In the grand theater of Wall Street, as the clock struck January 12-16, 2026, the U.S. spot Bitcoin ETFs, in a dramatic twist worthy of the finest Russian novels, recorded a staggering $1.42 billion in net inflows. Who would have thought? The very same assets that lay dormant, now awakened with a vigor reminiscent of a slumbering bear roused from hibernation.

- Indeed, Bitcoin spot ETFs have attracted $1.42 billion in weekly inflows, a phoenix rising from the ashes of prior losses.

- Leading this carnival of investments was none other than BlackRock’s IBIT, snatching an impressive 73% of the Bitcoin ETF inflows. A true capitalist colossus!

- And not to be outdone, Ethereum ETFs added a respectable $479 million, with ETHA taking home nearly half of that bounty.

Ah, IBIT, the crown jewel of BlackRock, proudly led the pack with a princely sum of $1.035 billion in allocations. It dominated the scene like a czar surveying his empire, accounting for 73% of total weekly inflows across all Bitcoin ETF products. Truly, a masterstroke!

Meanwhile, our dear Ethereum ETFs sauntered in with $479.04 million in net inflows during the same period. Among them, BlackRock’s ETHA stood tall, capturing $219 million, or a delightful 46% of the weekly Ethereum ETF flows. One might say it was a rather lucrative week for those in the know!

Daily Bitcoin ETFs Flow Breakdown: A Comedy of Errors and Gains

The daily performance of Bitcoin ETF flows resembled a rollercoaster ride – thrilling yet uncertain. Tuesday, January 14 took the crown for the strongest single-day performance, boasting $843.62 million in net inflows. Monday, January 13 followed closely behind with $753.73 million. Such excitement! 🎢

But wait! Thursday, January 16 shattered the party with a solitary outflow of -$394.68 million. Perhaps the investors took a moment to reflect on their choices? Wednesday, January 15 saved face with $100.18 million in inflows, while Sunday, January 12 added a modest $116.67 million. A week of highs and lows, indeed!

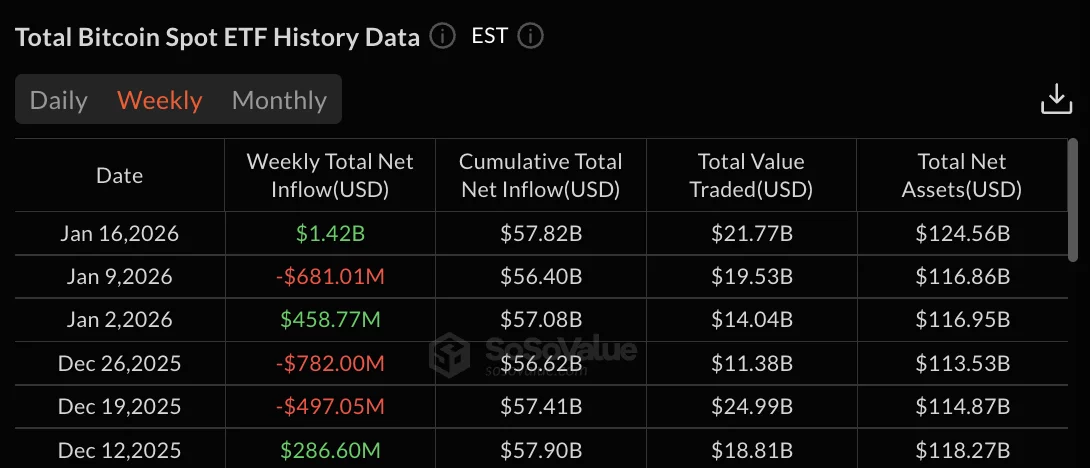

By the end of the week, total net assets across all Bitcoin ETF products reached a princely sum of $124.56 billion. Cumulative total net inflows since launch stood at $57.82 billion-what a journey! Trading volume for the week hit an astonishing $21.77 billion across the board. A veritable feast for the financial gluttons!

Let us not forget the previous week, which ended on a sour note with -$681.01 million in outflows. This week’s astounding $1.42 billion swing is nothing less than a melodrama-a reversal surpassing $2.1 billion! Can you imagine the conversations over fine vodka and caviar?

Ethereum ETFs: The Unsung Heroes of the Week

As if taking notes from the Bitcoin saga, Ethereum ETFs displayed an admirable consistency throughout the week. Tuesday, January 14 enjoyed the largest single-day gain at $175 million, while Wednesday, January 15 added $164.37 million. It seems Ethereum understands the art of subtlety!

Monday, January 13 contributed $129.99 million, while Thursday, January 16 and Sunday, January 12 brought in smaller, yet positive flows of $4.64 million and $5.04 million respectively. Every little bit counts in this financial ballet!

By the week’s close, total net assets for Ethereum ETF products had ascended to $20.42 billion. Cumulative net inflows since launch reached $12.91 billion, with a weekly trading volume across all Ethereum ETF products totaling $7.74 billion. Bravo, Ethereum, bravo! 👏

Read More

- Brent Oil Forecast

- Why Is Everyone Obsessing Over These Cryptos? 🤔

- EUR THB PREDICTION

- CRO PREDICTION. CRO cryptocurrency

- USD MXN PREDICTION

- BNB Hits ATH, But Bearish Whispers Grow 🚀💸

- USD JPY PREDICTION

- Gold Rate Forecast

- AVAX Poised for a Jump: Why the Next $80 Might Just Be a Matter of Time

- Economist Reveals His Biggest Bitcoin Mistake – You Won’t Believe What It Is

2026-01-18 22:03