In the world of cryptocurrencies-where fortunes can be made or lost faster than you can say “blockchain”-a mysterious high-roller has just thrown a staggering $748 million into the very volatile, very confusing crypto circus. Think of it as the financial equivalent of a giant throwing a tantrum in a china shop, but with more digits and fewer china plates.

Whale Drops a Whale of a Bet

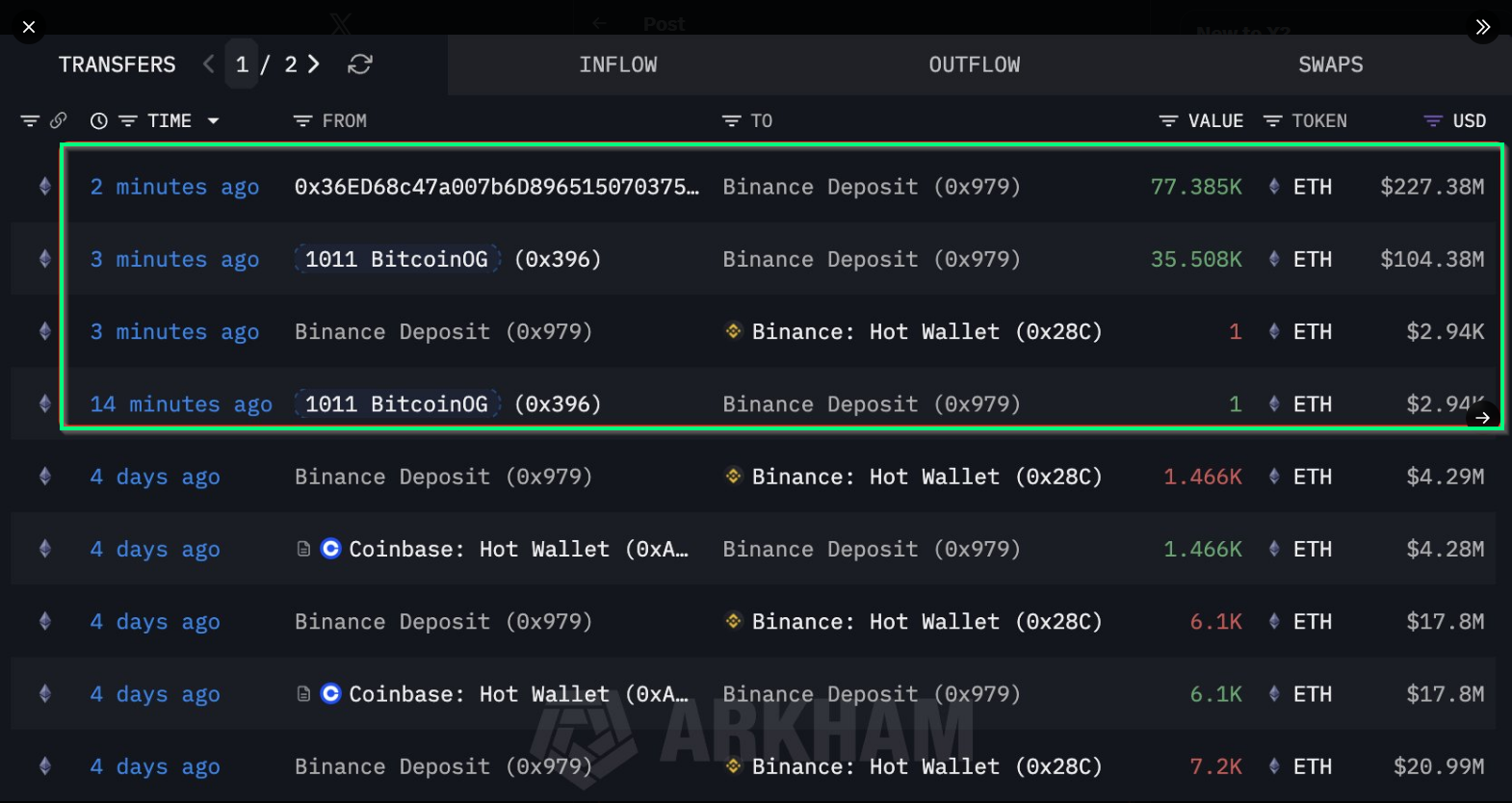

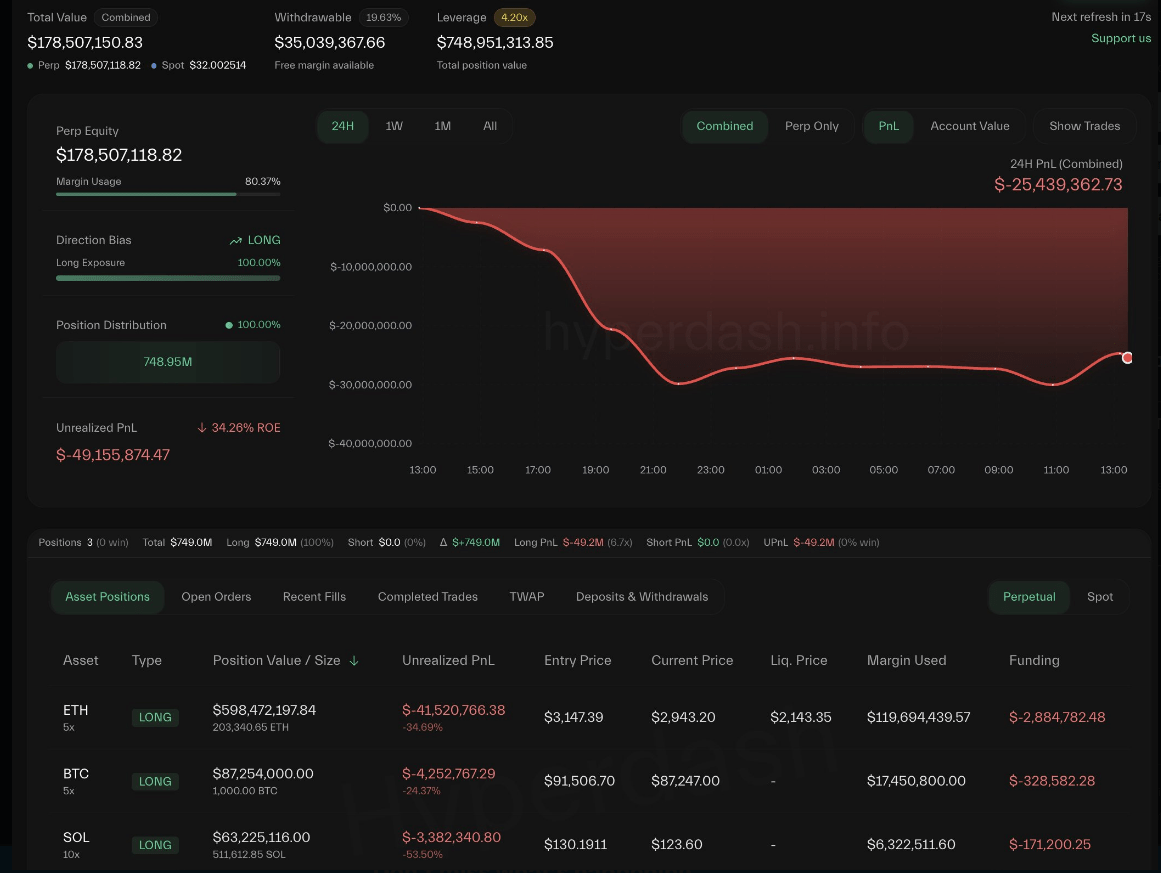

According to the ever-vigilant on-chain trackers (whose job is basically to watch the crypto equivalent of a dam about to burst), this anonymous billionaire (or perhaps a very bored millionaire with too much time and money) sold off around $330 million worth of Ether. But rather than tossing the cash into a fire pit, they used it to open three hefty long positions worth a combined $748 million. That’s right-almost three-quarters of a billion bucks riding on the hope that prices climb higher than a rocket on a clear day. The biggest of the bets? Nearly $600 million on Ether, with an entry point at a digit-festooned $3,147-mind you, it’s currently lounging around $2,975, looking a bit unsure of itself.

And if you thought that was the end of the crypto soap opera, think again. The whale also threw in bets on Bitcoin and Solana, with entry prices as dizzying as Bitcoin’s $87,883 and Solana at $124.43. The whale might be feeling a little queasy, with unrealized losses nearing $50 million-because, of course, in crypto, fortune favors the brave, or the utterly reckless.

BREAKING! A crypto legend (or a very rich gambler in a hoodie) just dumped over 112,894 Ether into Binance-equivalent to $332 million-in a move that’s making everyone look twice. Is this some brilliant ploy, or just a very expensive way to say “I might be wrong”? – Lookonchain (@lookonchain) December 30, 2025

Smart Money, Dumb Fads?

While our mysterious whale was busy making headlines, other large players (presumably none of whom are named Moby or Dory) also jumped into Ether in what looks like a game of ‘yo-yo trading.’ Reports show about $5 billion moving from Bitcoin to Ether since August-probably some crypto-version of musical chairs. In one frenetic day, nine big wallets added over $456 million worth of ETH-proof that even giant whales get a case of the crypto FOMO now and then.

But here’s the twist-the data from Nansen suggests that the shrewd traders, who clearly have better risk assessments than we do after three beers, have been quietly reducing their Ether bets by about $6.5 million in a single day. Now, they’re holding net short positions of roughly $121 million-meaning they’re betting on prices going down, not up. The same cautious crowd is shorting Bitcoin by nearly $200 million and Solana by $74 million, hinting that the smart money is bracing for a fall, not celebrating a rally.

And so, as December wrapped up with less of a bang and more of a whimper-the “year-end rally” turned out to be a bust-the crypto market showed its true fragility. Bitcoin made a valiant attempt to regain ground but was ultimately foiled, while shiny gold kept posting gains-because what’s more reassuring than a real metal, uncrashable and not powered by hacker memes?

All in all, it looks like the crypto market might need to hit the reset button-think of it like hitting pause on the chaos-before anyone can claim victory or even a modest rally. Until then, keep your wallets close and your crypto dreams closer.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Decentralized AI Gets a Trusty Makeover – Is This the Future or Just a Fancy Toy? 🤔

- BTC PREDICTION. BTC cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Pump.fun’s Record Volume: Is Solana’s Meme Coin Renaissance Here? 🚨

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- TIA PREDICTION. TIA cryptocurrency

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

2025-12-31 18:06