Markets

What to know:

- Tether, the digital alchemists who promised to turn $20 billion into $500 billion overnight, faced a minor setback when investors-shockingly-declined to fund a “valuation” larger than the GDP of some small nations.

- Advisers now float a “modest” $5 billion target, as skeptics wonder why anyone would value a stablecoin issuer like SpaceX when its main innovation is making money vanish into “reserves.”

- Regulatory risks? Transparency gaps? Who needs those pesky audits when you’ve got quarterly “attestations” from a firm named BDO Italia, which sounds delightfully Italian and utterly unverifiable?

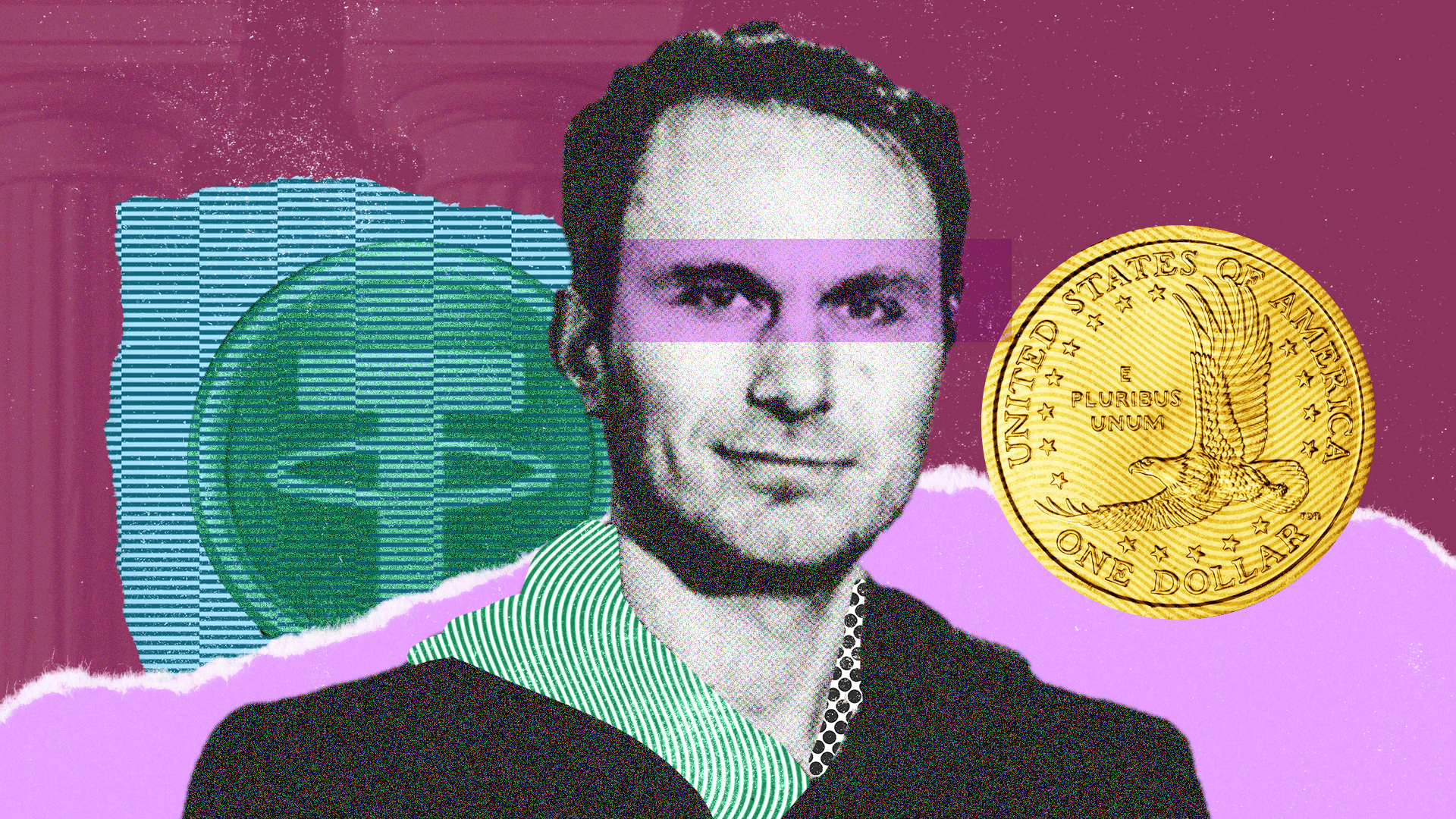

Tether, the company that brought us the thrill of “blockchain transparency” (read: accounting by magic), quietly abandoned its plan to raise $20 billion after investors-bless their naive hearts-objected to funding a valuation that could’ve made it the world’s first trillionaire stablecoin. The FT reported this week that the dream is dead. Or at least on pause. Again.

The USDT overlords, who somehow keep $185 billion in circulation despite being the financial equivalent of a Ponzi scheme with a nicer website, had floated a $500 billion valuation last year. Because why not? If AI startups with no revenue get unicorn status, why not a company that prints digital dollars and calls it “profit”?

Advisers now whisper about a “mere” $5 billion raise, a comedown from the original “let’s pretend we’re Apple” fantasy. Investors, still capable of basic math, balked at comparing Tether to SpaceX. One reportedly asked, “Is this a stablecoin or a delusion?”

CEO Paolo Ardoino, ever the statesman, claimed the $20 billion figure was a “ceiling, not a target,” adding, “If we sold zero, we’d be thrilled.” A bold admission that rivals the candor of a tax evader.

Yet Tether’s pitch remains: “We’re profitable! (Unlike those pesky AI firms burning billions!)” True, if you ignore the fact that their “profit” stems from interest on assets that don’t actually exist in any tangible form. It’s like claiming rent from a castle in the cloud.

Regulators, meanwhile, circle like vultures. S&P Global, ever the optimist, downgraded Tether’s reserves last year, noting their “increased exposure to bitcoin and gold.” Translation: “We’re nervous your vaults are just a PowerPoint slide.”

Ardoino’s rebuttal? “If you think an AI firm worth $800 billion with a minus sign is sane, enjoy!” Fair. But let’s not forget: Tether’s own minus sign is hidden in the fine print of its “reserves,” which are about as reassuring as a “trust me” from a magician.

In the end, Tether’s “glorious bridge between traditional finance and crypto” remains unshaken-mostly because the bridge is built on a swamp of unanswerable questions. Investors may grumble, but who needs clarity when you’ve got… well, nothing but vibes?

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- ETH Crash Incoming? 😱

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

2026-02-04 12:05