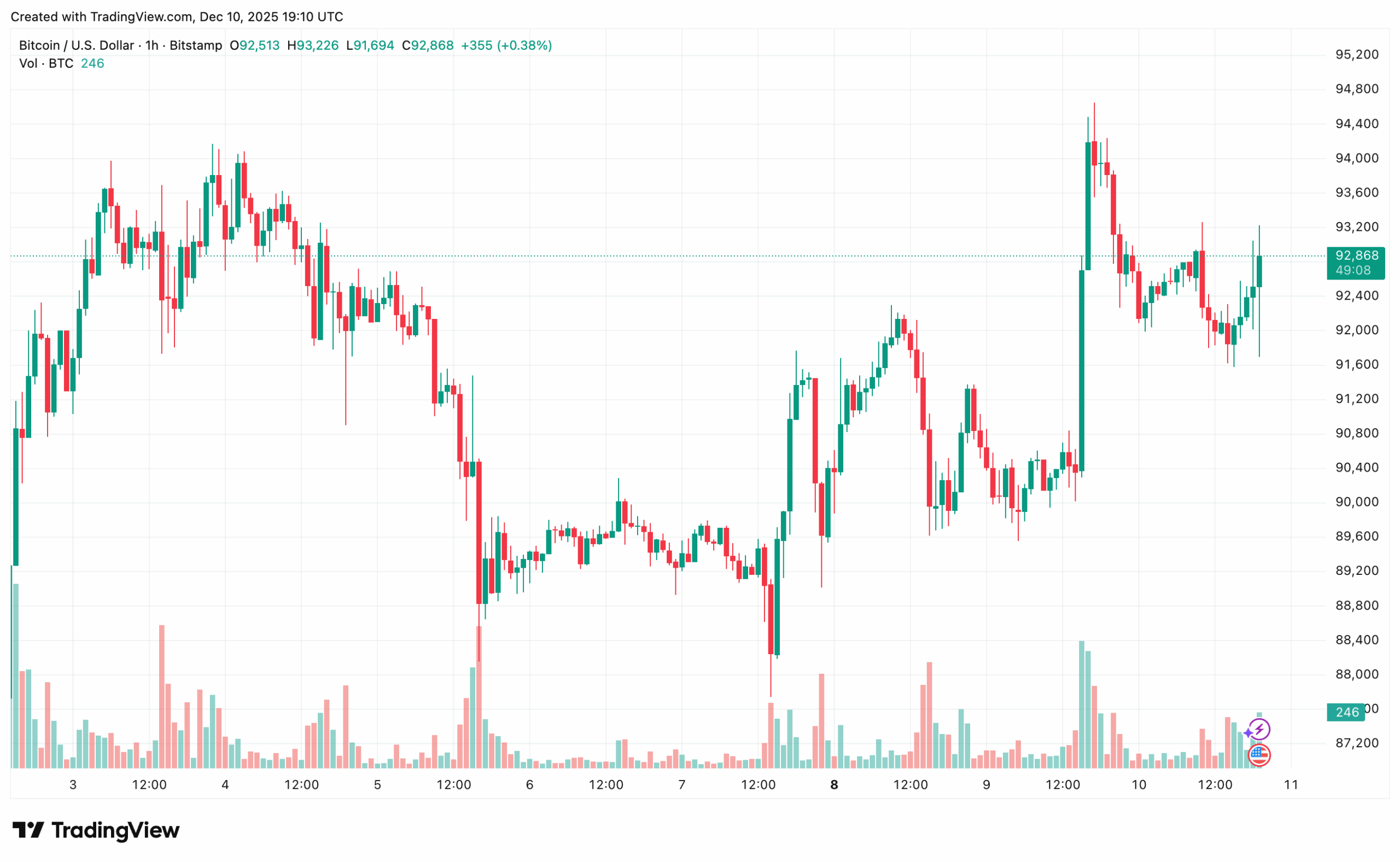

Ah, Bitcoin. Always keeping us on our toes, like a cat that just discovered the laser pointer. In the last 24 hours, it managed to shed more than $2,000. Yes, you read that right, $2,000 – poof! Gone. And, just when you thought it couldn’t get any more dramatic, it dropped another $500 in minutes, only to pull off a miraculous recovery. All this happened just as the US Federal Reserve made its announcement of yet another rate cut. Oh, and just in case you were wondering, it’s the third one this year. They slashed it by 25 basis points (0.25%). That’s right, a quarter of a percent. Truly groundbreaking stuff. Meanwhile, Powell was grinning like the Cheshire Cat, dropping hints about another cut in 2026. Don’t hold your breath, though.

The market, in its infinite wisdom, was expecting a 50 basis point cut. When that didn’t materialize, it responded with the kind of price action you’d expect from a teenager who was promised a new phone and got a pair of socks instead. In other words, chaos. However, most of this was already priced in – because when 99% of market odds are predicting a rate cut, you know there’s not much surprise left to be had. Kind of like when the plot twist in a movie is so obvious, even the popcorn’s bored.

Now, this all happens while the cryptocurrency market is in the midst of a period of excessive volatility – because, of course, it is. Just yesterday, CryptoPotato reported that Bitcoin did its best impression of a rollercoaster, skyrocketing by $4,000 in minutes, before promptly retracing. Classic Bitcoin. It’s the crypto equivalent of that friend who insists on driving but can’t decide whether to go 100 miles an hour or stop for snacks every five minutes.

And it wasn’t just Bitcoin playing this game. The altcoin market followed suit, with ETH (that’s Ethereum for those of you who don’t speak Crypto) increasing by 9% in the next 24 hours. At least some of the altcoins know how to behave themselves. They’re like the good kids at the birthday party who don’t throw the cake at anyone.

Speaking of predictions, remember when Coinbase Institutional said there would be a rally by the end of the month? Yeah, it seems they were onto something. They pointed out that their “systemic leverage ratio” (don’t worry, they’ll explain it at the next boring conference) has stabilized around 4-5% of the market capitalization, down from 10% in the summer. Translation: All those speculative bets? They’ve been flushed out. In layman’s terms: The market’s a little bit healthier now, but still not quite ready for yoga class.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- USD IDR PREDICTION

- CNY RUB PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Wyoming’s Wild Crypto Ride: Stablecoins, Solana & School Funds! 🚀

- Zcash Plummets: ECC Splits, Bears Feast, and $300 Looms 🤑💥

- USD KZT PREDICTION

2025-12-10 22:37