So, apparently, the monthly MACD for XRP is doing a thing. A “bearish” thing, they’re calling it. Which, in financial speak, is code for, “maybe don’t spend that boat money just yet.” Apparently, the shiny new ETFs are trying to gobble up almost half (42.87%, to be precise) of the XRP that’s actually, you know, available. It’s like trying to buy all the peanut butter at Costco. Good luck with that.

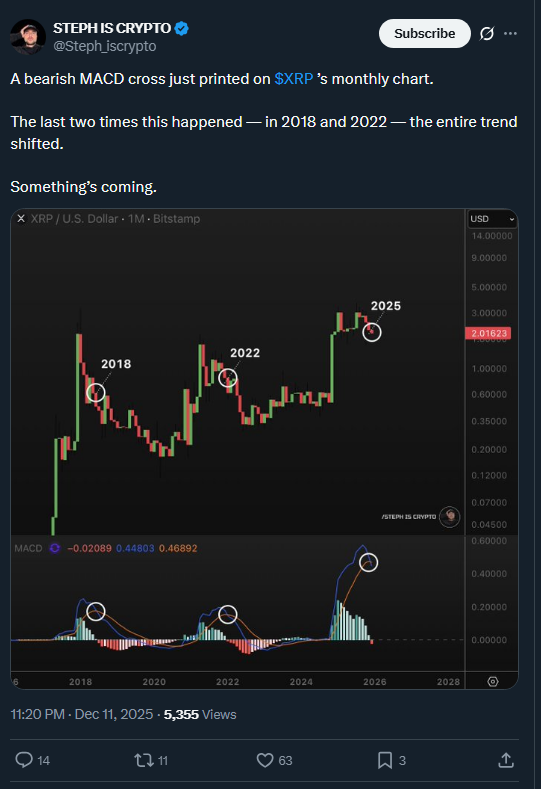

Some guy named Steph_iscrypto on X (formerly Twitter, for those of us still adjusting) says this MACD thing happened before. Like, in 2018 and 2022. And those times? Let’s just say the trend did a complete 180. A full-on, “Oops, wrong way!” kind of reversal. 🙃

Source: Steph_iscrypto

All this is happening while the grown-ups – the institutional investors – are suddenly very interested. The ETFs have already vacuumed up nearly a billion dollars in just 18 days. Billion! With a ‘b’! There are five of these things, all perfectly legal and regulated, which is scaring the day traders. It’s a whole new world. A slightly more boring, heavily monitored world. 🙄

Apparently, these MACD crosses are uncommon. Like spotting a polite person on the subway. They measure how strongly and in which direction the trend is moving. And historically, a bearish cross meant years of, shall we say, disappointment. You know, less yachting, more ramen.

You might also like: XRP RSI Reset Signals Bullish Setup as ETFs Near $1B

The 42.87% Supply Target Changes Everything

The ETFs only want the easy-to-get XRP, the liquid stuff. And some other guy, SMQKEDQG (excellent username, by the way), pointed out that only 42.87% of all XRP is actually liquid. The rest is…well, who knows? Probably locked away in a digital vault guarded by a grumpy algorithm. Everyone else is getting duped by the numbers they see. It’s a bit unsettling, isn’t it?

Source: SMQKEDQG

So, even though those ETFs only represent 0.75% of the total supply, they’re fighting over what feels like an uncomfortably small pool. And every time one of those ETFs buys XRP, there’s a little less available. Basic math, really. But apparently, people need it explained. 🤷♀️

The institutional investors used to hang out in these “OTC” (over-the-counter) places, quietly buying up XRP. But the ETFs are swooping in and draining those reserves. The supply shock is getting closer, quicker. Like realizing you’ve eaten all the cookies.

You might also like: XRP Coiling: Expansion Phase Imminent After Accumulation?

Historical Patterns Point to Volatility

Back in 2018, a similar MACD cross sent XRP spiraling. People lost hope. They started questioning their life choices. It wasn’t pretty. 2022 wasn’t much better. But this time, it’s different. Sort of. There are ETFs now, throwing money at the problem.

The people running the ETFs say the money coming in is legit – mostly from other institutions. They even keep the XRP in actual deposits, unlike those fancy “futures” products. So, every share bought means one less XRP swimming around. A little victory for supply and demand, or a prelude to chaos? Only time will tell. And my therapist. 🧑💼

Read More

- Gold Rate Forecast

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- Silver Rate Forecast

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- XRP’s Little Dip: Oh, the Drama! 🎭

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

2025-12-13 11:01