Markets 🌪️

What to know: 🤔

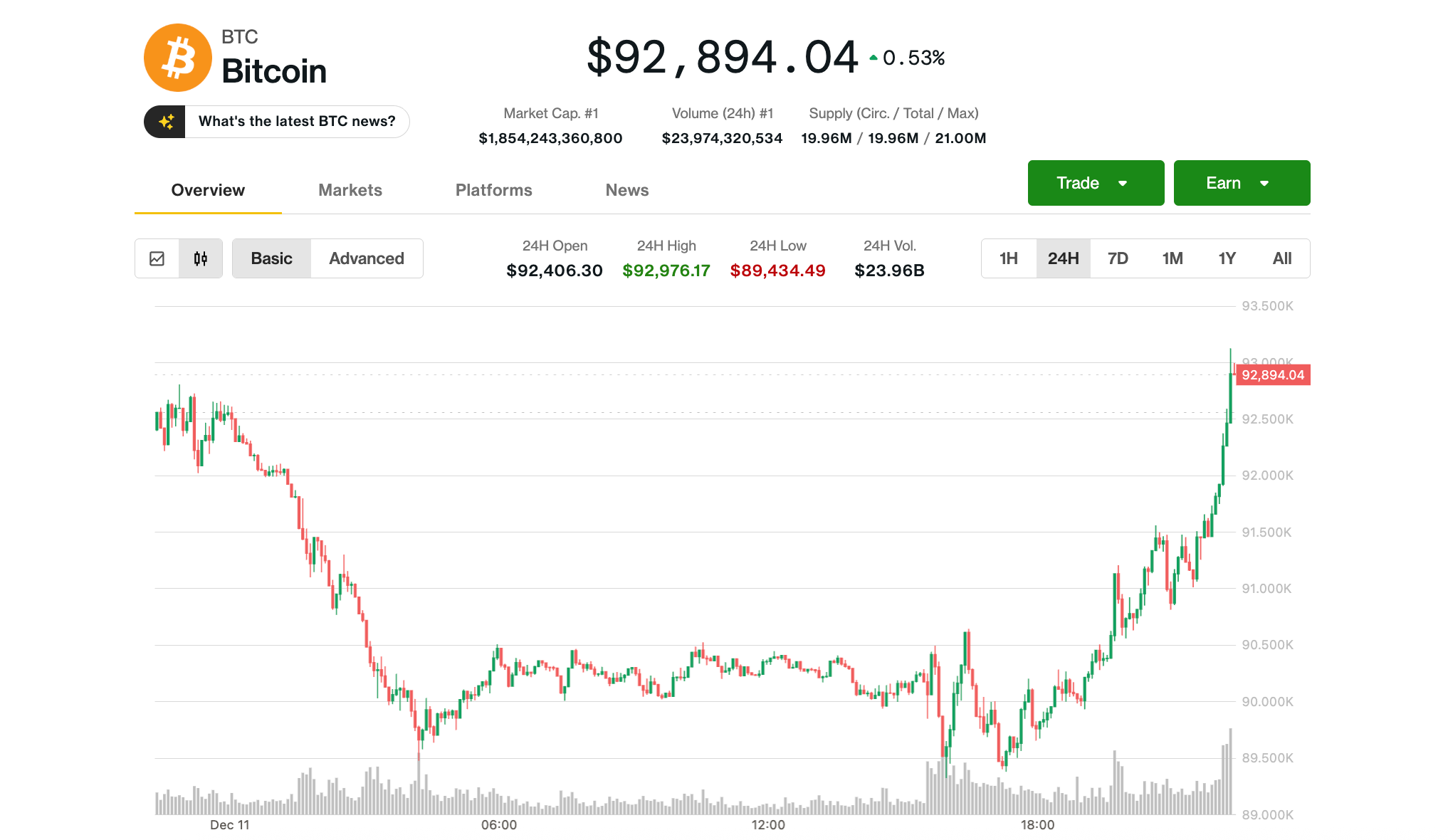

- Bitcoin, that fickle beast, decided to play nice on Thursday, rebounding from a dramatic early selloff to flirt with $93,000 just as U.S. stocks called it a day. 📈✨

- Meanwhile, the Nasdaq pulled a Houdini, escaping from a morning nosedive to close with a mere 0.25% loss. Tech stocks: the ultimate drama queens. 🎭

- One analyst quipped that the downward pressure on Bitcoin is “losing steam,” but let’s not pop the champagne just yet-we’re still in the financial forest. 🌲🤞

Bitcoin, ever the resilient darling, clawed its way back to $93,000 on Thursday as traders tried to make sense of the Fed’s latest move. Altcoins, however, were left sipping their sorrows in the corner, mostly missing out on the party. 🎉🥺

After slipping to $89,000 post-Fed rate cut and a gloomy U.S. stock open, Bitcoin staged a late-day comeback, trading at $93,000-a marginal gain over 24 hours. Altcoins, though? Not so much. Cardano‘s ADA and Avalanche’s AVAX led the decline, down 6%-7%, while Ether sulked at 3% lower, clinging to $3,200 like it’s a life raft. 🌊💔

Bitcoin’s bounce mirrored U.S. stocks’ late-day rally, with the Nasdaq closing down just 0.25% after flirting with a 1.5% loss. The S&P 500 squeaked into the green, and the DJIA flexed with a 1.3% gain. But the real stars of the day? Precious metals. Silver surged 5% to a record $64 per ounce, and gold climbed over 1% to nearly $4,300. Blame it on the U.S. dollar index (DXY) taking a nap since mid-October. 💎💤

In crypto land, Gemini stole the show, soaring over 30% on news of regulatory approval for prediction markets in the U.S. Because who doesn’t love a good bet? 🎲💰

Crypto vs. Equities: The Decoupling Saga 📉📈

Jasper De Maere, desk strategist at Wintermute, noted that Thursday’s action highlighted crypto’s growing independence from equities, especially when macro events are in play. “Only 18% of the past year’s sessions have seen BTC outperform the Nasdaq on macro days,” he pointed out. “Yesterday was textbook: equities rallied, crypto sold off. The rate cut was priced in, and marginal easing is so last season.” 🗓️👋

De Maere also hinted at early stagflation jitters creeping into 2026, with markets shifting their gaze from Fed policy to U.S. crypto regulation as the next big thing. Because nothing says “fun” like regulatory uncertainty. 🎢🤪

Bitcoin’s Sell Pressure: Fizzling Out? 💨

Swissblock, the analytics wizards, chimed in that Bitcoin’s downward pressure is “losing steam,” with the market stabilizing-but don’t break out the confetti just yet. “The second selling wave is weaker than the first, and pressure isn’t ramping up,” they tweeted. “Signs of stabilization? Yes. Confirmation? Not so fast.” 🛑🤔

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- NEXO PREDICTION. NEXO cryptocurrency

- Ethereum’s Drama: When Crypto Gets More Exciting Than Bridget Jones!

- TRON’s Secret Weapon: Crypto Crime Fighters (And a Few Surprises) 🤖💣

- South Korea’s 2026 Bitcoin ETF Plan: Genius or Absolute Chaos?

- BTC PREDICTION. BTC cryptocurrency

2025-12-12 00:36