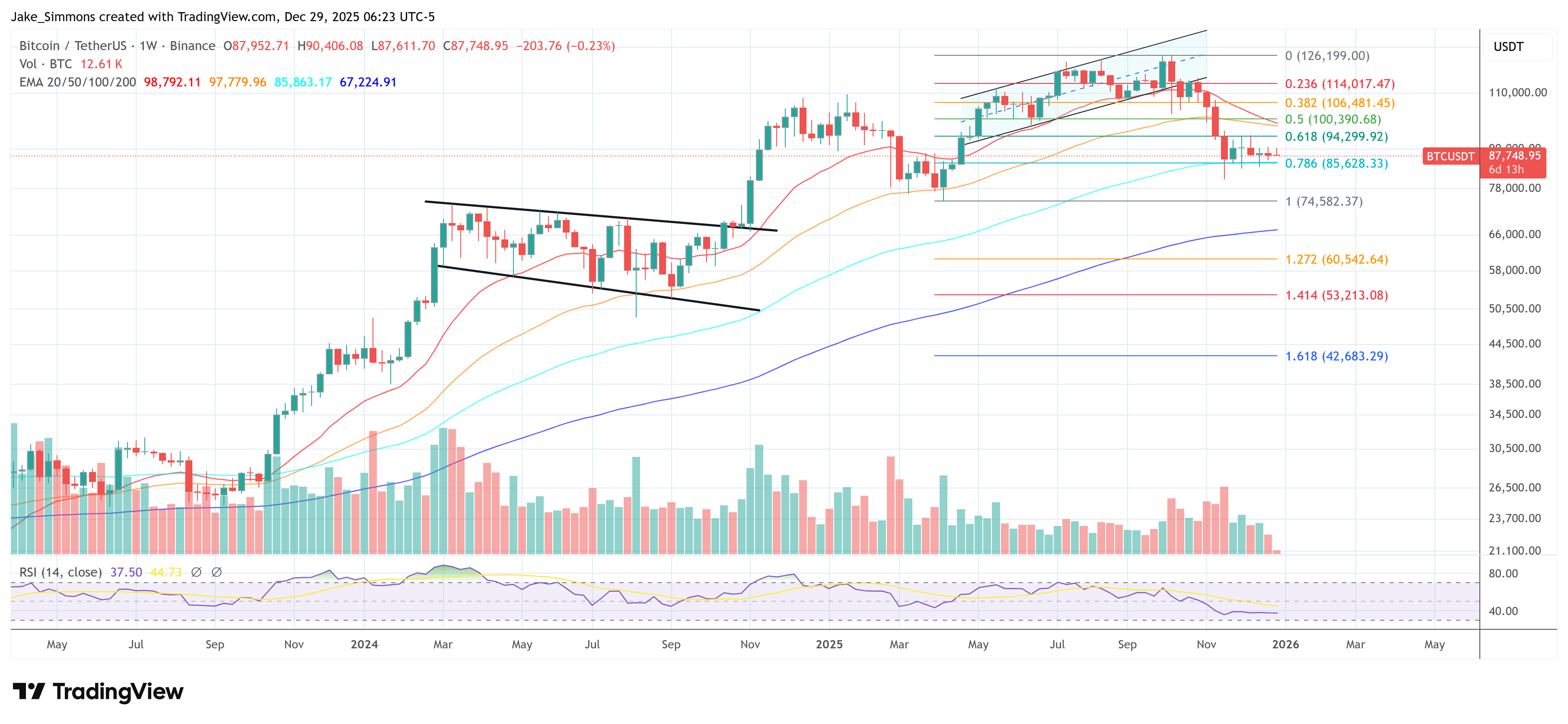

Bitcoin, that sly digital dragon, is waltzing into New Year’s Eve with a sulky red yearly candle, a spectacle more awkward than a wizard’s attempt at a dance routine. Galaxy Digital’s Alex Thorn, a man with more graphs than a medieval scribe, declared that BTC is down 6.3% year-to-date, and 8.25% year-over-year. To finish 2025 with a smile, it needs a daily close above $93,389-because nothing says “victory” like a last-minute dash to the finish line. 🏁

The late-year mood? A soft Q4 tape, which is to say, a gentle nudge from the market’s collective elbow. Thorn noted BTC dipped 36% below its October 6, 2025 high of $125,296, even as bullish headlines rained down like confetti at a party no one invited. 🎉

“Despite the tepid finish, 2025 was a banner year for Bitcoin,” Thorn wrote, as if the market had suddenly developed a taste for humility. “Even Bitcoin’s staunchest supporters wouldn’t have believed some of 2025’s headlines just a few years ago… Today, these victories feel like par for the course. Maybe we really are ‘tired of winning?’” 🤷♂️

Thorn argues the market’s stasis is more about the mechanics of the game than deep philosophical musings. A large month-end options expiry could be the spark that ignites the market’s slumber, he claims, while January might tempt portfolio managers to “take a fresh look” at the world’s oldest cryptocurrency. Because nothing says “renewal” like a crypto crash. 🧙♂️

“A significant options expiry at the end of the month clears some of the outstanding dealer gamma that has encouraged bitcoin to stay pinned between major $85k and $90k,” Thorn explained, as if the market were a stubborn cat. “January may prompt some portfolio managers to take a fresh look at the world’s oldest cryptocurrency. There are reasons why the quiet period we’ve seen for the last month will not persist in the near term.” 🐱

He also cited headwinds like “significant whale distribution,” an Oct. 10 leverage wipeout, and competition from other macro trades like AI, hyperscalers, gold, and the “Mag 7”-a group of tech titans more exciting than a dragon with a PhD in finance. 🧠

Thorn’s key observation? The divergence between Bitcoin’s drawdown and US bitcoin ETF behavior. “US bitcoin ETF cumulative inflows are down only 9% from their October peak of $62 billion,” he said, “even though Bitcoin fell sharply from its highs. It’s like watching a magician pull a rabbit out of a hat… only the rabbit is a $62 billion ETF.” 🎩🐇

That resilience, he argued, makes the source of selling more notable. “So, who has been selling?” Thorn wrote. “The call is coming from inside the house.” Since July 2025, coins held by long-term holders have declined more sharply than at any point in the eight years since the 2017 bull run, suggesting older on-chain holders have been net sellers into newer brokerage-led demand. 🧙♂️

Thorn framed that distribution as painful in the short run but constructive for the asset’s long-run maturity, lifting the average cost basis and broadening ownership. He highlighted Bitcoin’s realized market cap above $1.1 trillion and a realized price above $56,000 as evidence of the network’s rising aggregate principal. 📈

In a Dec. 21 post, Thorn predicted Bitcoin to hit $250,000 by 2027, while calling 2026 “too chaotic to predict.” Options markets, he noted, are currently pricing roughly equal odds of $70,000 or $130,000 by end-June 2026, and $50,000 or $250,000 by year-end 2026, reflecting unusually wide uncertainty bands. 🌀

He also pointed to a structural decline in longer-term volatility and a changed skew: the BTC vol smile now prices puts as more expensive than calls, which he described as a shift toward patterns more typical of macro assets than high-growth markets. 🧠

Looking into 2026, Thorn’s near-term marker is whether BTC can “firmly re-establish” itself above $100,000-$105,000. Over the longer run, he argued the bigger story is demand for non-dollar hedges-and how little incremental allocation might be needed to move the market. 🌍

“We believe it is likely only a matter of time before ‘Bitcoin follows gold to become widely adopted as a monetary debasement hedge.’ It doesn’t take much to start a stampede in that direction – a few major allocators, central banks, or nation states might be all it takes to spark the fuse and light a fire.” 🔥

At press time, BTC traded at $87,748, which is roughly the same as the number of times people have tried to predict Bitcoin’s future since 2009. 🧮

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

2025-12-29 14:49