Ah, the crypto carnival continues its macabre dance, with Bitcoin and Ethereum as the star-crossed lovers, each vying for the spotlight in this theater of financial folly. While Bitcoin teeters on the precipice of $60,000, Ethereum, ever the dramatic diva, flirts with the $2000 support level-a flirtation as perilous as a tightrope walker in a storm. The question, my dear reader, is not if the distribution phase is upon us, but whether we shall all be left holding the proverbial bag of digital confetti.

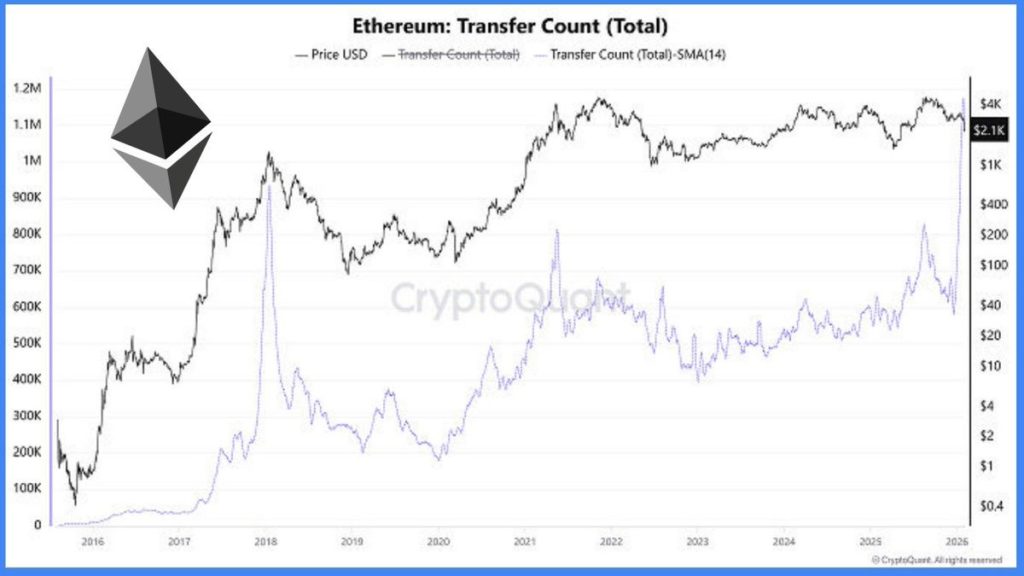

Ethereum’s Transfer Extravaganza: 1.17 Million and Counting

Behold, the on-chain data doth reveal a spectacle most curious: Ethereum’s transfer count hath surged to 1.17 million, a number as grandiose as a Victorian ball. Yet, history, that wily raconteur, reminds us that such peaks were last seen in the halcyon days of 2018 and 2021-epochs that preceded financial tempests and prolonged periods of existential ennui. High network activity, they say, is bullish-but pray, when did a crowded ballroom ever guarantee a harmonious waltz?

In this farce of finance, activity sans price expansion is but a masquerade, where large holders continue their dance while the music grows faint. Supply, that uninvited guest, threatens to outstay its welcome, leaving demand to sip its champagne alone.

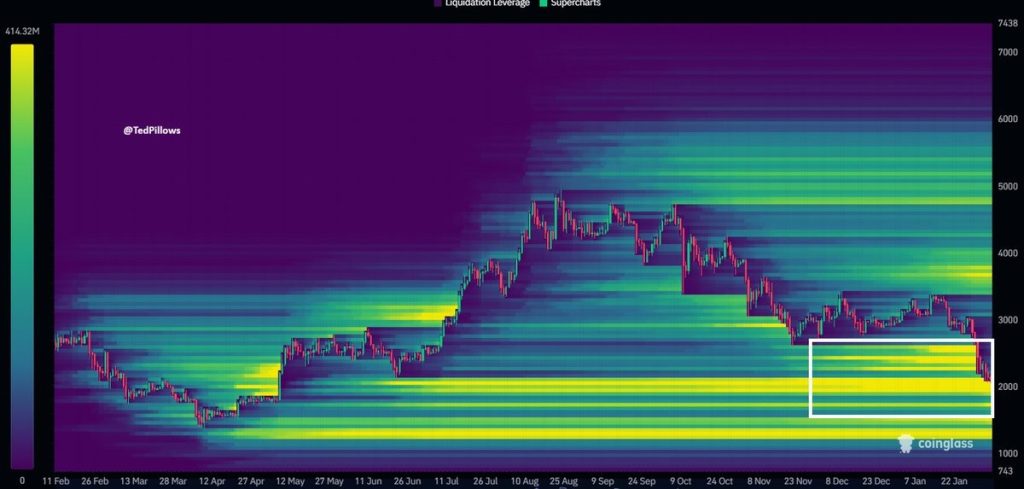

ETH Price: A Drift Toward the Liquidity Abyss

Meanwhile, in the derivatives theater, a dense liquidity cluster lurks between $1,800 and $2,000-a veritable magnet for price, particularly in moments of waning momentum. Liquidation heatmaps, those harbingers of doom, suggest that ETH is but a moth drawn to the flame, its path illuminated by the allure of maximum carnage.

In this distribution charade, price drifts not toward resistance but toward the abyss of liquidity, where leverage is but a fragile construct awaiting its dramatic collapse. Volatility, that fickle mistress, promises sharp moves as the market flushes out its excesses-a spectacle both terrifying and sublime.

The Trader’s Dilemma: To Watch or To Waltz?

The charts, those silent oracles, whisper of active participation and supply rotation, with downside tests looming like specters at a séance. Ethereum, once the belle of the ball, now appears vulnerable to the whims of liquidity-driven moves, its upside follow-through as elusive as a ghost in broad daylight. This, my friends, is the distribution phase-a transition from the frenzied momentum of youth to the sober balance of maturity.

Yet, fear not, for Ethereum shows no signs of panic or breakdown, merely a tilt toward the downside in the near term. But then, as we all know, the most tragic comedies are those where the protagonists remain blissfully unaware of their impending doom.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

2026-02-05 17:03