The Bitcoin price, having concluded its annual candle, bore a pattern reminiscent of a shooting star, a harbinger of anxieties that the surging selling pressure near its peaks may herald a more profound bearish transformation in the horizon. 🚨💸

//media.crypto.news/2026/01/BTCUSD_2026-01-01_23-56-09.webp”/>

From a higher-time-frame perspective, the shooting star reflects rejection at premium prices. The long upper wick suggests strong upside attempts were met with equally strong supply, preventing Bitcoin from holding higher valuations into the yearly close. A cruel irony, where ambition meets its match. 🤯📉

However, confirmation is critical. On higher time frames, such as the yearly chart, bearish implications gain validity only if followed by acceptance below key structural levels in subsequent price action. Without follow-through, shooting stars can simply represent exhaustion within an ongoing range rather than the beginning of a sustained downtrend. A fleeting flicker in the night. ⚠️🌌

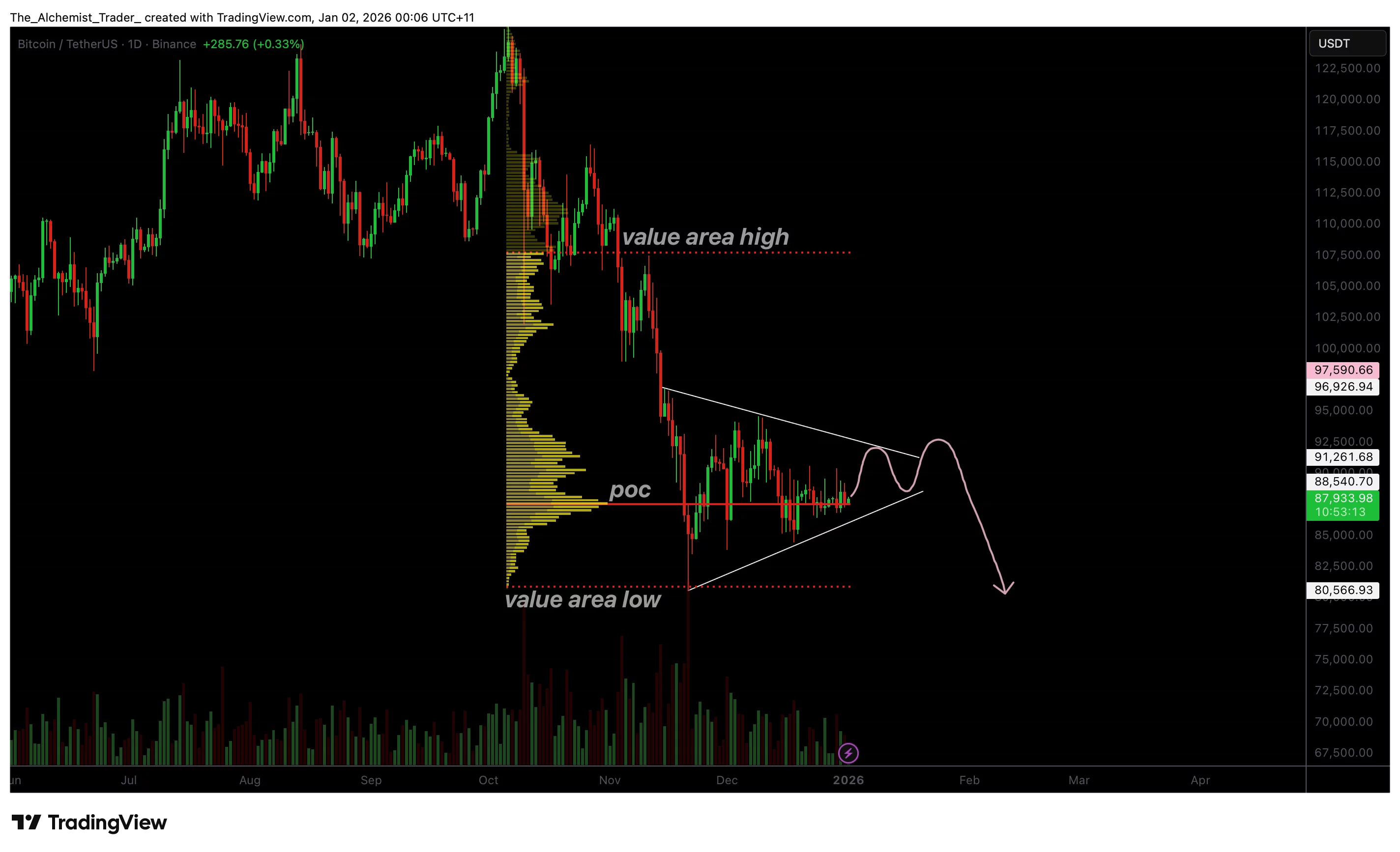

Zooming in on shorter time frames, Bitcoin is currently trading within a tight triangular equilibrium. Price is compressing between lower highs and higher lows, reflecting indecision following the rejection from highs. A chess game of patience, where every move is a calculated risk. 🎭📉

The midpoint of this triangle aligns closely with the Point of Control (POC) of the recent downtrend, the price level with the highest traded volume. This makes the POC a critical inflection zone. Holding above it implies balance and stability, while acceptance below it would likely trigger a rotation toward the Value Area Low, reinforcing the bearish implications of the yearly candle. A crossroads of fate. 🚧📉

Volume behavior remains muted during this compression, which is typical as volatility contracts. Historically, such conditions precede sharp expansions once price exits the structure. The direction of that expansion will largely determine whether the shooting star evolves into a meaningful bearish signal or fades into consolidation noise. A gamble with no guarantees. 🎲📉

What to expect in the coming price action

As Bitcoin trades deeper into the triangle apex, a volatility expansion is increasingly likely. A downside break below the Point of Control, mainly if supported by rising sell volume, would strengthen the bearish interpretation of the yearly shooting star and open the door for a move toward lower value areas. A descent into the abyss. 🌌📉

Conversely, a high-volume breakout above triangle resistance would invalidate the bearish setup and suggest that the yearly candle reflects temporary exhaustion rather than a structural shift. Until a decisive breakout occurs, Bitcoin is likely to remain range-bound. A prison of uncertainty. 🧩📉

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Oops! User Accidentally Burns $75K Worth of PUMP Tokens! 🔥

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

- PENGU: The Cryptocurrency Drama Fit for a Molière Play 🎭💰

- Bitcoin’s Wild Ride: Coinbase & Strategy Laugh All the Way to the (Crypto) Bank! 🚀💰

- DOGE PREDICTION. DOGE cryptocurrency

- Zcash: The $520 Fiasco 🎭💸 – Will ZEC Ever Break Free?

- Barclays Bets on Ubyx: A Token Tale of Tons of Cash! 💰🚀

2026-01-01 20:32