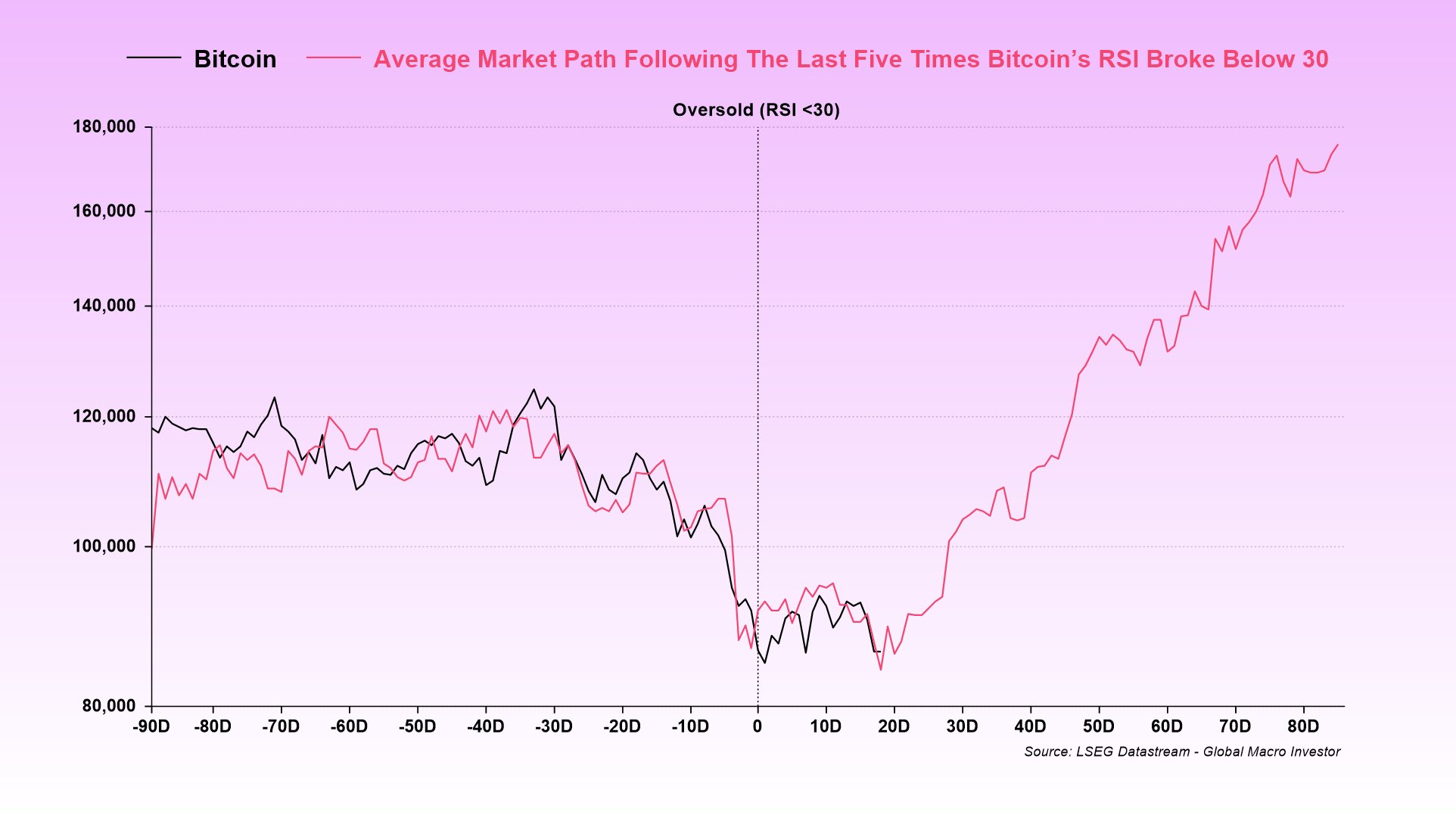

In the shadow of the market’s relentless dance, a whisper spreads: the RSI, that weary traveler, dips below 30, and with it, a prophecy of $180,000 in 90 days. Julien Bittel, the macro bard of X, paints a tale where numbers hum like lullabies, and cycles bend to his will. “A chart for the curious,” he writes, as if offering a key to a locked vault, though the lock creaks with doubt.

“So far, it’s been pretty bang on,” he boasts, yet the chart’s path is a mirage-sharp, steep, and as reliable as a poet’s promise. The BTC price, that fickle muse, may soar near $180k, but only if the bull market isn’t already a ghost, haunting the corners of the crypto realm. “No, it won’t be perfect,” he concedes, like a lover who knows their heart is fragile.

Can Bitcoin Skyrocket To $180,000 In Just 90 Days?

The chart, a siren’s song, lures the hopeful. Yet Bittel warns: the rebound is a tempest, messy and unpredictable. “Bases can take time to form,” he murmurs, “and usually come with plenty of chop before the bigger up-move kicks in.” A poetic way of saying, “Don’t blame me if you’re left in the dust.”

He reiterates the chart’s conditional nature with the bluntness of a man who’s seen too many cycles crumble. “If you think the bull market is over… move along,” he snaps, as if shooing away the skeptical. Yet the bigger truth, he argues, is that the four-year cycle, that old, tired tune, is now a relic. “The balance of probabilities,” he claims, “leans toward 2026-a future where the 4-year cycle is dead.”

But let’s not forget the halving, that sacred ritual. Bittel scoffs, “The 4-year cycle was never about the halving,” as if correcting a child’s misunderstanding. Instead, he points to the debt’s heavy sigh, a monsoon of interest expenses that outpaces GDP’s meager growth. “The bigger picture,” he writes, “is a world still drowning in liquidity’s illusion.”

Reactions? A chorus of “$180k in 90 days!” and “precision-grade hopium,” the latter a sardonic nod to the chart’s fragility. LondonCryptoClub? “Noise and chop into year-end,” they warn, while others dream of BTC’s 2026 renaissance. “Sentiment appears sufficiently bad for a BTC move higher to be the most hated trade to start 2026!” they declare, as if predicting the next great tragedy.

Capriole’s Charles Edwards, ever the skeptic, demands, “Now re-run this with 100 occurrences, not 5 during up only.” A demand as futile as asking a poet to quantify love. For traders, Bittel’s post is a mix of tactical signal and regime call-a dance between hope and despair, where the RSI sub-30 template maps the rebound path, but only if the bull market isn’t already a ghost.

At press time, BTC traded at $87,330-a number as fleeting as the promises of the market. Yet in the realm of crypto, even the most precise forecasts are but whispers in the wind, and the $180k dream remains a mirage, shimmering just beyond the horizon. 🌌

Read More

- Gold Rate Forecast

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-12-18 17:45