The Bitcoin network, in a display of sheer cosmic stubbornness, shrugged off the alleged Xinjiang mining shutdowns like a cat avoiding a bath. Data revealed a brief, trivial hashrate dip on December 18-probably caused by a rogue toaster in Siberia-contrary to social media’s usual blend of panic and poorly sourced memes.

Claims of a 100 EH/s collapse were met with polite eye-rolling by pool-level data, which suggested the disruption was about as impactful as a hiccup at a black hole convention. The chaos began when Jack Jianping Kong, founder of Nano Labs (formerly Canaan co-chair), casually mentioned Xinjiang inspections had “knocked out 400,000 rigs and 8% of hashrate in a day.” Spoiler: He forgot to mention he was probably hallucinating.

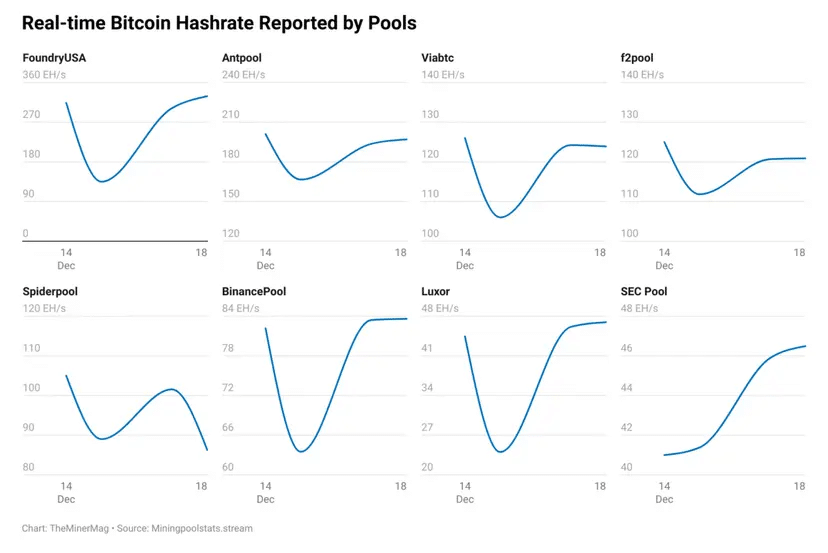

The hashrate dip did happen, but it turned out most of the drama was happening in North America. Foundry USA’s mining power nosedived by 180 EH/s, while Luxor joined the fun with its own crash. Together, they accounted for 200 EH/s of the drop-likely due to the American Midwest deciding to play its part in the chaos by turning up the chill during winter. Cold weather? More like hostile weather.

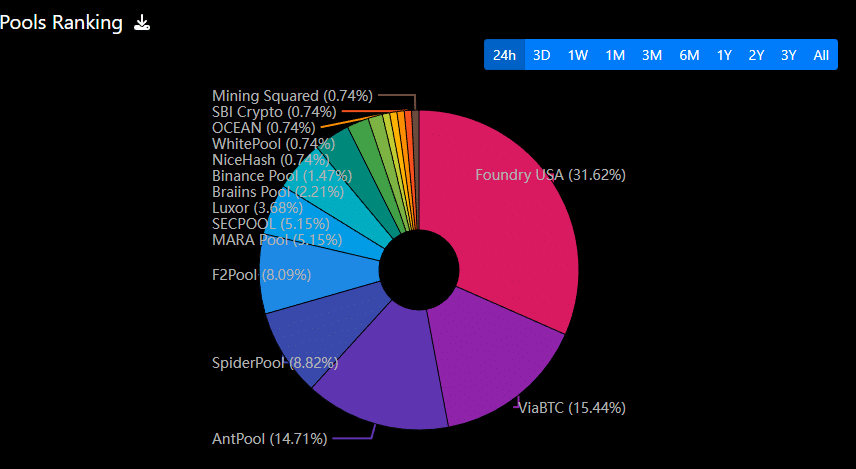

Pools ranking charts | Source: Mempool Space

Chinese-origin pools like Antpool and F2Pool collectively lost 100 EH/s-matching social media’s favorite number but not confirming Xinjiang as the villain. These pools, it turns out, route hashrate from multiple regions, including Bitmain’s US operations, which might’ve been affected by the same weather that turned your coffee into ice. Attribution? Please. This is the digital equivalent of blaming the entire orchestra for a single violinist’s off-key note.

The network’s recovery was so swift it made a hummingbird look lethargic. By December 17, most mining groups had bounced back, leaving the total hashrate only 20 EH/s shy of peak levels. Proof that Bitcoin’s resilience is about as fragile as a brick wall-unless you’re a brick wall.

Comparison of the hashrate between Bitcoin mining pools | Source: TheMinerMag

The Bitcoin Mining Strength Persists in 2025

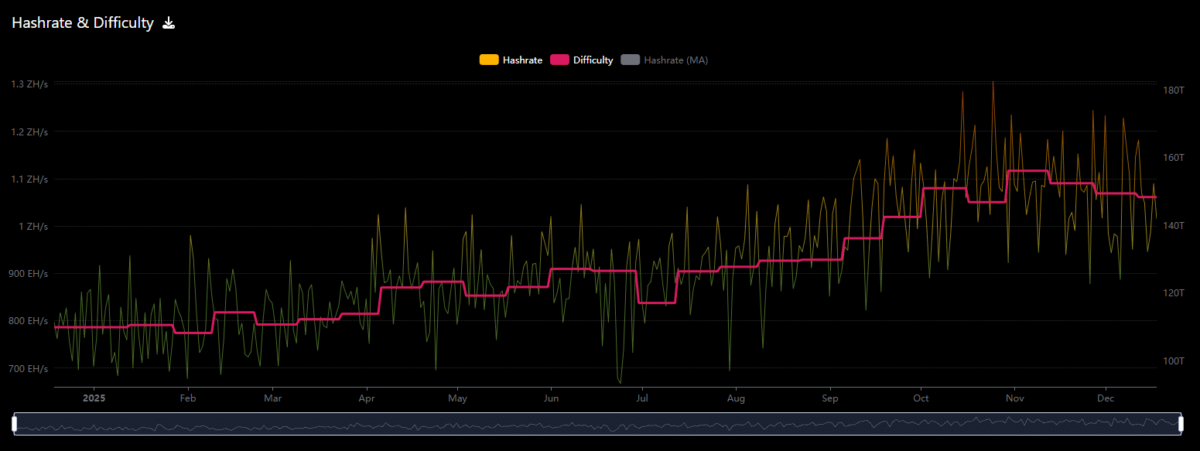

Broader metrics suggest Bitcoin mining is thriving like a vegan buffet at a meat convention. Hashrate Index data for mid-December showed a 7-day average dip so minor it could’ve been caused by a sneeze. The 30-day averages? Still flirting with all-time highs. Difficulty adjustments? A gentle nudge, not a kick in the pants.

In 2025, Bitcoin’s hashrate climbed from 700 EH/s to 1 ZH/s-thanks to mining companies upgrading gear and spreading out like a viral TikTok trend. Meanwhile, smaller miners are enjoying a breather as the network’s difficulty eases slightly. It’s like the universe finally realized Bitcoin mining needed a bit more mercy… or at least a better PR team.

Hashrate and difficulty of mining in the Bitcoin network on 1 year | Source: Mempool Space

The Xinjiang situation, while a temporary hiccup, proves local regulations are about as impactful as a whisper in a hurricane. Bitcoin mining is now so globally dispersed it could survive a meteor strike. The network now dances to Bitcoin’s price like a marionette on a string, while regulations tighten like a vice. But hey, nothing says “stability” like a global system that thrives on chaos. 🌌💸

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-12-18 22:44