Ah, the markets-a theater of human folly! Bitcoin ETFs, once the darlings of the financial world, now bleed for the fifth consecutive day, while Ether ETFs join the waltz of despair. Yet, XRP and Solana ETFs stand firm, like stoic monks in a sea of chaos, whispering, “We told you so.” 🧘♂️💎

XRP and

Solana

Giggle in Green as

Bitcoin

Weeps in Outflow Misery

The holiday season, a time for joy and reflection, has instead become a carnival of financial reckoning. The crypto exchange-traded funds (ETFs) lie exposed, their wounds bared for all to see. Investors, those fickle souls, flee Bitcoin and Ether like rats from a sinking ship, while XRP and Solana bask in their modest, yet defiant, inflows. Ah, the irony! 🎪🐀

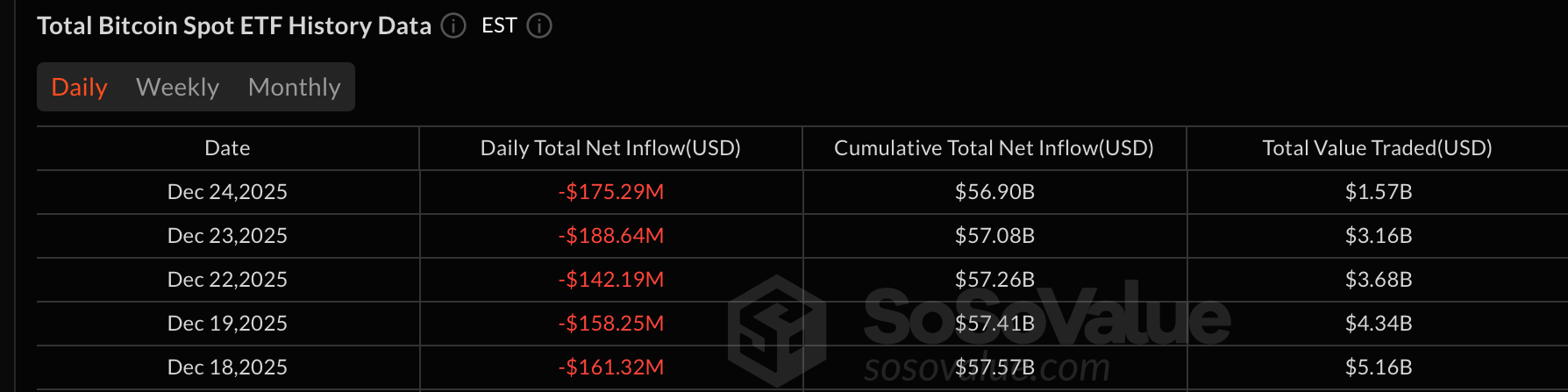

Bitcoin spot ETFs, once the pride of the portfolio, now hemorrhage $175.29 million. Blackrock’s IBIT, the fallen titan, sheds $91.37 million, while Grayscale’s GBTC follows suit with $24.62 million. Fidelity’s FBTC, Bitwise’s BITB, and the rest-all join the chorus of lamentation. Yet, trading activity remains feverish, a desperate dance of $31.57 billion, as net assets shrink to $113.83 billion. The show must go on, mustn’t it? 🎭💸

bitcoin ETFs-a tragedy in five acts. 🎭⚰️

Ether ETFs, too, are bathed in red, losing $52.70 million. Grayscale’s ETHE leads the descent with $33.78 million, while Blackrock’s ETHA follows with $22.25 million. Only Grayscale’s Ether Mini Trust dares to whisper hope, attracting a meager $3.33 million. Trading volumes cool to $689.44 million, and net assets hold at $17.86 billion-a fragile equilibrium. 🌡️💔

XRP ETFs, however, march to a different drum, adding $11.93 million. Franklin’s XRPZ claims the lion’s share with $11.14 million, while Canary’s XRPC chips in $794K. Total value traded? A modest $10.84 million, with net assets steady at $1.25 billion. Ah, the sweet taste of victory! 🦁🍷

Solana ETFs, too, remain in the black, with a $1.48 million inflow. Fidelity’s FSOL and Vaneck’s VSOL share the spoils, $1.08 million and $399K respectively. Trading volume reaches $15.77 million, and net assets stand at $930.59 million. Small gains, perhaps, but in this market, a triumph nonetheless. 🏆✨

Christmas Eve’s trading-a microcosm of the human condition. Bitcoin and Ether ETFs bleed, while XRP and Solana stand firm. The markets, ever fickle, take their holiday leave, leaving us to ponder: Who, in this grand drama, is the hero? And who, the fool? 🎄🤡

FAQ🎄

- Why are

bitcoin ETFs

seeing five straight days of outflows?

Holiday liquidity, a thin veil for fear, drives investors to trim their Bitcoin exposure. The heart, it seems, is a cowardly organ. 💔🐇 - What’s driving continued weakness in ether ETFs?

Redemptions, like vultures, circle the major funds. Caution reigns, even as assets hold steady. The market, ever paranoid, sees danger in every shadow. 🦅⚠️ - Why are

XRP

ETFs still attracting inflows?

Steady demand and regulatory clarity-a rare beacon in the crypto wilderness. Investors, ever pragmatic, cling to what they know. 🌟📜 - How are

solana

ETFs performing during the holiday period?

Modest, yet consistent-a quiet revolution. Capital rotates, ever so slightly, to the underdog. The tortoise, it seems, may yet win the race. 🐢🏁

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- XRP’s Little Dip: Oh, the Drama! 🎭

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

2025-12-25 15:57