On a rather curious Saturday, Ethereum‘s spot price dangled like a ripe fruit at $3,087 per shiny coin, while sneaky little derivatives traders were busy stacking risks like kids piling up cookies before mom catches them! 🍪 The numbers show that leverage is building up faster than a balloon at a birthday party, even though the price action looks about as stable as a tightrope walker on a windy day. It’s a classic setup that loves to trip up those who get too cozy! 🎈

Ethereum Futures and Options: A Topsy-Turvy Tug-of-War Near $3,100!

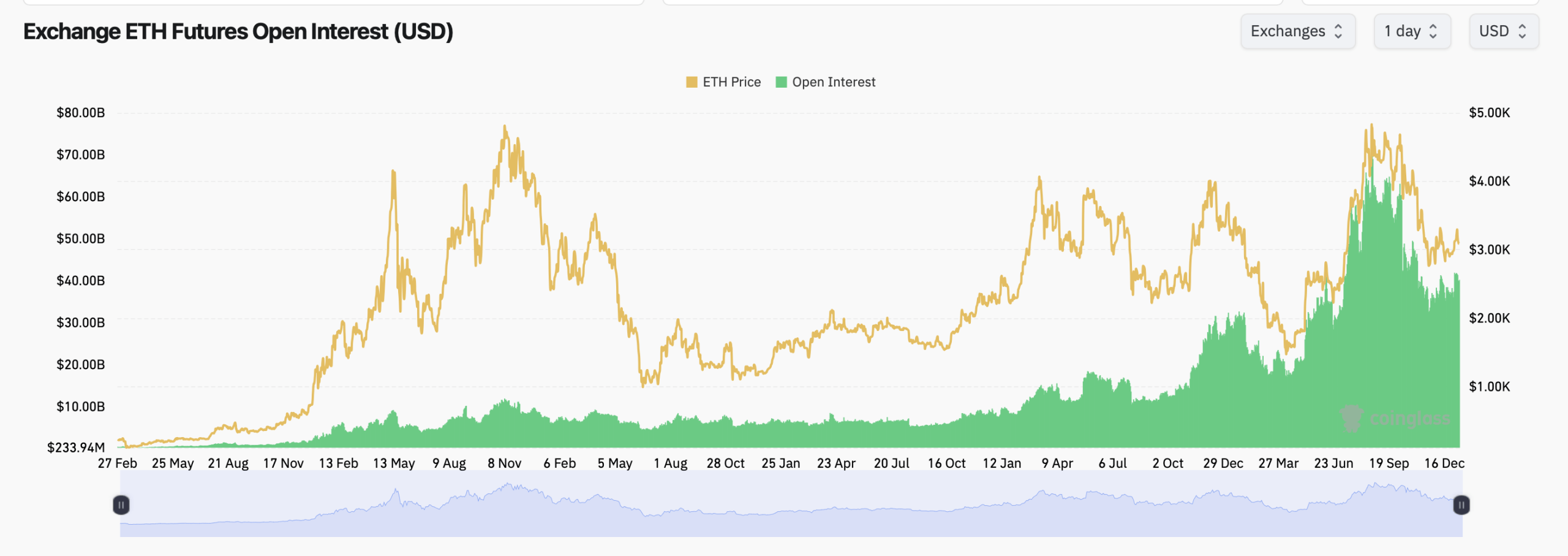

Ethereum futures open interest has shot up to 13.01 million ETH, which translates to a whopping $40.22 billion across the major exchanges! 💰 Despite a few hiccups in the past hour or so (maybe someone tripped over their own feet?), open interest still rose by 0.69% in 24 hours. Traders are clearly throwing caution to the wind and adding fuel to the fire instead of retreating back to safety! 🔥

Over at Binance, they’re sitting pretty, controlling a hefty 22.62% of total open interest-about $9.10 billion. That’s one giant cookie jar! Meanwhile, the CME is munching away with $5.86 billion, proving that big institutions aren’t shy about joining the fun either. Gate, Bybit, OKX, and Bitget are also in the mix, each wielding multi-billion-dollar positions like superheroes in a financial comic book! 🦸♂️

The short-term market is a bit like a rollercoaster-lots of ups and downs! 🎢 Most exchanges have seen small dips in open interest, perhaps a sign that some traders are trying to play it safe. But wait! The broader picture reveals a different tale: Gate had a joyful leap of 4.34%, and OKX sprang up by 2.47%. Looks like some are selectively stocking up, while others are racing for the exits! 😱

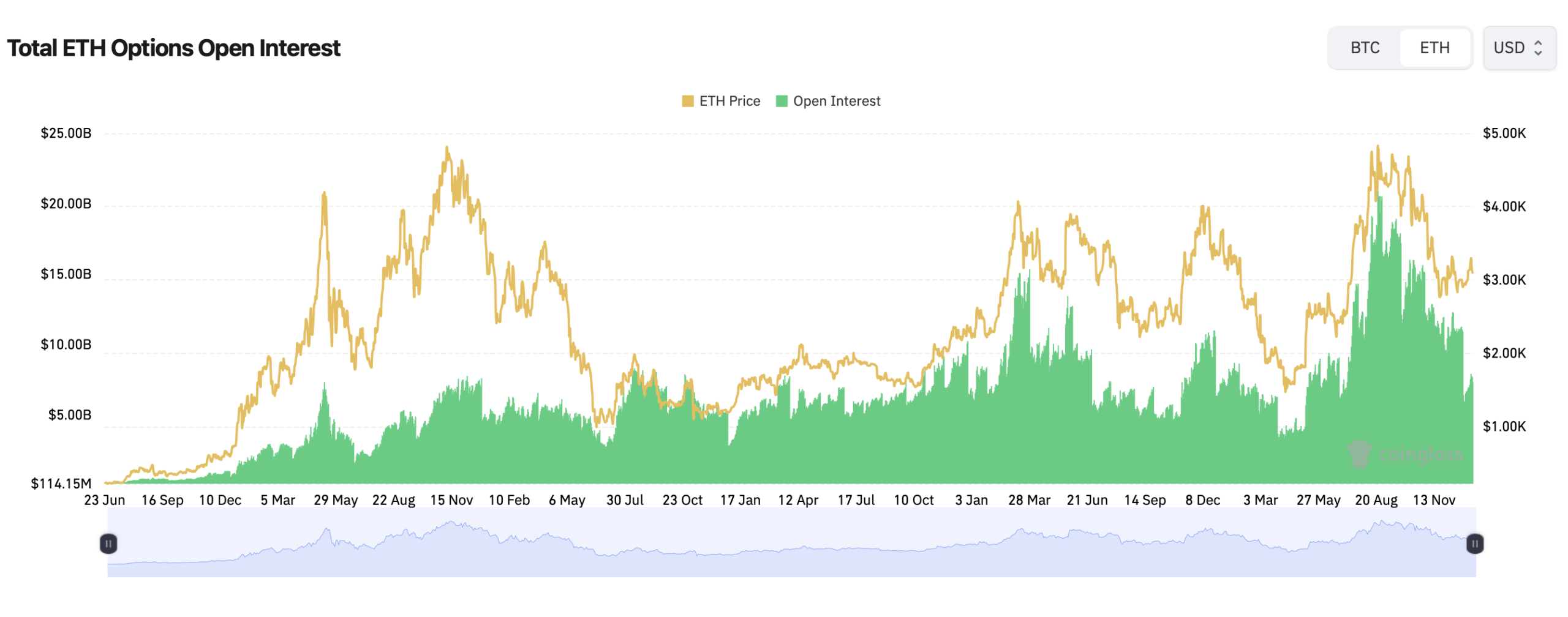

In the options playground, the mood is decidedly sunny! 🌞 Total ethereum options open interest shows calls making up 60.40% compared to 39.60% in puts. That’s about 1.29 million ETH in calls versus a mere 843,794 ETH in puts. Talk about a bullish crowd! 📈 Volume over the last 24 hours echoes this optimism, with calls taking a hefty 52.83% of the trading contracts.

Now, here’s where it gets spicy! 🌶️ The most popular options strikes are floating far above the spot price. On Deribit, the biggest open interest contracts feature ETH-$6,500 calls expiring on March 27 and $5,500 calls set to expire on both March 27 and June 26-traders are clearly dreaming big! 🚀

But wait, there’s a twist! The max pain data is lurking around like a mischievous cat. 😼 On Deribit, ethereum’s max pain level hovers near $3,100, uncomfortably close to our current price. Similar patterns appear on Binance and OKX, with max pain curves dipping toward the $3,000-$3,100 range, which historically acts like a magnet as expiration approaches. Watch out, folks! 🧲

This creates a rather awkward standoff, doesn’t it? Futures traders are loading up on leverage, options traders are cheerfully stacking calls, and max pain is quietly lurking below the most popular bullish strikes. It’s the kind of setup where patience, not bravado, usually takes the prize! 🎖️

Historically, when futures open interest rises quicker than the spot price, sharper moves tend to follow. Direction? Well, that’s anyone’s guess! But when everyone leans the same way, the market has a cheeky way of testing their resolve. Will they stand strong, or will they waver? 🤷♂️

For now, ethereum derivatives markets reflect a mix of conviction and uncertainty. 🧐 Leverage is building, optimism is shining through, and risk hangs precariously near a psychologically charged price level. Whether traders end up celebrating or sobbing will depend on who blinks first! 🎉😢

FAQ ❓

- What is ethereum futures open interest right now?

Ethereum futures open interest stands at roughly $40.22 billion across major exchanges. - Are ethereum options traders more bullish or bearish?

Options data shows a bullish tilt, with calls making up about 60% of open interest. - Where is ethereum’s max pain level?

Max pain clusters near the $3,000-$3,100 range on Binance, OKX, and Deribit. - Which exchange dominates ethereum futures trading?

Binance leads with more than 22% of total ethereum futures open interest.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR NZD PREDICTION

- Crypto’s Latest Darling: Ondo Defies Gravity While RWAs Hit Absurd Heights 🚀

- Memecoins Mania: How Traders Are Betting on Rate Cuts and Altcoin ETFs!

- Pi Network’s Dilemma: A Blockchain’s Descent 🚀💸

2026-01-10 23:03