Ah, Bitcoin, that ever-fascinating creature of the digital depths! Once frolicking around the jubilant heights of $94,500, it now finds itself in a rather precarious predicament, struggling like a fish out of water, as it flirts with the tantalizing support level of $89,000.

- Our dear Bitcoin has embarked on a rather unfortunate downside correction, drifting below the once-comfortable $92,000 threshold.

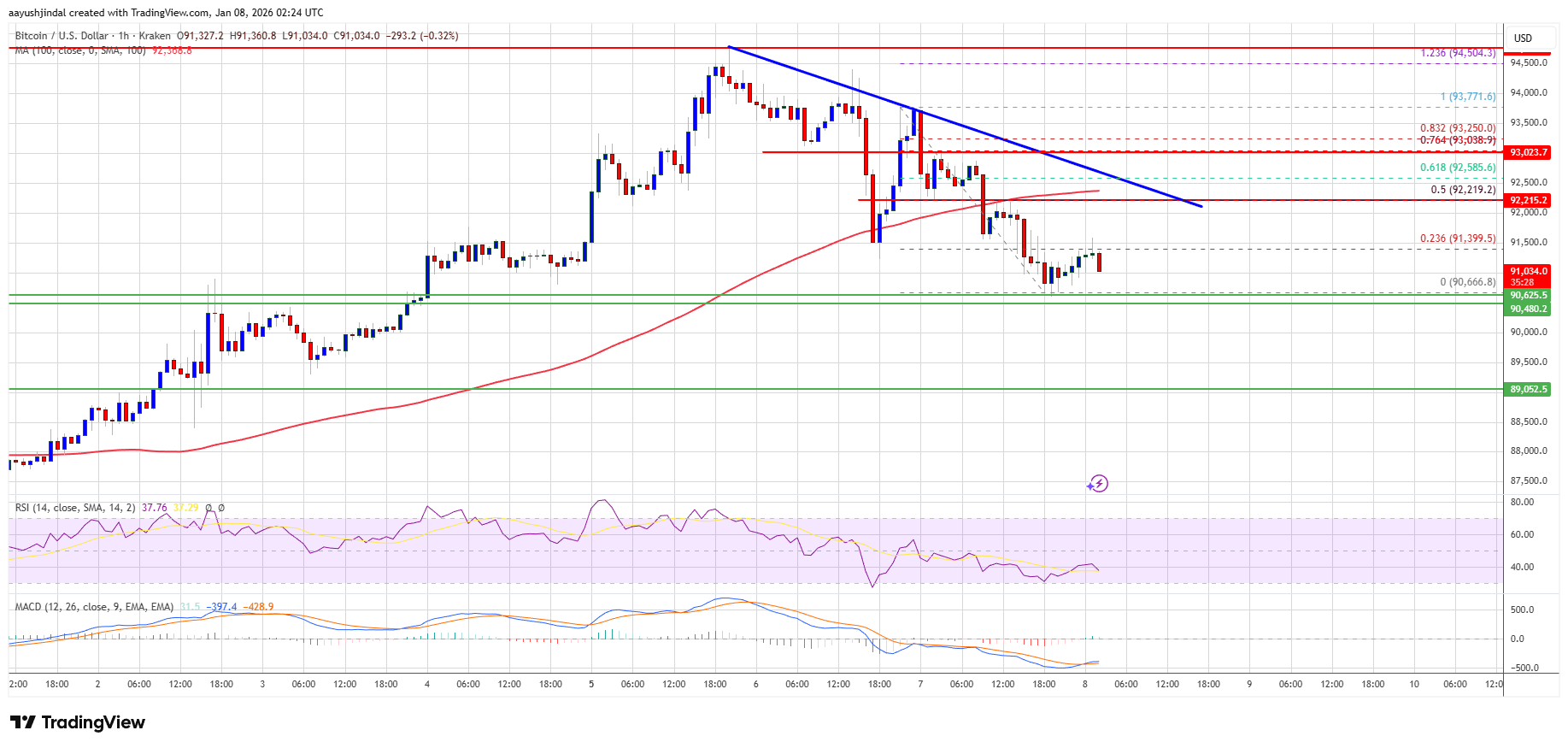

- This fickle price dances beneath the $92,000 mark and the 100-hourly Simple Moving Average, like a teenager avoiding chores.

- Lo and behold, a bearish trend line is forming, complete with a resistance at $92,650 on the hourly canvas of the BTC/USD pair (a delightful data feed courtesy of Kraken).

- If Bitcoin remains under the $92,500 umbrella, the descent may continue into the abyss.

The Spectacle of Bitcoin’s Downward Dance

Alas, Bitcoin could not maintain its lofty perch above $94,000 and has chosen instead to embark on a downward journey. It has dipped below $93,200, flirting shamelessly with the $92,500 mark, thus entering a temporary bearish soirée.

It even took a plunge below $92,000, testing the chilly waters at $90,650. A low was recorded at the devilish $90,666, and now it seems to be consolidating its losses like a squirrel stashing away nuts for winter. The price has audaciously tested the 23.6% Fibonacci retracement level from the recent decline, reminiscent of a high-wire act without a safety net.

Currently, Bitcoin finds itself languishing beneath the $92,000 realm and the 100-hourly Simple Moving Average. And yet, a bearish trend line looms ominously, with resistance at $92,650 on the hourly chart of the BTC/USD pair.

Should it manage to remain stable above $90,500, there exists a glimmer of hope for an upward resurgence. Immediate resistance lies near the $91,400 level, while the first key obstacle stands at the $92,200 mark, coinciding with the 50% Fibonacci retracement level from the dramatic decline.

The next hurdle to overcome could be the $92,500 barrier. Should Bitcoin close above this ceiling, we might witness a glorious ascent toward the $93,050 resistance. Any further gains could propel it toward the majestic $93,800 level, with the bulls eyeing $94,000 and beyond-if they can muster the courage.

Are More Pitfalls Awaiting Our Bitcoin Friend?

The next safety net appears at the $89,000 zone. Should further losses ensue, we might see the price plummet toward the somber $87,200 support in the near future. The ultimate barrier rests at $86,000; breach this, and our dear BTC may find itself in a most troubling tailspin.

Technical indicators, you ask?

Hourly MACD – Gaining momentum in the bearish territory, like a slow-moving train wreck.

Hourly RSI (Relative Strength Index) – Currently languishing below the 50 mark, as if it forgot its purpose.

Major Support Levels – $90,500, quickly followed by $90,000.

Major Resistance Levels – $92,200 and $92,500, looming large like storm clouds on the horizon.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- PENGU: The Cryptocurrency Drama Fit for a Molière Play 🎭💰

- Zcash: The $520 Fiasco 🎭💸 – Will ZEC Ever Break Free?

- Barclays Bets on Ubyx: A Token Tale of Tons of Cash! 💰🚀

- TIA PREDICTION. TIA cryptocurrency

- Decentralized AI Gets a Trusty Makeover – Is This the Future or Just a Fancy Toy? 🤔

- Pump.fun’s Record Volume: Is Solana’s Meme Coin Renaissance Here? 🚨

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

2026-01-08 05:49