Ah, the dawn of 2026! A year where hope and despair waltz like drunken peasants at a funeral feast. Will the U.S. economy rise like a phoenix from the ashes of fiscal absurdity, or collapse under the weight of its own hubris? Crypto, that temperamental diva, sulks in the corner while stocks prance like show ponies and gold preens toward record heights. Meanwhile, Polymarket, that circus of amateur prophets, gives a 21% chance of recession. How reassuring! 🤡

2026: A Test of Liquidity, Or a Farce of Biblical Proportions?

The optimists chant: “More liquidity, more miracles!” They envision a world where central bankers sprinkle digital fairy dust to revive the corpse of capitalism. The pessimists, meanwhile, recall 2008-the year “solutions” saved banks but left the rest of us gnawing on stale bread. 🍞💔 And then there’s the third camp: the popcorn gang, content to watch the theater of the absurd unfold. 🍿

The “expansionists” cling to Trump 2.0, that maestro of economic optimism, who believes GDP grows when he tweets. The Fed’s rate cuts? A mere warm-up act. Replace Powell with a “dovish” puppet, and voilà! “Ultra-dovish” liquidity rains from the heavens, funding both prosperity and midterm campaigns. 🐦🏛️ Critics note this plan hinges on timing liquidity like a political piñata-smash it when votes matter most. 🎉💥

History? A mere footnote. Reagan’s deregulation worked? Let’s repeat it, but dumber! In a podcast episode titled Token Narratives (where else?), Graham Stone and David Sencil mused on Venezuela’s collapse, oil markets, and Trump’s plan to buy $200 billion in MBS. Sencil gasped: “This is QE infinity! When Trump controls the Fed, crypto will dance like never before!” 🕺💸

“QE infinity,” he repeated, as if summoning Beelzebub himself. 🐐✨

The Bear Case: Liquidity-A Palliative for the Inevitable

The bears scoff: “Liquidity delays doom, but cannot prevent it.” Marc Faber, that prophet of gloom, urges fleeing stocks as inflation gnaws like a rat on a corpse. 🔥🐀 Tech and AI valuations? A bubble so vast it could swallow Manhattan. Political chaos? The 2026 midterms might trigger a “Trump put”-a panic button for markets addicted to chaos. 📉🎭

JPMorgan, that eternal optimist (or is it pessimist?), assigns a 35% chance of recession. Polymarket’s gamblers, less courageous, say 21%. Either way, the odds scream: “Buy a helmet.” 🛡️

Markets dither, pricing in both salvation and ruin. If liquidity arrives early, stocks rally. If late? The guillotine drops. Until then, the sidelines overflow with spectators whispering, “Where’s the popcorn guy?” 🥕

FAQ ❓

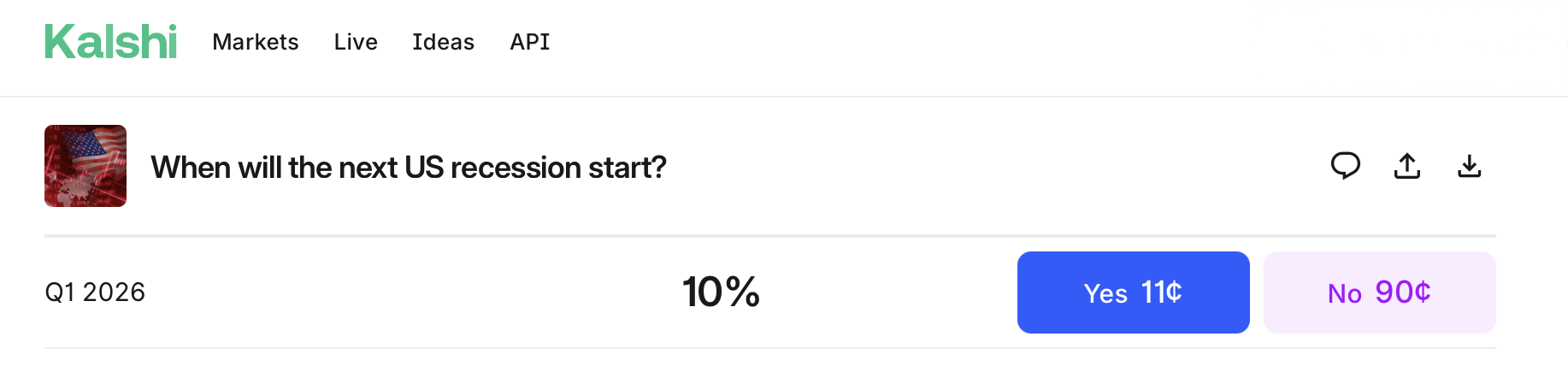

- Recession odds for 2026? Prediction markets: 11-21%. JPMorgan: 35%. Basically, coin toss territory. 🪙

- Why liquidity will save us? Because obviously, printing money solves everything. 🖐️💸

- Why bears think we’re doomed? Debt, AI hype, and Trump’s approval ratings. Take your pick. 🎰

- Markets positioned how? Like a nervous virgin at a frat party: hopeful, but clutching the emergency exit. 🚪

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR NZD PREDICTION

- Crypto’s Latest Darling: Ondo Defies Gravity While RWAs Hit Absurd Heights 🚀

- Memecoins Mania: How Traders Are Betting on Rate Cuts and Altcoin ETFs!

- Pi Network’s Dilemma: A Blockchain’s Descent 🚀💸

2026-01-11 02:58