As the global debt markets find themselves in a state of particular disquiet, the esteemed U.S. dollar, once the stalwart of safe havens, now confronts an unprecedented challenge. This sentiment is echoed by none other than the esteemed economist, Robin J. Brooks.

In the latest chapter of this financial fiasco, it seems that global currency markets are advancing towards a destabilizing phase, as confidence wanes and traditional defenses crumble. On the 24th of January in the year 2026, Mr. Brooks graciously shared with the public his stark analysis of the current market condition, encompassing accelerating bond turmoil and a rather alarmed capital flight.

This Mr. Brooks, a gentleman with a respected tenure at both the Brookings Institution and the Institute of International Finance, being previously engaged at Goldman Sachs, has taken it upon himself to cast the light upon a decisive inflection point. His domain of excellence is indeed a grand one-encompassing global macroeconomics, the nuances of exchange rate valuations, the tangled pathways of capital flows into emerging markets, and the cloaked intricacies of Western sanctions. It was with a languidly grave tone that he proffered his insights:

“One observes, with a certain degree of apprehension, that the dollar’s descent is rather more than upon a mere whim.”

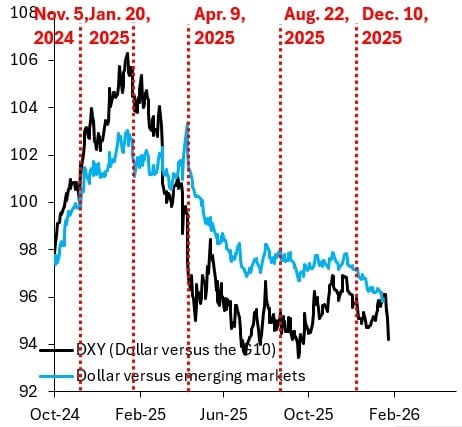

To lend credence to Mr. Brooks’ assertions, he has furnished a pair of charts, tracing the odyssey of the dollar against both G10 and emerging market currencies from October 2024 to the early months of 2026. Not to clutter one’s thoughts with the menial details of fiscal organisation, the G10 consists of those leading advanced-economy currencies, encompassing the likes of the euro, Japanese yen, and a sprinkling of others. Through his learned eyes, the break of the emerging markets dollar below its prior boundaries is scribbled down as nothing less than an omen, with its G10 counterpart teetering on the precipice of a similar fortuitous breakdown.

The chart-no less an indication of fate-presents us with the ebony line of the DXY index, a measure most melancholy of the U.S. dollar’s plight compared to a basket of rival currencies. Its ascent soared above 106 in the early dawn of 2025, soon thereafter plunging sharply, much akin to the decline of an empire. In contrast, the azure line traces the dollar’s interaction with emerging markets, which, having begun its decline prematurely, now continues with relentless tenacity.

Moreover, Mr. Brooks has undertaken the task to redefine what delicacies our palate deems fitting as safe havens. In a surprising twist, our gentle friends in the low-debt economies, namely the Swedes, Norwegians, and Swiss, have caught the eyes of the market as delectable alternatives to the dollar and yen. The esteemed economist employs wit to counter arguments concerning Japan’s liquidity deficits, instead, with a smirk, attributing the flight of capital to concerns of fiscal credibility and an aversion to austerity. Even with the ascending long-term yields, he quips that these do not suffice to compensate investors for their sovereign risks, leaving the yen in a most precarious position. In summarizing the vast outlook before us, Mr. Brooks has penned:

“The very essence of our discussion lies in the revelation that the Dollar, much like the Yen, faces formidable opposition, within a world where the flight to safety from the perils of debt monetization becomes the prevailing theme.”

Thus, his discourse solidifies the anticipation of a migration, akin to the grand movements of empires of old, toward tangible assets and the embrace of currencies borne from fiscal discipline, as the yoke of debt becomes ever so burdensome.

FAQ ⏰

- Why do the U.S. dollar’s shelves seem so bare in the year of our Lord, 2026?

It appears that the garret of the dollar is unpopulated, burdened by bond market stress, the frightful flights of capital, and the renewed specters of debt monetization which haunt its corridors. - What catalyst hath released the latest unholy tempest upon the dollar?

A sharp, indeed quite ungentlemanly, sell-off within Japan’s government bond sanctuary has rippled through the serene ponds of global debt and currency markets. - What genteel assets, thoughtful reader, are now receiving jubilant attention in lieu of what was previously desired?

Precious metals such as gold, silver, and platinum, along with those currencies that remain unburdened by debt, are fitting fortunes spent. - Which currencies are beginning to wear the jeweled crown as the dollar and yen abdicate?

The lands of Sweden, Norway, and Switzerland are regaling in newfound popularity due to fiscal reputations most untarnished.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Silver Rate Forecast

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

2026-01-25 07:57