In the vast expanse of the financial world, where fortunes rise and fall like the tides, there exists a peculiar tale of an XRP ETF that, alas, found itself in a state of utter stagnation. The largest of its kind, Canary’s XRP ETF, which once basked in the glow of inflows, now stands as a curious relic of a bygone era, its net inflows reduced to the humble sum of zero. 🧵

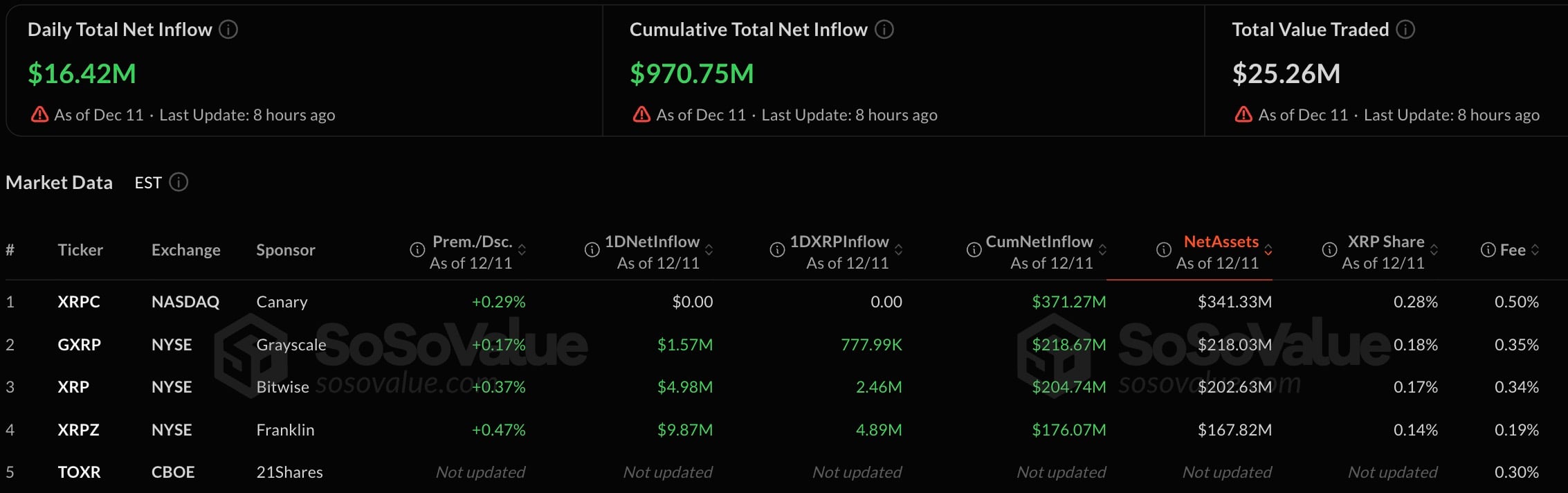

Behold, the numbers: a total of $930 million in assets, yet the daily inflows? A mere whisper of nothingness. While its peers danced with millions, Canary remained still, as if frozen in time, a statue of inaction. 📉

One might wonder, dear reader, why such a titan of the market would falter. Ah, the answer lies in the fee-a regal 0.5%, a sum so steep that even the most ardent investors might pause, their wallets trembling. Meanwhile, competitors, with their modest fees of under 0.35%, slyly beckon with promises of lower costs. 🤑

And so, the XRP price, a fickle lover, lingers near $2.05, while investors, ever the pragmatists, weigh their options. The question lingers: will Canary reclaim its glory, or will it be left behind, a relic of a market that has moved on? 🕰️

XRP demand meets reality

Canary, though still a giant among its peers, now finds itself in a quandary. Its net assets, though substantial, are met with the cold reality of a market that demands more than mere size. Large allocators, those titans of capital, now watch with bated breath, waiting for either a price breakthrough or a reason to pay a premium. 🤔

For the short term, the stage is set. A rise in XRP’s price could see Canary regain its former luster, but should the price remain stagnant, its competitors, with their lower fees, may steal the spotlight. 🎭

Thus, the lesson is clear: demand for XRP ETFs endures, but capital is fickle. Fees now vie with conviction, and even the mightiest of products can face a day of absolute zero. 🧨

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- EUR HUF PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- NEAR PREDICTION. NEAR cryptocurrency

- XRP’s Slip ‘n Slide: A Crypto Whodunit 🕵️♂️

2025-12-12 17:55