Ah, the tale of BNB! Today it lingers near the humble threshold of $830, like a weary traveler seeking shelter from a storm. The bustling market, like an overzealous bartender, has seen increased trading activity, yet the open interest falls away like leaves in autumn-traders wisely cutting their risks as the tide of bearish pressure rolls in. 🍂

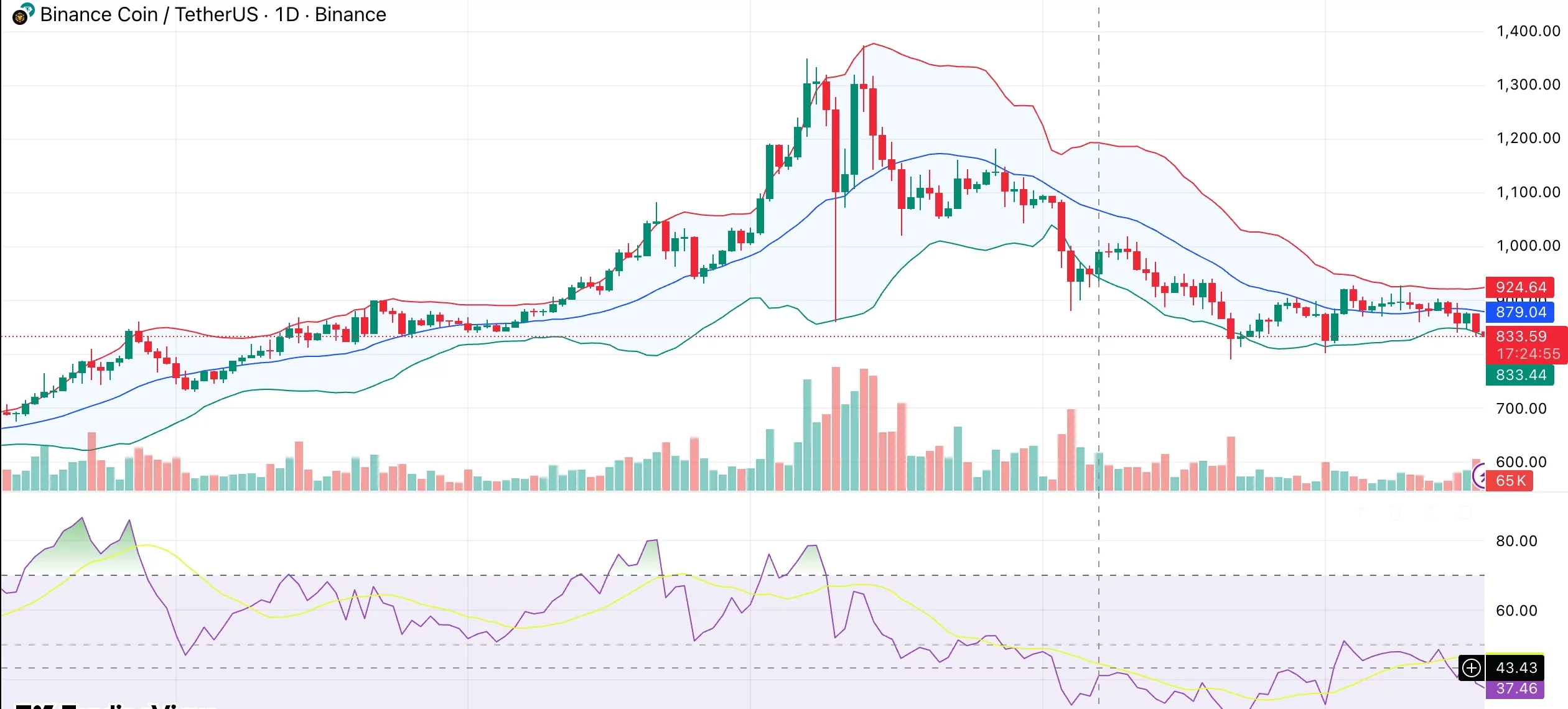

- BNB, once a gallant knight, now trades near the lower Bollinger Band, having taken a nosedive from its recent lofty heights.

- Volume rises like dough in the oven while open interest deflates, indicating traders are unwinding positions faster than you can say “financial crisis.”

- Charts still favor the sellers, unless our brave BNB can reclaim the sacred ground of key resistance levels.

As we check the clock, BNB has changed hands at a meager $832, plummeting approximately 4% over the last day, continuing its downward spiral. Over the past week, it has treaded between $830 and $899, now sitting at a 4.3% loss for the week. A longer look reveals a more tragic tale-a decline of 8.4% in the last 30 days, still a staggering 39% beneath its October zenith of $1,369. Oh, the humanity! 😱

But lo and behold! In the midst of this descent, trading activity has surged like a caffeinated squirrel, with BNB marking a volume of $2.51 billion in the last 24 hours-up a whopping 33.6% from the previous day! This frenetic activity suggests a flurry of repositioning rather than a serene consolidation, as the price continues to tumble downwards.

Now, let us not forget the derivatives data, which adds a twist to this unfolding drama. According to CoinGlass, the derivatives volume skyrocketed by 48%, reaching $2.03 billion, while open interest took a slight dip, down 1.72% to $1.33 billion. Traders seem to be closing their positions as they embrace the thunderous volatility-who needs roller coasters when you have the crypto market? 🎢

Fundamentals Stay Firm Despite Price Weakness

Despite the somber price movements, BNB’s underlying fundamentals remain robust. The Abu Dhabi Global Market has bestowed upon Binance full regulatory approval, making it the first cryptocurrency exchange to receive the trifecta of licenses-exchange, clearing, and brokerage. It’s as if they’ve been awarded the Oscar of the crypto world, enhancing Binance’s reputation among institutions and regulators alike. 🌟

Moreover, the BNB Chain is basking in the glow of increasing adoption in real-world applications. BlackRock’s tokenized treasury fund is now riding on this network, adding institutional credibility and generating real on-chain demand. Talk about a power couple!

In addition, BNB’s auto-burn mechanism has been tirelessly working behind the scenes, reducing supply like a magician pulling rabbits out of hats, thereby strengthening its long-term value proposition.

There are whispers of steadier leadership, with Changpeng Zhao re-emerging into the public eye following his legal escapades. Attention is shifting back to stronger positioning in the U.S. market-let’s just hope they don’t trip over their own shoelaces! 🤞

BNB Price Technical Analysis

As we delve into the technical realm, BNB finds itself clinging to the lower Bollinger Band near $830, reflecting steady downside pressure rather than a dramatic bounce from exhaustion. The volatility has expanded during this selloff-like a balloon on the verge of popping! 🎈

The overall trend appears to be heading south, with price action carving out lower highs and lower lows. What was once a sturdy support around $900 has now morphed into a formidable resistance. Talk about a plot twist!

Momentum remains soft, like a lukewarm cup of tea. The relative strength index is clinging below the 50 mark, and every hopeful bounce has fizzled out faster than a soda left open too long. Volume reflects a similarly bleak narrative, with aggressive trading appearing only during the breakdown, leaving buying interest looking rather thin.

Still hovering in negative territory, the MACD stands below the signal line, indicating that the downward momentum shows no signs of abating. And on the moving average front, prices are languishing below every major short- and medium-term average, from the 10-day to the 200-day. Yikes!

Should BNB manage to rise above $880, it could relieve some pressure and pave the way toward the $900-$920 range. However, failing to maintain above $820 would keep the clouds of downside risk looming as long as the price hovers beneath the key moving averages. It’s a precarious dance indeed! 💃

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2025-12-18 11:26