Permit me, dear reader, to illuminate the peculiarities of our contemporary financial landscape:

- Behold Tether, that stalwart issuer of stablecoins, now embarking on a most extravagant endeavor-doubling its workforce from a size so diminutive it could easily be mistaken for a gathering of local philosophers at a café, all in the name of compliance and grandiose plans for AI and mining expansion.

- Stablecoins, it appears, serve as the foundation of our monetary system, yet one must ponder: are new L3 protocols truly the panacea for our fractured liquidity dilemmas?

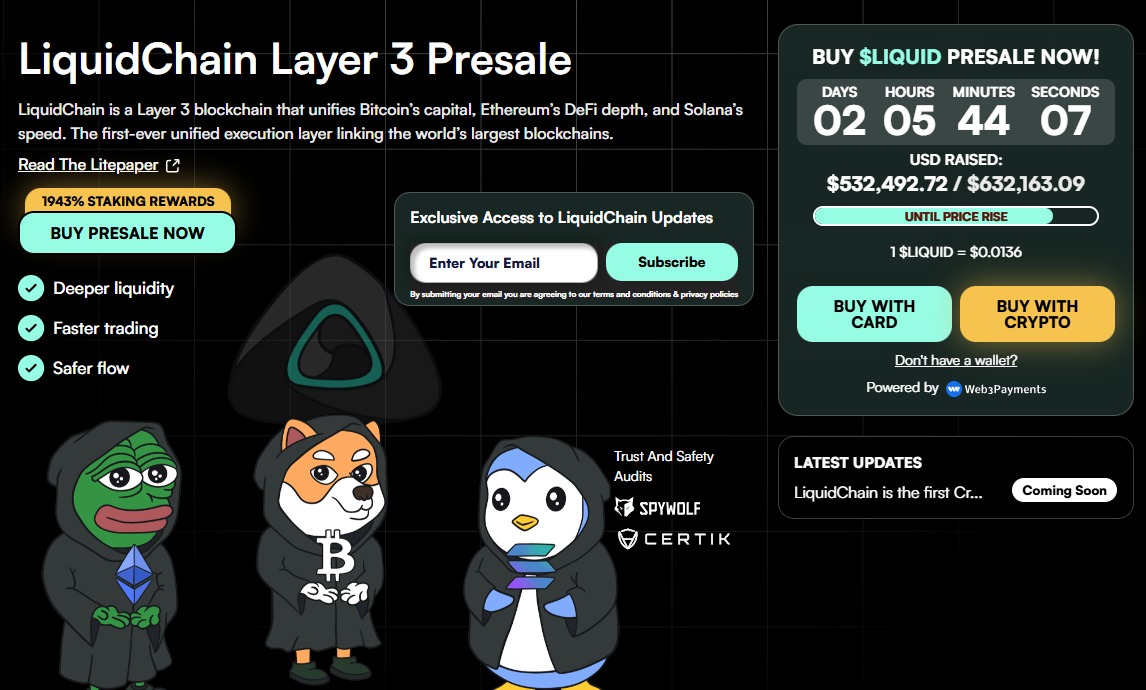

- Enter LiquidChain, an ambitious project seeking to weave together the disparate threads of Bitcoin, Ethereum, and Solana, promising simplification for both developers and users alike-ah, how noble!

- And lo! The presale of LiquidChain has amassed a sum exceeding $526k, like a beggar with newfound wealth, hinting at a genuine thirst for solutions amidst the quagmire of cross-chain fragmentation.

Tether, in what can only be described as an existential pivot, seeks to rewrite the very essence of its operational ethos. This titan of stablecoins, renowned for managing a staggering $118B market cap with a team smaller than a typical village’s ensemble of bakers, is finally embracing the notion of growth.

As articulated by the illustrious CEO Paolo Ardoino, the company intends to welcome approximately 150 new souls into its fold over the next eighteen months-an indication, perhaps, of a shift from sheer efficiency towards institutional entrenchment.

For years, Tether adhered to a philosophy of unyielding frugality, bordering on the ludicrous, where automation reigned supreme and yielded record profits amounting to an astounding $5.2 billion in net profit for merely the first half of 2024. Such is the irony of human endeavor!

Ah, but alas! The regulatory landscape grows ever more confining, much like a tight corset on an unyielding maiden. With the EU’s MiCA framework stirring to life and the U.S. casting an increasingly scrutinizing gaze, this hiring spree seems less a festival of ambition and more an act of defensive fortification.

Yet, let us not be deceived; this expansion transcends mere legalities and accounting. A significant portion of these newly minted roles aims at diversifying Tether’s interests in peer-to-peer communications, Bitcoin mining, and the enigmatic realm of AI infrastructure. The grand design? To solidify USDT as the global settlement layer while utilizing its formidable reserves to construct a parallel technological universe.

However, as Tether meticulously safeguards the issuance of digital dollars, a different malady afflicts the movement of capital: fragmentation. As liquidity languishes in isolated silos across the realms of Bitcoin, Ethereum, and Solana, the user experience deteriorates, creating an opportunity for infrastructure protocols yearning to unify these disparate ecosystems.

One such endeavor, LiquidChain ($LIQUID), emerges as a beacon of hope, gaining traction with its audacious strategy for cross-chain execution, striving to bridge the chasm between the issuance of assets and their actual interoperability.

LiquidChain: The Unifier of $BTC, $ETH, and $SOL Liquidity

The current state of decentralized finance resembles a cobweb of incompatible standards, where transferring value from Bitcoin to Solana necessitates navigating a labyrinthine route through centralized exchanges, perilous bridges, or convoluted wrapping mechanisms-each fraught with counterparty risks.

LiquidChain, however, postures itself as the antidote to this chaotic predicament. Functioning as a Layer 3 (L3) infrastructure, it aspires to amalgamate liquidity from the ‘Big Three’-Bitcoin, Ethereum, and Solana-into a singular execution environment.

Technically speaking, this represents a quantum leap beyond conventional bridging. LiquidChain champions what it dubs a ‘Deploy-Once Architecture,’ enabling developers to craft code that seamlessly interacts with assets across all connected chains without the burden of maintaining separate deployments. For our weary institutional traders and beleaguered DeFi users, this translates to ‘Single-Step Execution.’ No more hopscotch across chains; the protocol graciously abstracts complexity for you.

This emphasis on unification addresses a point of contention stablecoin issuers like Tether cannot rectify directly. While Tether ensures the dollar finds its place on the blockchain, LiquidChain guarantees that dollar flows effortlessly between a Solana DEX and an Ethereum lending protocol. The market’s hunger for such infrastructural plumbing is palpably evident in the project’s early statistics.

By the latest reports, the LiquidChain presale has already accumulated a princely sum of $532K, suggesting that the astute investors are indeed scavenging for opportunities that simplify rather than complicate the user journey.

Do explore the $LIQUID presale, should you fancy delighting in the absurdity of it all.

The Premiums of Infrastructure and the $LIQUID Token

Investors, in their ceaseless quest for stability, often gravitate toward “pick and shovel” plays during market expansions. While charming meme coins and whimsical governance tokens rely on the fickle winds of sentiment, infrastructure tokens such as $LIQUID derive their worth from the very utility of the network itself. The logic is elegantly simple: as cross-chain volumes ascend into the heavens, the protocol facilitating this volume captures the fees.

The tokenomics of LiquidChain are meticulously crafted to incentivize liquidity provision and safeguard the network’s Proof-of-Stake consensus. With the presale price currently resting at a modest $0.0136, early participants enter at a valuation reflective of the project’s embryonic stage-a stark contrast to those venture capital-backed L2s that launch, grandiose as a peacock, with multi-billion dollar fully diluted valuations (FDV), leaving mere retail investors to scramble for crumbs.

The risk? Ah, dear reader, it is always execution. Constructing a Cross-Chain Virtual Machine (VM) that verifiably handles transactions across disparate chains is no small feat, akin to building a cathedral in a day. Yet the potential reward is capturing the ‘transaction fuel’ market for a unified DeFi ecosystem. Should LiquidChain succeed in becoming the connective tissue for $BTC, $ETH, and $SOL, the demand for $LIQUID as the primary gas asset may decouple from the broader market tumult.

Should you wish to partake in this grand experiment, buy $LIQUID here, if your heart dares.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- XRP’s Little Dip: Oh, the Drama! 🎭

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- US & UK Team Up To Save Crypto – Or Just To Keep Up With Each Other?

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2026-02-09 12:37