What to know:

- The volatility indices of Bitcoin, much like the S&P 500, are taking a leisurely stroll downward, as if they’ve decided to nap instead of dance.

- This dip in implied volatility has left the prospects of a year-end rally looking as spry as a wet cat on a slippery floor-unlikely to spring into action.

- Matrixport, that esteemed firm of financial soothsayers, opines the volatility compression suggests the likelihood of a grand year-end rally is about as probable as a snowstorm in July-possible, but don’t hold your breath.

Bitcoin’s volatility indexes, those once-wild beasts of the market, now saunter downward like a sleepy riverboat captain after a long voyage, mirroring the S&P 500’s own sedate shuffle. According to one analyst, this newfound serenity weakens the case for a year-end rally, which now resembles a turkey with no legs-still there, but not going anywhere fast.

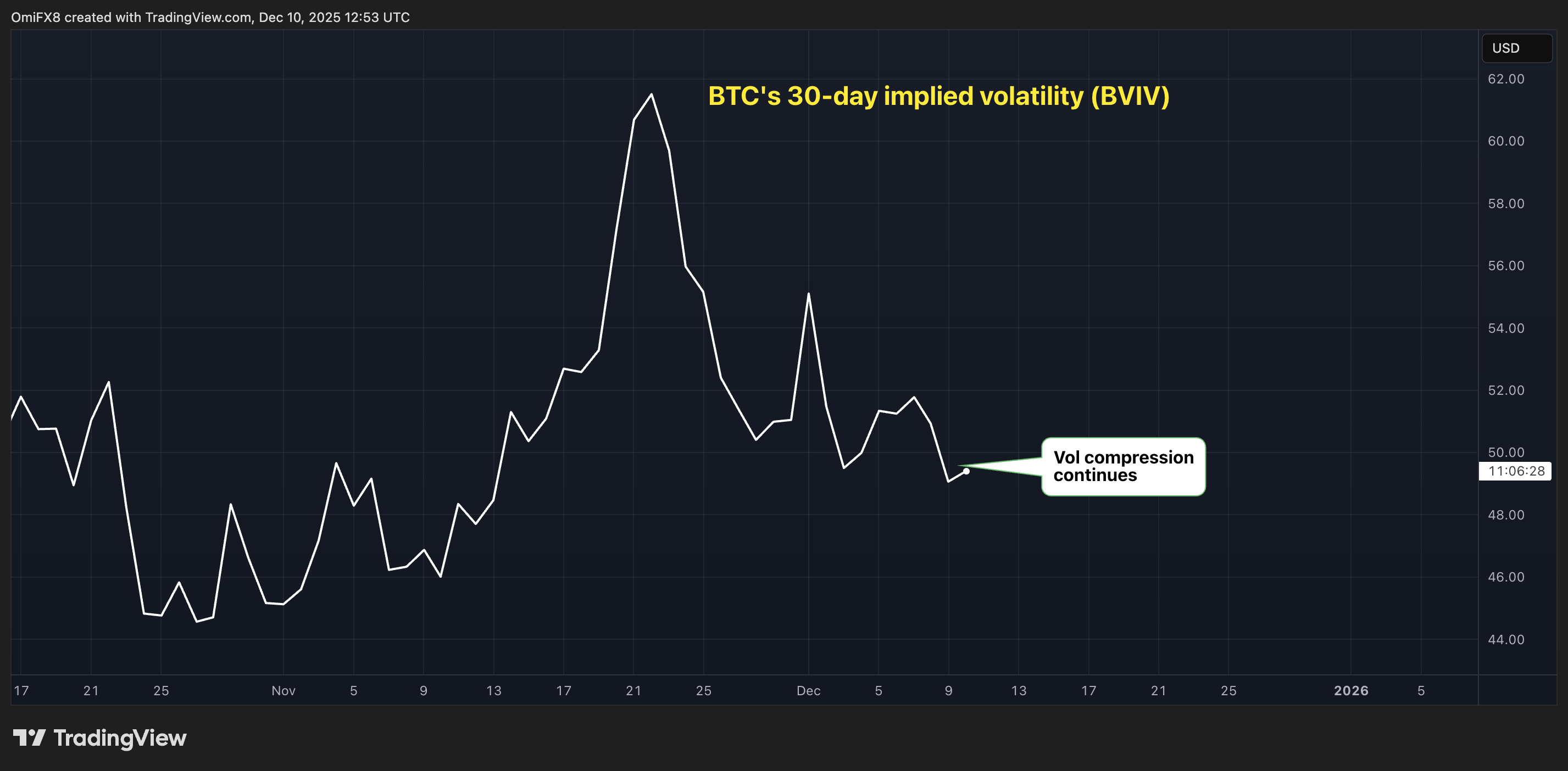

BTC’s annualized 30-day implied volatility, as measured by Volmex’s BVIV index, has sunk to 49%, nearly undoing the spike from 46% to 65% over 10 days through Nov. 21. Per TradingView data, it’s as if the market whispered, “Let’s all take a deep breath and remember how to count to 10.”

Implied volatility, that cryptic oracle of options traders, measures the market’s expectations for price swings. The drop from 65% to 49% means the expected turbulence has softened from a 5-point frenzy to a 14% yawn. A 30-day calm so profound it could put even a Wall Street broker to sleep.

The VIX index, that old barometer of market nerves, has likewise cooled its heels, dropping from 28% to 17% since Nov. 20. It’s the financial equivalent of swapping a hurricane for a gentle drizzle-still wet, but less dramatic.

Matrixport, ever the optimists, claims this “volatility compression” suggests the odds of a year-end rally are about as thin as a politician’s promise. “Implied volatility continues to compress, and with it, the probability of a meaningful upside breakout into year-end,” they declared in their market update. “Today’s FOMC meeting represents the final major catalyst, but once it passes, volatility is likely to drift lower into the year-end.”

Their view aligns with Bitcoin’s historical love affair with volatility-though since November 2024, that romance has soured into a lukewarm handshake. On Wall Street, such volatility compression is typically a bullish reset, like telling a bear to wear a top hat and call it a “strategic pivot.”

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- Ethereum’s Drama: When Crypto Gets More Exciting Than Bridget Jones!

- TRON’s Secret Weapon: Crypto Crime Fighters (And a Few Surprises) 🤖💣

- South Korea’s 2026 Bitcoin ETF Plan: Genius or Absolute Chaos?

- TRX PREDICTION. TRX cryptocurrency

- XMR PREDICTION. XMR cryptocurrency

2025-12-10 17:56