Markets

What to know:

- In a surprising twist of fate, bitcoin accumulation has begun to cast its net wider, an event not seen since the last time we were all wondering if our wallets could survive the emotional rollercoaster of late November.

- Ah, those bold wallets holding between 10 and 100 BTC-our brave heroes! They have taken it upon themselves to buy the dip with such gusto as prices plummeted toward the $60,000 precipice. Where others fled, they dove!

As the bleak month of February lumbered in, bitcoin was strutting around the trading arena at a princely sum of $80,000. Whales cautiously dipped their toes in the frosty waters, while retail investors, seeing the storm clouds gather, sprinted for the exits, possibly leaving behind a shoe or two. Yet, in a mere week’s time, bitcoin took a nosedive down to $60,000 on February 5, triggering what appears to be a glorious revival of interest across almost all cohorts as the once-dreaded ‘value’ word re-entered the conversation.

This newfound enthusiasm follows one of the most dramatic capitulation events in the colorful history of bitcoin-a saga that now seems to be morphing into a synchronized dance of accumulation. Bravo, dear investors, the show must go on!

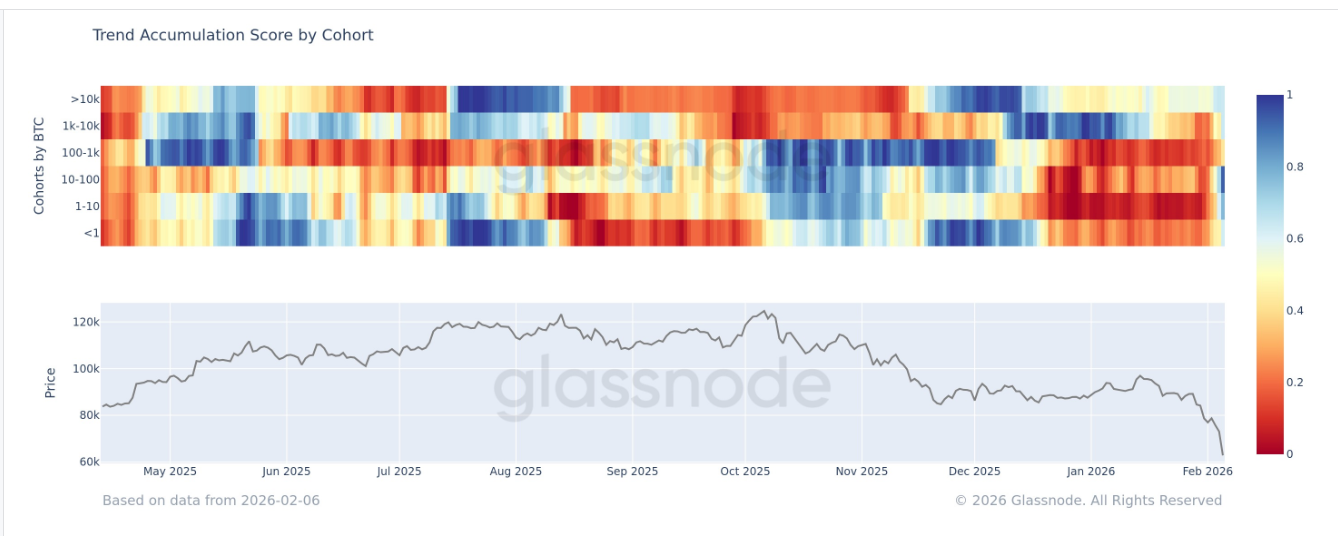

Glassnode’s Accumulation Trend Score by cohort-what a mouthful!-illuminates this behavioral shift. This metric, an arcane concoction balancing entity size against the amount of BTC acquired over the previous fortnight, is the oracle we need. A score teetering closer to 1 suggests our friends are accumulating, while a score languishing near 0 indicates a rather sad distribution party.

On an aggregate level, this mystical Accumulation Trend Score has soared past the 0.5 threshold, landing squarely at 0.68. Rejoice! This marks the first instance of broad-based accumulation since late November, a time when bitcoin fancied itself resting at a local bottom near $80,000-a true renaissance moment!

The cohort leading the charge in this audacious dip-buying spree? The wallets holding between 10 and 100 BTC, who have proven themselves particularly brave as prices gracefully glided toward the $60,000 abyss.

Though uncertainty looms like a shadow, with the ultimate bottom still playing coy, one thing is clear: investors are rediscovering the allure of bitcoin following a staggering drawdown of over 50% from its lofty October heights. Oh, how the tables turn in this grand game of digital treasure hunting!

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Silver Rate Forecast

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

2026-02-08 00:30