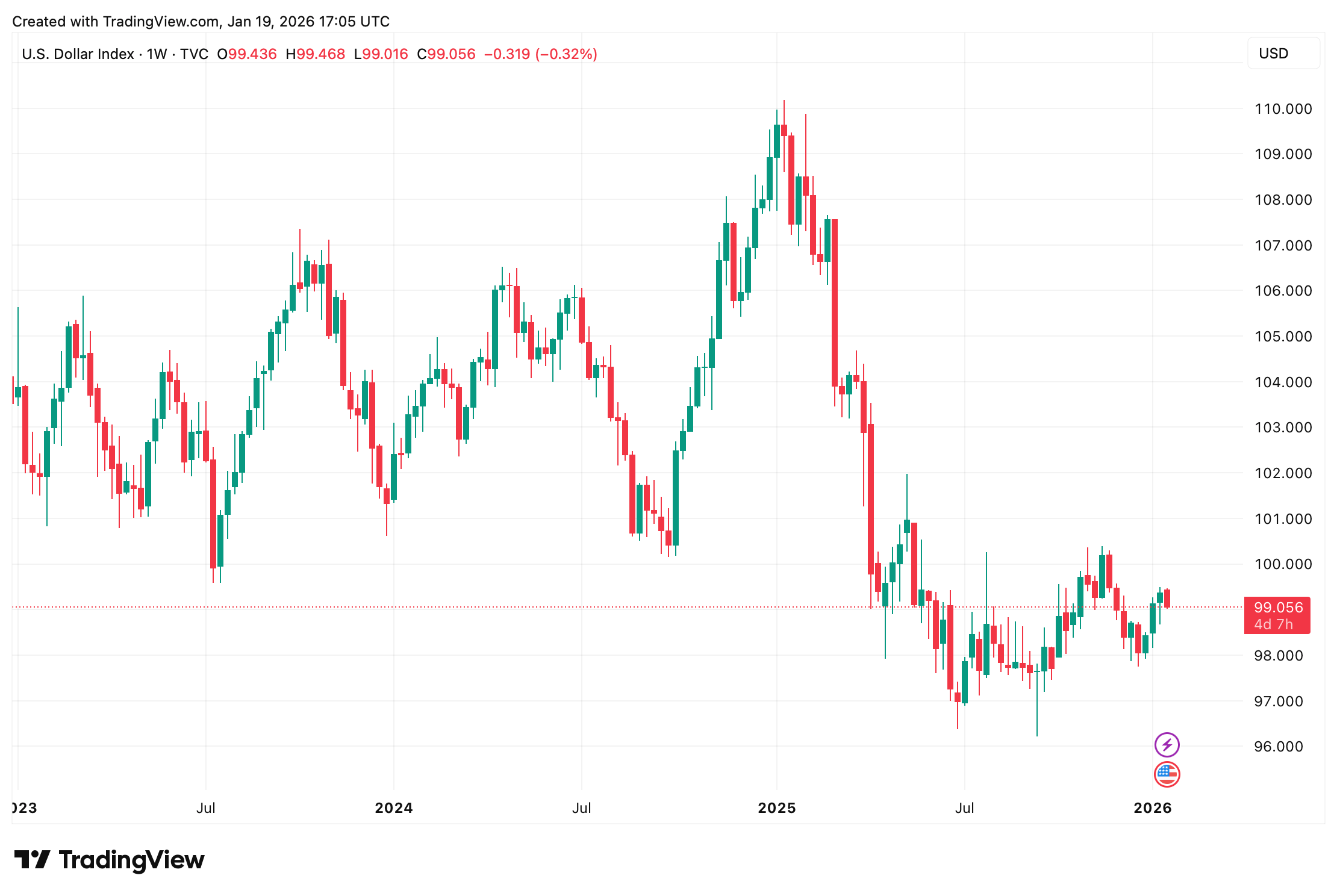

Monday morning, and the U.S. dollar decided to take a little vacation-probably to some tropical place where it can’t hear Trump’s latest tariff threats or Fed whispers. The Dollar Index (DXY), which is basically a popularity contest between the euro, yen, yuan, and pound, took a nosedive-because who doesn’t love a good tumble? Market insiders are calling it the “Sell America” trade, fueled by Trump’s recent spat with the Fed and his diplomatic finesse in telling Europe, “Hey, hold my tariff.”

Markets Flinch as Fear Grips the Greenback and Risk Assets Wobble

Oh, and just to keep things interesting, the U.S. markets-those precious things we all pretend to understand-are closed today for Martin Luther King Jr. Day. But fear not! Those open markets are practically twitching with anxiety, like a jittery Chihuahua at a cat convention, just waiting for the real chaos to start when they reopen tomorrow.

Crypto markets are in a bit of a funk too, bleeding red following Sunday night’s sell-off. Bitcoin, the digital gold that people love to love, is below $93,000 and down more than 2%, probably contemplating its life choices. Meanwhile, precious metals are having their moment in the sun: Gold is gliding at $4,679 an ounce, and silver is frolicking at $94.55, as if to say, “Hey, we’re still valuable, folks!”

Meanwhile, the dollar’s attitude is as chilly as a polar bear in a blizzard, thanks to rising geopolitical tensions. Trump, ever the diplomat, threw out some fresh tariff threats-aimed at eight European countries, no less-adding more spice to the global market’s spicy stew of uncertainty.

Global markets are now in a “risk-off” mood, meaning everyone is running for cover-preferably into assets that are not the U.S. dollar. Reuters reports that the dollar has taken a little tumble against the euro, pound, and Norwegian crown. Amanda Cooper, a Reuters journalist with a crystal ball, notes that “the initial reaction among investors has been to sell the dollar,” reminiscent of last April’s tariff tantrum, sparking what she charmingly called “a crisis of confidence in U.S. assets.” Because nothing says “trust me” quite like a tariff tantrum, right?

A CNBC report humorously calls this chaos the “Sell America” trade, which sounds like something you’d yell at a Fourth of July barbecue but is actually a very serious market strategy (if you’re into losing money). It’s part of a broader move by investors to diversify-they’re basically saying, “Sure, America’s great… but maybe let’s hedge our bets, just in case.”

Krishna Guha, global policy guru at Evercore ISI, says this risk-off mood could be a “familiar replay of last year’s pattern,” which probably involves a lot of frantic phone calls and some very confused traders. JPMorgan analysts aren’t far behind, warning that this “Sell America” vibe might be the dominant story for now. But don’t worry, folks-critics argue the U.S. economy is not as fragile as a house of cards, and while markets panic today, tomorrow they might just remember how lucrative U.S. yields can be when they sober up from their panic attack.

As Wall Street gets ready to re-emerge from its holiday hibernation, the dollar’s on shaky ground-politics, policy, and a dash of hysteria all playing their part. Crypto has taken a hit, precious metals are flexing, and investors are playing defense. Whether the dollar will recover or turn into the economic equivalent of a bad hair day remains to be seen. But one thing’s certain: Tuesday’s market opener could be the economic version of a circus-loud, chaotic, and not for the faint of heart.

FAQ 🇺🇸

- What is the “Sell America” trade? It’s when investors decide that U.S. assets and the dollar are too sketchy and start looking for safer bets-like seats at the wedding of a very rich, very unpredictable relative.

- Why is the U.S. dollar falling? Tariffs, Fed drama, and risk-averse investors are basically giving the dollar the cold shoulder, like a dinner guest who overstayed their welcome.

- How are crypto and metals reacting? Crypto is taking a hit, while gold and silver are showing off their safe haven status-more like metal bodyguards than shiny jewelry.

- What could happen when U.S. markets reopen? Well, if history’s any guide, global stress might spill over into equities-think of it as a hangover that everyone forgot to warn you about.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- USD HKD PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- EU’s Crypto Crackdown: Can Regulations Keep Up with the Wild West?

- Trump’s Tariff Tango with China: Drama, Markets, and a Lot of Eye-Rolls 🌍💸

2026-01-19 22:28