Oh, what a marvel! The price of Pepe Coin, that most enigmatic of digital jesters, found itself on the precipice of a three-week high, as if the very cosmos had conspired to grant it a moment of respite. One might say it’s a tale of redemption, or perhaps just a fleeting illusion, as Bitcoin and its ilk danced in the shadows of the Federal Reserve’s impending decision. 🧠

- Pepe Coin’s price, with all the grace of a drunken seagull, has formed an inverse head-and-shoulders pattern. 🧠

- The token has also leapt above the Supertrend indicator, a feat as impressive as a penguin wearing a top hat. 🦉

- The coin, ever the optimist, will likely break out in a burst of bullish fervor, as if the universe itself were whispering, “You’ve got this!” 🚀

Pepe (PEPE), that steadfast little meme, climbed to the psychological threshold of $0.0000050, a 28% ascent from its November lows. The market cap, now over $2.1 billion, is a number that would make even the most stoic investor raise an eyebrow. 🤯

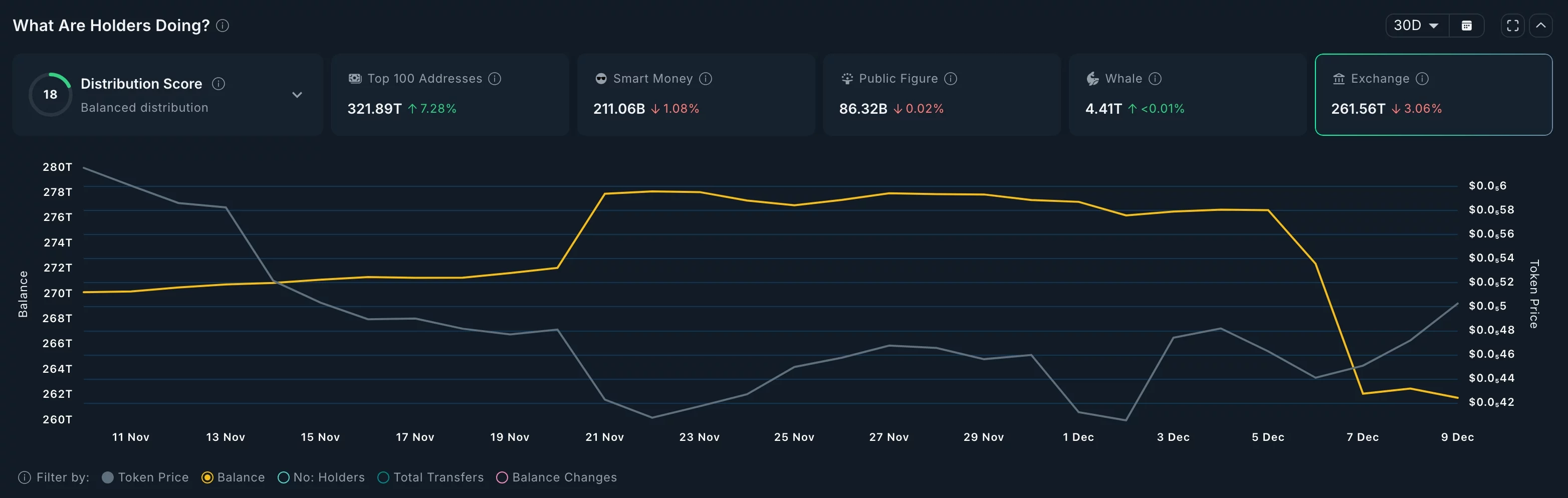

On-chain metrics and technicals, those fickle courtiers of the crypto world, suggest a brief rebound is on the horizon. One such metric? The number of Pepe tokens languishing on exchanges has nosedived, as if they’ve finally had enough of the limelight. 🧠

The supply, once a towering 276 trillion tokens, has now dwindled to 261.6 trillion. Over 15 trillion tokens, worth a tidy $75 million, have fled to self-custody, a move as bullish as a cat chasing a laser pointer. 🐱 This trend, of course, mirrors that of other tokens like Chainlink and Shiba Inu, who clearly have no idea what they’re doing. 🤷♂️

Pepe’s ascent coincides with the collective breath-holding of market participants, all awaiting the Federal Reserve’s interest-rate decisions. One can only hope that a rate cut, accompanied by a dovish statement, will shower riskier assets like Pepe with the favor they so desperately crave. 🌟

Meanwhile, the recent decline in Pepe’s futures open interest has reached its nadir, and now, like a phoenix, it rises anew. CoinGlass data reveal a surge in open interest to $255 million, a figure that would make even the most jaded trader smirk. A rebound here is as likely as a snowball’s chance in hell-yet here we are. 🧊

Pepe Coin price technical analysis

The four-hour chart, that silent witness to the coin’s trials, shows a slow crawl back from its nadir of $0.000003950. The coin has inched slightly above the Supertrend indicator, a move that, in the world of crypto, is as significant as a whisper in a storm. 🌪️

Pepe has also rallied above the 50-period Exponential Moving Average, a milestone as meaningful as a toddler’s first steps. It has also formed an inverse head-and-shoulders pattern, a common bullish reversal sign. The Relative Strength Index, that ever-temperamental barometer, continues its ascent, inching closer to the overbought abyss. 🚨

Thus, the most likely scenario is that it continues its ascent, with the next key target at $0.0000063-27% above the current level. This target, coinciding with the highest point on Nov. 11, is as thrilling as a rollercoaster without the safety harness. A drop below the right shoulder at $0.0000043 will invalidate the bullish outlook, a fate as inevitable as the sun setting on a day of folly. 🌅

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- ALGO PREDICTION. ALGO cryptocurrency

- Is OKB’s Price Surge Just a Mirage? Find Out Why It Might Plummet to $65! 😱

- You Won’t Believe What DBS Just Did with Crypto! 😲💰

- USD PLN PREDICTION

- GBP CAD PREDICTION

2025-12-09 22:20