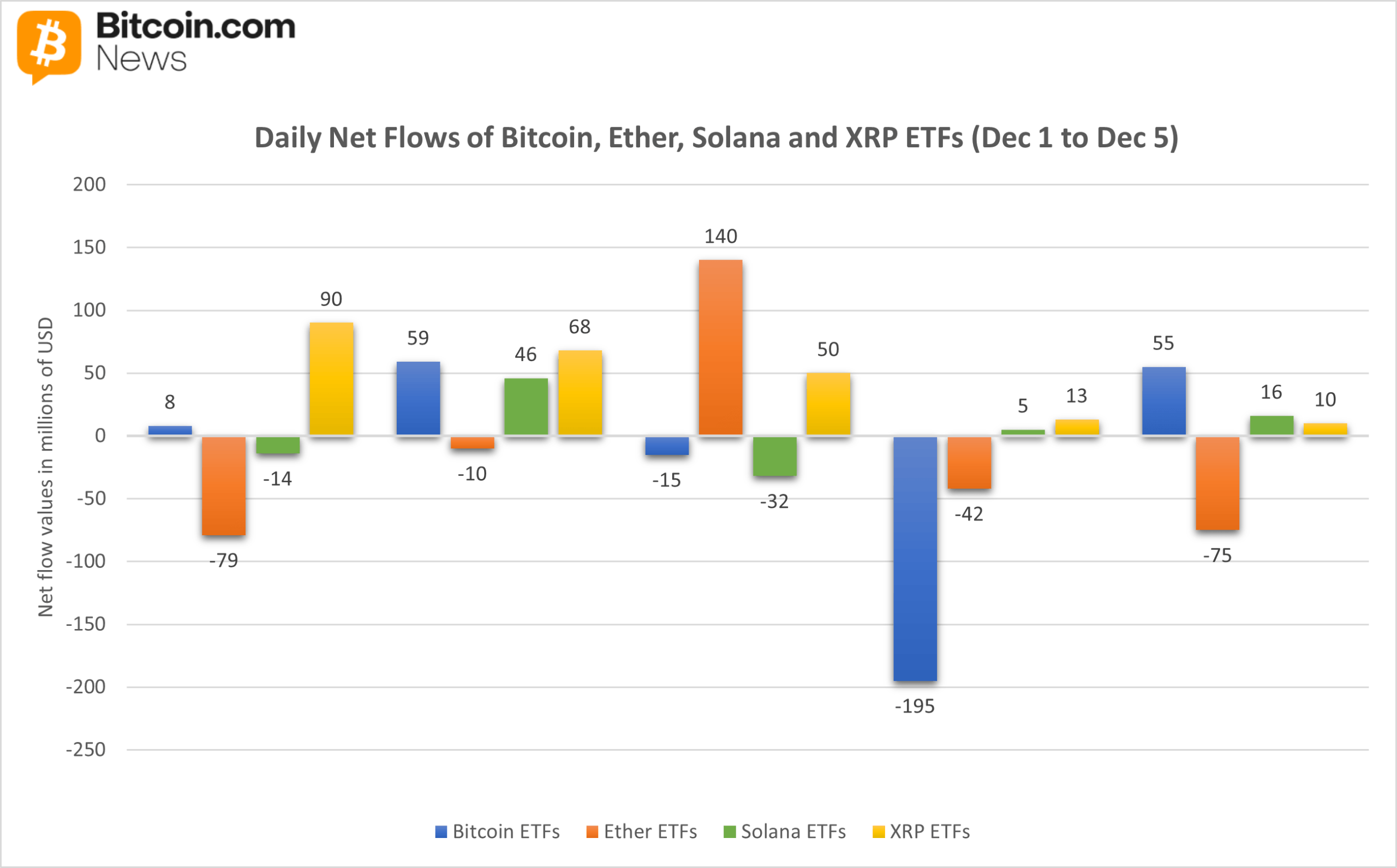

The first week of December? More like the first week of “What the heck is going on?” 🤪 Bitcoin and Ether ETFs took a nosedive after some mid-week shenanigans, while Solana and XRP were quietly stacking coins like it’s a game of Monopoly. 🤑 Each issuer had its own drama-some were recovering, some were tripping over their own feet, and others were riding the momentum like a boss! 🕺

Bitcoin ETFs: A Week of Wild Rides and Faceplants 🤡

Across all spot bitcoin products, the category ended the week with a net outflow of -$87.77 million. 📉 Daily data? More like daily drama! Blackrock’s IBIT swung wilder than a Tarzan vine, finishing -$48.99 million. Ouch! 😣 Fidelity’s FBTC, on the other hand, was like, “I got this,” ending up $61.96 million. Bitwise’s BITB? Steady Eddie with $9.30 million. 👏

ARK & 21Shares’ ARKB? Biggest faceplant of the week at -$77.86 million. 😱 Grayscale’s GBTC added another -$29.77 million to the misery, while its Bitcoin Mini Trust slipped -$411.52K. Vaneck’s HODL? -$2.95 million. Wisdomtree’s BTCW? A tiny but mighty $947.22K. 🌟 Despite the tears, trading volume hit $22.57 billion-healthy interest or just chaos? You decide! 🤔

Ether ETFs: Blackrock’s ETHA Ruined the Party 🎈

Ether ETFs lost -$65.59 million this week. 😢 Blame it on Blackrock’s ETHA, which single-handedly erased gains with a -$55.87 million dive. Fidelity’s FETH? The hero we needed, adding $35.50 million. 🦸 Grayscale’s Ether Mini Trust? Green with $7.51 million, while ETHE slipped -$53.17 million. Bitwise’s ETHW and Vaneck’s ETHV? Modest moves at $4.48 million and -$4.03 million, respectively. 🤷♂️

Solana ETFs: The Steady Eddy of the Week 🌟

Solana ETFs posted a net inflow of $20.3 million from Dec. 1-5. 💪 Bitwise’s BSOL led the charge with $65.11 million. Fidelity’s FSOL? $14.11 million. Grayscale’s GSOL? $11.19 million. Vaneck’s VSOL? $2.71 million. Canary’s SOLC? $1.09 million. 21Shares’ TSOL? The odd one out with -$73.91 million. 🤦♂️

XRP ETFs: Four Weeks of Green and Counting! 💚

XRP ETFs kept the party going with $230.74 million in gains. 🎉 Grayscale’s GXRP? $140.17 million. Franklin’s XRPZ? $49.29 million. Bitwise’s XRP and Canary’s XRPC? $21.10 million and $20.19 million each. Four weeks of green-investors are diversifying like it’s going out of style! 🛍️

FAQ📈

- Why did Bitcoin ETFs finish the week negative?

BTC ETFs saw a -$87.77 million outflow as issuers played a game of “Who can lose the most?” 🤪 - What drove the decline in Ether ETFs?

Ether ETF outflows? All Blackrock’s ETHA’s fault-thanks for nothing! 🙄 - Why did Solana ETFs stand out this week?

Solana funds posted $20.3 million in inflows-steady like a rockstar! 🎸 - How did XRP ETFs perform compared to others?

XRP ETFs surged $230.74 million-four weeks of green, baby! 🤑

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- EUR INR PREDICTION

- FLR PREDICTION. FLR cryptocurrency

- Three Coins Chekhov Would Yawn at-Yet Might Still Make You Rich 😴💸

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- ETF Mania: Bitcoin And Ethereum Funds Hit Record $40 Billion Week

2025-12-08 19:01