Ah, Coinbase. One gathers they’re not merely content to dabble in digital amusements, but aspire to orchestrate the very symphony of global finance by 2026. Ambitious, darling, positively ambitious! To merge crypto, equities, payments, and these… “onchain tools” into a single platform. The audacity! 🎭

Coinbase Maps Aggressive 2026 Expansion Beyond Crypto Trading

Coinbase (Nasdaq: COIN) is, it seems, experiencing a touch of grandiosity. One detects a distinct desire for broader financial dominance in 2026, signaling a rather decisive evolution. It wishes to be more than just a purveyor of digital tokens, you see. Oh, the drama! 🙄

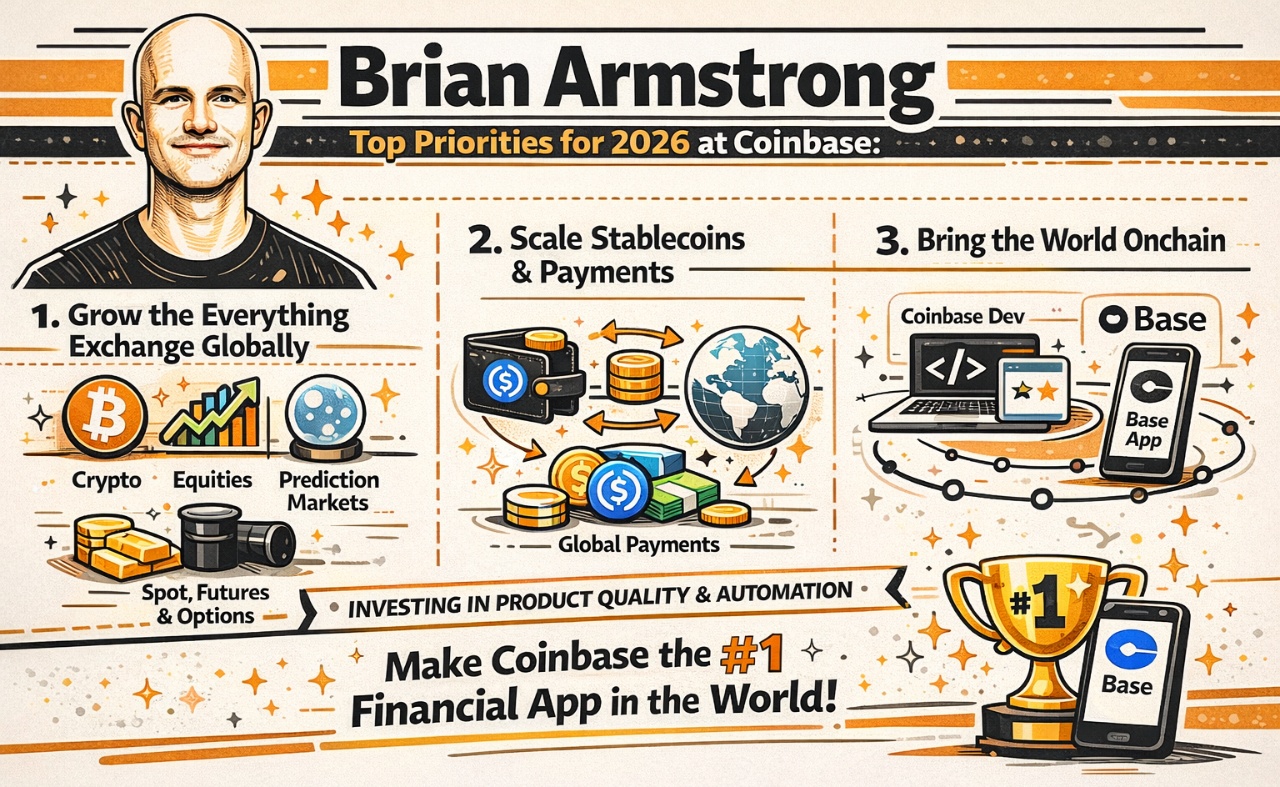

Brian Armstrong, Coinbase’s chief executive officer – a man of vision, no doubt – shared on social media platform X on Jan. 1, 2026, a forward-looking roadmap. Scale, diversification, and the enigmatic “onchain adoption.” How terribly modern. He declared:

Here are our top priorities for 2026 at Coinbase.

Mr. Armstrong first outlined the company’s intent to “Grow the everything exchange globally (crypto, equities, prediction markets, commodities – across spot, futures, and options).” A plan, daringly, to integrate all manner of assets into one unified platform, thereby reducing friction for users with… pecuniary inclinations. How convenient! 🤗

Then, our Coinbase chief prioritized payments infrastructure, highlighting plans to scale stablecoins and payments. A cornerstone, naturally, of future blockchain-based financial activity. Lastly, the grand scheme of bringing the world “onchain” through the Coinbase Developer Platform (CDP), Base chain, and Base App. A veritable empire of developers! 🧐

Further into the post, Armstrong described the operational backbone supporting these initiatives, writing:

We’re making major investments in product quality and automation underlying each of these as well. Goal is to make Coinbase the #1 financial app in the world.

Automation and refinement, he explains, are to enable rapid growth while preserving security and, crucially, user trust. A decidedly bullish view, wouldn’t one say, that stablecoins, onchain applications, and multi-asset trading will somehow coalesce into a singular consumer experience. Dreams, darling, dreams!✨

By targeting equities, derivatives, payments, and developer infrastructure, Coinbase aligns itself with a future where crypto-native platforms bravely compete with global fintech firms. A strategy brimming with confidence that onchain finance and integrated digital markets shall summon the next wave of… mainstream financial adoption. One wonders if they’ve considered the sheer boredom of it all. 😉

FAQ 📌

- What is Coinbase planning for 2026?

Coinbase plans to conquer the world… or, you know, expand into equities, commodities, payments, and onchain tools alongside crypto trading. - What does Brian Armstrong mean by an “everything exchange”?

One platform to rule them all, offering crypto, equities, prediction markets, and derivatives. A veritable cornucopia of financial possibilities! - Why are stablecoins central to Coinbase’s strategy?

Stablecoins, my dear, are the key infrastructure for global payments and blockchain-based settlement. So practical, so… dull. - How does Base fit into Coinbase’s future plans?

Base seemingly supports developers and onchain apps. Facilitating expansion into the blockchain ecosystems. How very…inclusive.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

- USD KZT PREDICTION

- PENGU: The Cryptocurrency Drama Fit for a Molière Play 🎭💰

- Zcash: The $520 Fiasco 🎭💸 – Will ZEC Ever Break Free?

- Barclays Bets on Ubyx: A Token Tale of Tons of Cash! 💰🚀

- BTC PREDICTION. BTC cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

2026-01-06 08:58