Well, well, well, if it isn’t Tether, strutting into the new year like it owns the place. Reports are flying around that this digital behemoth raked in over $10 billion in profits for 2025, while its stablecoin, USDT, ballooned to an absolutely ludicrous $186 billion in circulation. The financial world is collectively scratching its head, wondering if they missed a memo about how to make money in their sleep.

Strong Balance Sheet And Big Reserves

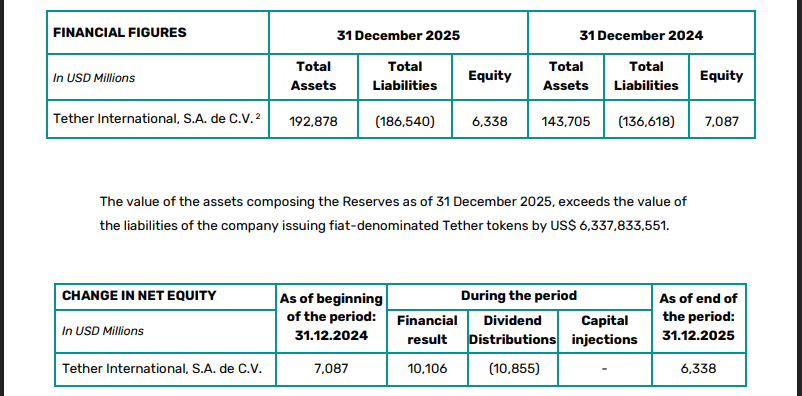

It appears Tether’s balance sheet is as solid as my willpower at an all-you-can-eat buffet-after dividends and payouts, they’ve reportedly ended the year with several billion in excess reserves. That’s right, folks, they’re sitting on a cushion of cash that would make even Scrooge McDuck green with envy. Investors are feeling all warm and fuzzy inside, despite the nagging fear about whether a stablecoin can actually be stable when it’s backed by a bunch of numbers and promises.

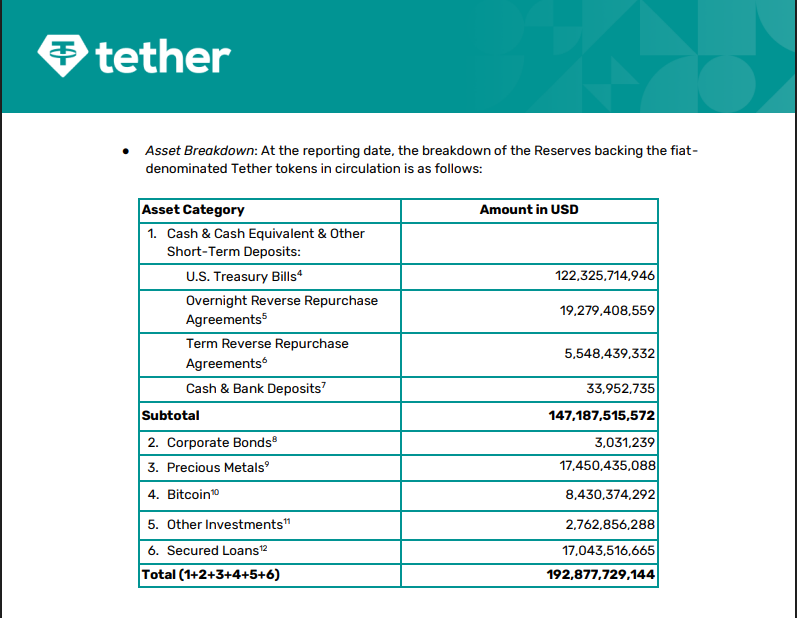

Tether’s stash is heavily weighted in US Treasuries-the grandmothers of the investment world. They’ve got a large slice of their reserves sitting pretty in those, generating steady interest income. It’s like watching your money grow old gracefully while sipping mint juleps on a porch somewhere in the Hamptons.

These delightful figures come straight from Tether’s recent annual attestation, prepared by accountants who, let’s face it, probably deserve a medal for deciphering whatever passes for “accounting” in the crypto universe.

Gold Buys And A Shift In Mix

In a plot twist worthy of a daytime soap opera, Tether has started hoarding physical gold like it’s preparing for the apocalypse. Reports claim they bought about 27 tons of gold in the last quarter alone. I mean, who needs a diversified portfolio when you can just start a new trend called “gold hoarding”? Rumor has it they’re aiming for 10% to 15% of their portfolio in gold, which might be their way of saying, “We’re not just crypto; we’re also a little bit pirate.”

This profit surge and the expanding USDT supply are drizzling down like confetti at a New Year’s party, affecting everyone from market makers to exchanges, who treat Tether as their go-to dollar substitute. Just imagine, more USDT means better trading liquidity-it’s like adding extra cheese to your pizza. Who wouldn’t want that?

However, not everyone is throwing a party. Some rating agencies and analysts have raised their eyebrows, pointing out potential issues with transparency and risk. It’s like inviting a friend to a dinner party only to realize they’re still wearing their pajamas-awkward!

For users, the influx of USDT is basically like opening the floodgates to a water park-better on-ramps for trading and moving value between platforms! Just don’t forget your floaties.

As for regulators and big lenders, they’re staring at these numbers like a deer caught in headlights, desperately wanting clearer disclosures to match the colossal scale of these holdings. Because let’s be honest, no one wants to buy a ticket to a rollercoaster without knowing how many loops it has!

Tether’s performance is shaping a larger narrative about how crypto navigates the slippery waters of dollar-like liquidity. The company insists their reserves and reporting meet their own standards, while independent commentators are waving their arms like they’re in a revival meeting, calling for even more clarity.

But one thing’s for sure: USDT’s influence is expanding, and the conversation surrounding risk, disclosure, and backing assets is only getting louder. Buckle up, folks-this ride is just getting started!

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- XRP’s Little Dip: Oh, the Drama! 🎭

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- Silver Rate Forecast

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

2026-01-31 19:24