Markets

What to know:

- The Russell 2000 index has surged to all-time highs alongside U.S. equities and metals, while Bitcoin lags a quaint 27% below its peak. Such a divergence is rare, considering the years these two have been joined at the hip.

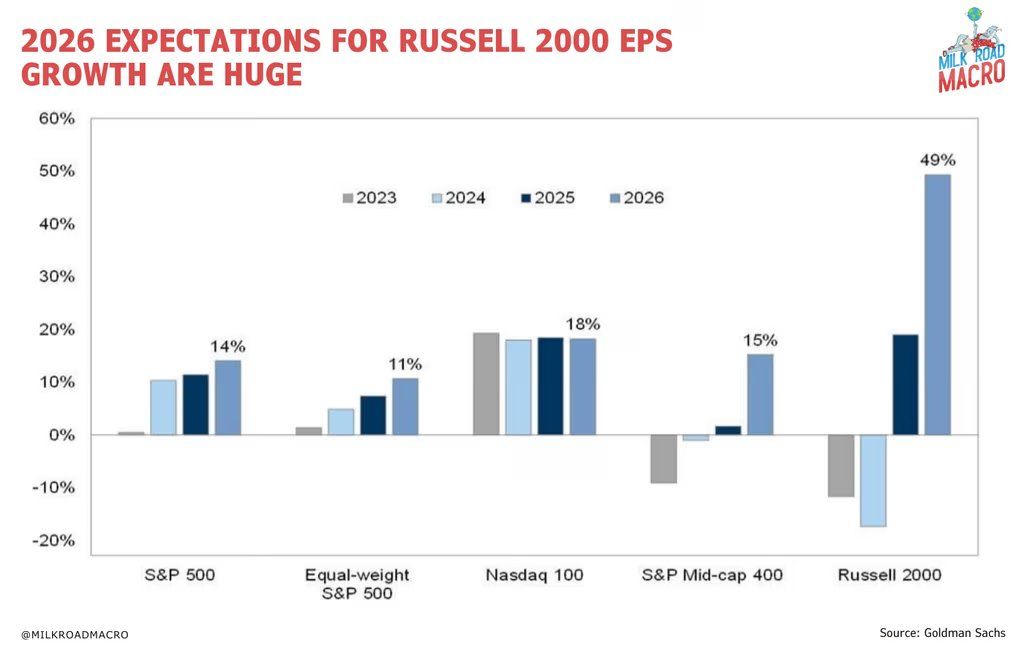

- Small-cap stocks are like a hyperactive toddler at a candy store-highly sensitive to interest rate changes. With expectations for 2026 earnings-per-share growth at a whopping 49%, improving macroeconomic conditions might just nudge Bitcoin back into line.

- The Federal Reserve, in its infinite wisdom, begins its Treasury bill purchases today, starting with a modest $8.2 billion-just the beginning of a $40 billion reserve management program until April.

In an unprecedented turn of events (okay, maybe not that dramatic), the Russell 2000 Index (IWM) has hit new record highs. Meanwhile, Bitcoin, the once loyal companion, has taken a detour and is still 27% below its October record. Now, don’t worry, history suggests that the world’s largest cryptocurrency will eventually catch up. Maybe it just needs a coffee break.

The Russell 2000, which measures the pulse of U.S. small-cap equities, hit its peak on Thursday, following the footsteps of larger indexes like the Dow Jones (DJIA) and S&P 500. Even the Nasdaq 100 is nearly at its record. Oh, and let’s not forget about silver, which is showing off at new highs too.

Since 2020, the Russell 2000’s new highs have been eerily synchronized with Bitcoin’s jumps. Remember November 2021? Bitcoin hit a glorious $69,000. Fast forward to November 2024, it breezed past $90,000, and in mid-October, it nearly touched $126,000 before it decided to take a nap on November 21st.

Milk Road Macro (because who doesn’t take financial advice from a dairy farm?) pointed out that smaller, more volatile companies are more sensitive to interest-rate changes than their larger, more stoic counterparts. This sensitivity becomes crucial after the Federal Reserve’s recent 25 basis-point rate cut. Goldman Sachs forecasts a nearly 49% earnings-per-share growth for the Russell 2000 by 2026. Risky assets like cryptocurrencies may soon be in for a jolly ride.

Oh, and in case you missed it, there’s a delightful 50 basis-point rate cut priced into the market for the next 12 months, according to the CME Fed Watch Tool. Sounds like a Christmas present for riskier assets, such as cryptocurrencies. We can all look forward to this liquidity being splashed around like confetti at a New Year’s Eve party.

Fed Starts Treasury Bill Buying

Meanwhile, the Federal Reserve, always the generous uncle, is rolling out its Treasury-bill purchase program. This delightful exercise begins today, with an initial $8.2 billion purchase, all part of its $40 billion reserve management plan. This is like a big financial snowball rolling down the hill, bringing liquidity to the money markets as it goes. Merry Christmas, everyone!

The buying program will run from December 12 through April, ensuring that the liquidity keeps flowing, like a well-placed champagne fountain at a royal wedding. Cheers to that! 🥂

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- USD TRY PREDICTION

- EUR INR PREDICTION

- USD COP PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

2025-12-12 14:04