Ah, the cryptocurrency market, a veritable theatre of the absurd where fortunes are made and lost in the blink of an eye! In the last 24 hours, we have witnessed a catastrophic plunge, with crypto liquidations exceeding a staggering $1.45 billion. This unfortunate event marks the fourth most dramatic day in liquidation history over the past three months; one cannot help but chuckle at the sheer audacity of it all.

As fate would have it, more than 311,000 traders found themselves rudely awakened from their dreams of wealth, as their positions were unceremoniously flushed away. The pièce de résistance of this calamity was a single liquidation from the BTC/USDT pair, which rolled forth from Hyperliquid’s competitor, Aster, to the tune of $11.36 million. Oh, the sweet music of despair! CoinGlass, the ever-watchful chronicler of our times, unearthed this data at precisely 5:30 p.m. UTC on February 5.

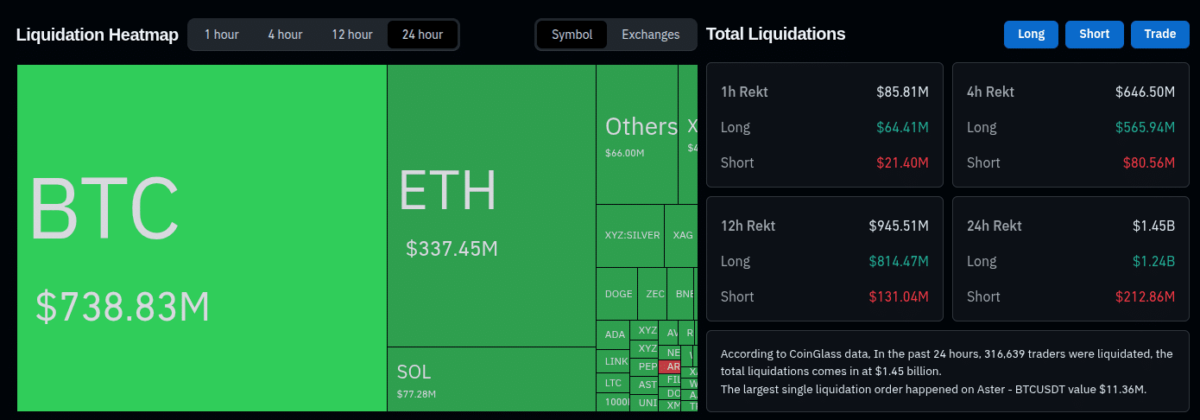

Liquidation heatmap and total liquidations as of February 5, 2026 | Source: CoinGlass

It seems that the long positions bore the brunt of this tempest, accounting for a hefty $1.24 billion of the total liquidations. Bitcoin, the grandmaster of digital currency, leads the charge with a staggering $738.83 million in liquidated funds-twice that of Ethereum, which languishes in second place with a mere $337.45 million. Solana, our dear underdog, is left nibbling at the crumbs with $77.28 million.

Most of this liquidation frenzy transpired in a mere 12 hours, as if the market had collectively decided to engage in a mad dash towards oblivion. A staggering $646 million vanished into thin air in just the last four hours, and $85 million within the final hour of our data collection. It appears the crypto gods have their own sense of humor.

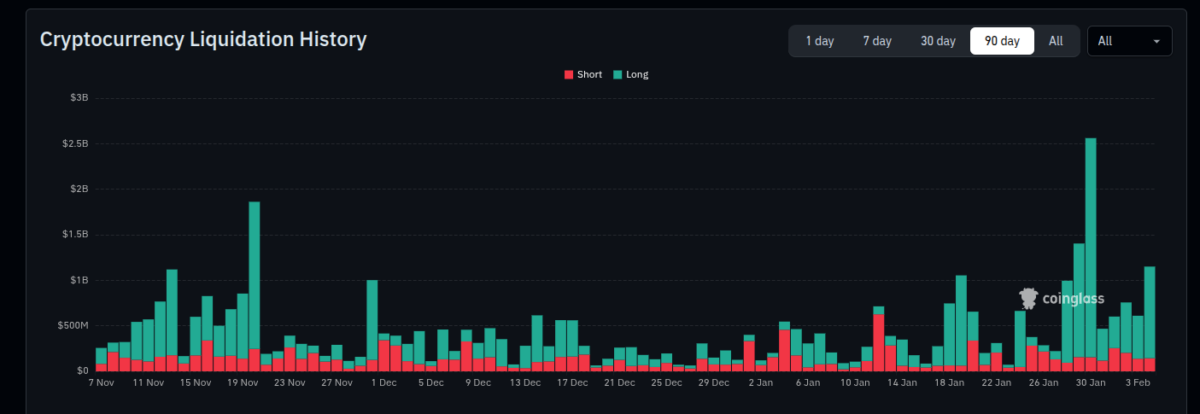

A historical chart from CoinGlass now reveals this event as the fourth-largest daily liquidation spectacle in the last 90 days, trailing only behind events from January 29, November 20 of last year, and January 30. One can only wonder what cosmic misalignment led us to this juncture.

Cryptocurrency liquidation history (90D), as of Feb. 5, 2026 | Source: CoinGlass

Analysts Predict Further Downfall as BTC, ETH, SOL Take a Nosedive

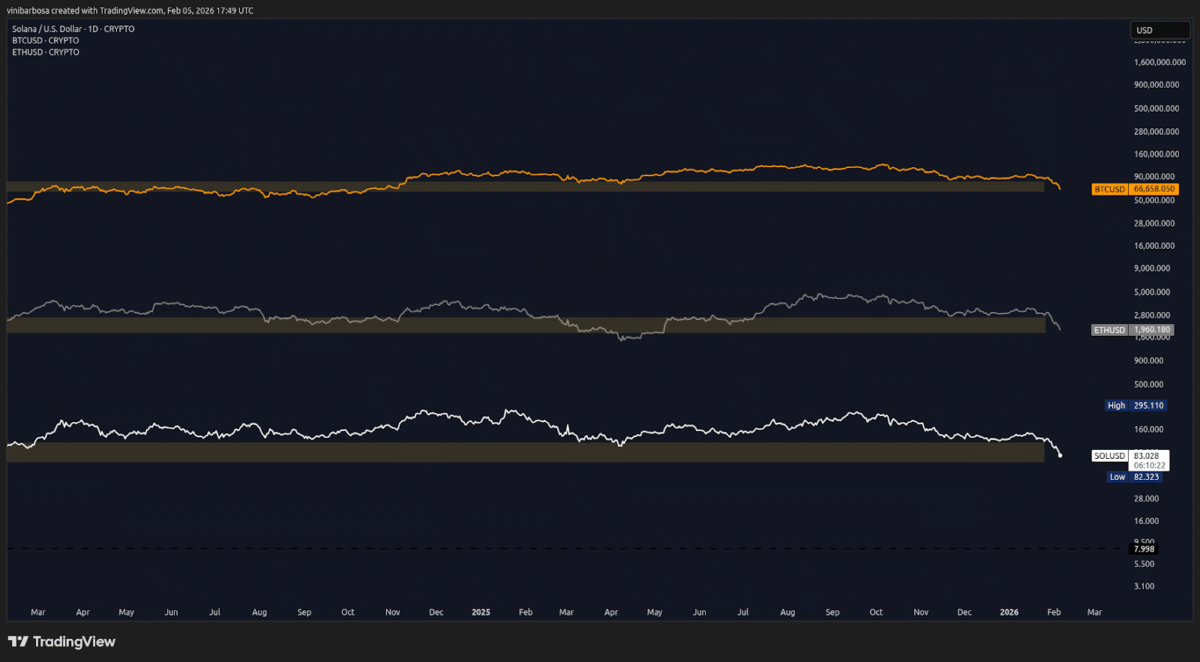

Our three protagonists-Bitcoin, Ethereum, and Solana-have met with disastrous luck, losing key support levels during this catastrophic long squeeze. They now find themselves in the melancholy realm of bear markets, where whispers of lower levels echo ominously in the corridors of speculation. A recovery, should it come, would defy the dire predictions and perhaps restore some semblance of order to this chaotic realm.

As of this very moment, Bitcoin is trading at $66,650, Ethereum at $1,960, and Solana at $83, each a testament to the wild swings of fortune.

Bitcoin, Ethereum, and Solana 1D price charts, as of February 5, 2026 | Source: TradingView

In a twist worthy of the finest Greek tragedy, Michael Burry, heralded for his foresight during the 2008 crisis, cautions that Bitcoin might be poised to repeat its earlier catastrophic plunge, potentially plummeting to $50,000 or even lower. Meanwhile, our astute analyst known as PlanB has concocted four bear market scenarios that threaten to unfold in the coming days, leaving us all to ponder the whims of fate in this ever-unpredictable narrative.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

2026-02-05 22:15