The Curious Case of Bitcoin Sellers: Who’s Really Behind the Dip? 😂💸

In the somber village of the financial markets, Bitcoin has taken a quaint tumble back to the nostalgic $85,000. The bulls, those brave souls, clutch their spears, whispering prayers to the support gods, while the price stagnates, like a lazy cat sprawled on a sunny windowsill, indifferent to the chaos. Volatility, that unpredictable feline, has curled up into a tight ball, leaving traders in a state of uninspired apathy and mounting fear. 🐱📉

Across the crypto wilderness, sentiment has become as cheerful as a rainy Monday. Analysts, those daring prophets, chatter about a possible extended bear market-think of it as the winter that refuses to end, dragging on into next year. And yet, amidst this gloom, understanding who actually unloads Bitcoin feels more crucial than ever-like figuring out who ate the last piece of pie during family dinner. 🍰🤔

A recent CryptoQuant report, unmasked as the cryptic spell it is, reveals that Bitcoin’s retreat from the $88.2K summit to a humble $85K was not fueled by long-term deciders selling their precious holdings. No, it was more like short-term traders taking profits-those quick flickers of greed in the night. This suggests that the market’s current drama isn’t a sign of long-term believers capitulating, but rather folks just repositioning. Perhaps they needed cash for a new boat or a trip to Siberia. 🛥️❄️

Short-Term Profit-Taking, Not an Apocalypse

According to the whimsical Crazzyblockk, when BTC briefly flirted with $88.2K, about 24,700 BTC-think of it as roughly a small mountain-were sent rushing to exchanges. Astonishingly, 86.8% of this was sold at a profit, as if everyone suddenly remembered they’d rather cash out before the market dips like a bad soufflé. The $1.89 billion in profits makes it clear: these sellers are the opportunistic holidaymakers, not panicked refugees fleeing a collapsing fortress.

As December 16 rolled in, with the price creeping down to $86K, the short-term inflows dwindled-only about 3,900 BTC whimpered into the exchanges. Like a small child’s cry in a quiet room, it wasn’t enough to signal chaos but perhaps exhaustion. The little volume of loss realization suggests traders are simply tired, not defeated, and certainly not throwing in the towel. Meanwhile, long-term holders remain stoic, unmoved by the minor tremble, showing no signs of capitulation-or perhaps they’re just busy knitting sweaters for their digital pet rocks. 🧶🪨

Bitcoin’s Weekly Saga: The Support Stage

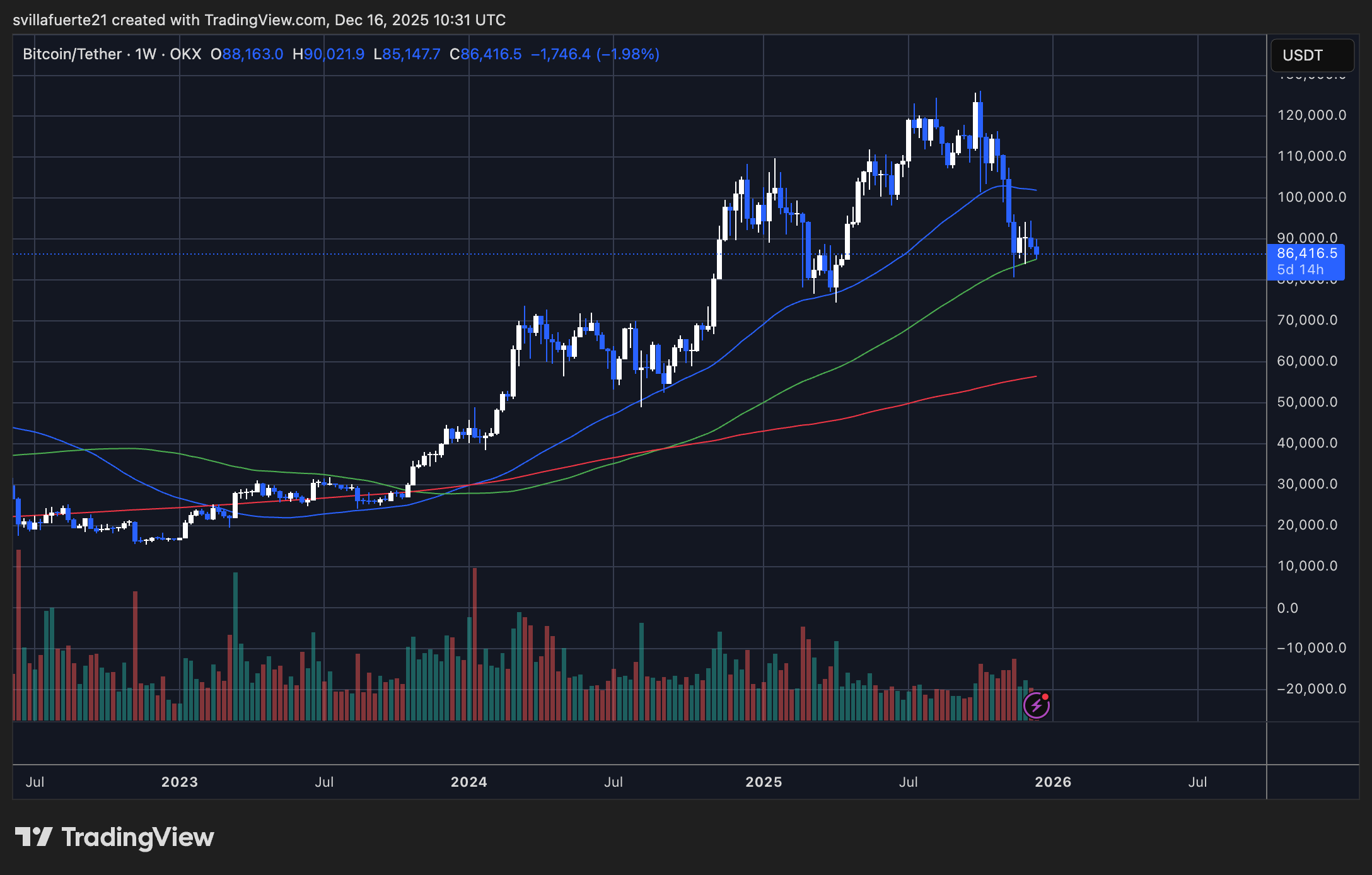

Our hero, Bitcoin, has taken a sharp step back from its recent peaks, settling into the cozy zone between $85K and $88K. This area, like a trusty old pub, offers some comfort-particularly the 100-week moving average, which has acted like a loyal bouncer throughout 2023. The market’s quest now is to defend this level, avoiding a tragic weekly ending that would leave everyone sobbing into their wallets. 🍺📉

The market, once impulsive and wild, now appears to be more like a cautious gentleman at a dance-moving gently into correction rather than storming into disaster. The loss of the 50-week average marked a shift, but as long as Bitcoin stays above the 200-week average, it’s just a funny story to tell at the next gathering. Volume has quieted, indicating not a stampede but a calm walk-perhaps towards the low-$70K abyss if support fails, or a triumphant leap back above $90K if luck favors the brave. Either way, it’s all just a game of hide and seek, with a dash of existential dread. 🎭🤡

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-12-17 00:23