So, What’s the Tea?

- China is on a mission to shove the US dollar off the stage in global trade, and honestly, it’s getting spicy! This is creating a global financial system that’s more fragmented than my last Tinder date’s personality.

- Meanwhile, the crypto world is having its own identity crisis-liquidity is scattered like confetti at a failed party. You’ve got Bitcoin, Ethereum, and Solana playing hard to get. Someone call for an interoperability therapist!

- But fear not! LiquidChain swoops in like a superhero, blending these ecosystems into one cozy Layer 3 environment. Developers can now deploy apps once and access liquidity everywhere, like a buffet for code.

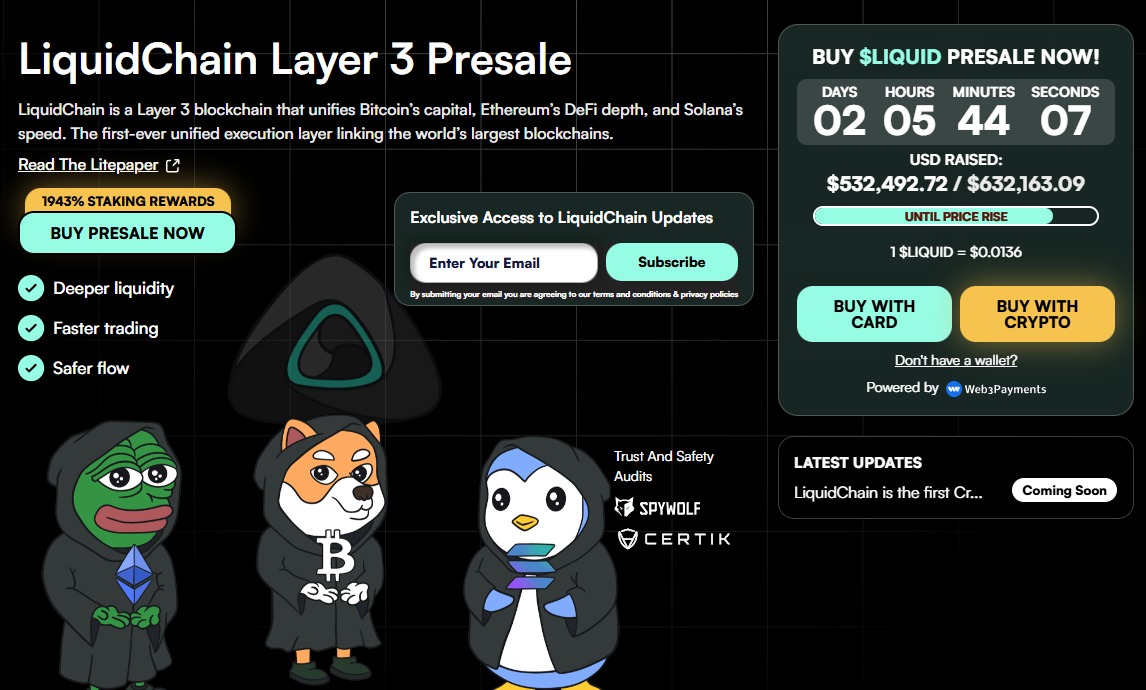

- And guess what? They’re already making waves, raising over $532K in their presale. Cha-ching!

The East-West financial drama isn’t just talk anymore; it’s a full-on geopolitical soap opera!

Recent gossip (a.k.a. data) shows China is kicking the US dollar to the curb for cross-border dealings. The People’s Bank of China is hoarding gold like a dragon and pushing BRICS partners to play nice with local currencies. The end game? Completely ghosting SWIFT.

This split is turning the global economy into a high school cafeteria: the dollar-loving West on one side, and the resource-rich East on the other. And as these financial “walled gardens” grow taller, liquidity gets trapped like a bad haircut, dragging down global trade execution. Naturally, everyone is crying out for a neutral, trustless settlement layer that doesn’t owe allegiance to a single central bank.

Ironically, as traditional finance splinters, crypto is facing its own version of this drama. Liquidity is stuck in its own little boxes, creating a mess that looks almost as bad as my last attempt at cooking.

Traditional finance is panicking and desperately searching for infrastructure to unite these capital pools. Enter LiquidChain ($LIQUID), the Layer 3 solution that’s ready to smash those blockchain borders like a wrecking ball.

LiquidChain: The Matchmaker for Bitcoin, Ethereum, and Solana!

Honestly, the current state of decentralized finance (DeFi) is like trying to organize a group project with people who don’t show up. A Bitcoin holder can’t easily snag yield on Solana without jumping through hoops that would make a circus performer cry. This creates ‘liquidity islands’ where capital just sits there, twiddling its thumbs.

Enter LiquidChain, introducing a Unified Liquidity Layer that acts as the connective tissue for all those heavyweights. Think of it as the social butterfly of the crypto world.

Unlike those clunky traditional bridges that rely on lock-and-mint mechanisms, which are basically open invitations for hackers, LiquidChain uses a nifty Layer 3 architecture. It’s the universal translator for value instead of a passport control nightmare.

The protocol’s Cross-Chain Virtual Machine (VM) lets developers channel their inner lazy genius with a ‘Deploy-Once Architecture.’ Instead of rewriting code three times, they can launch a lending platform on LiquidChain L3 and instantly connect with users across all networks. Goodbye technical friction; hello streamlined efficiency!

Presale Hits $532K as Investors Dive into Cross-Chain Infrastructure!

The market is clearly hungry for infrastructure plays that pack a punch.

According to the latest scoop, LiquidChain’s presale has raked in a whopping $532K, with the native token ($LIQUID) priced at a cheeky $0.0136. This cash influx suggests the smart money is betting on a 2025 narrative where users don’t need to know which blockchain they’re using, just that it works. Kind of like dating!

Investors are eyeing the utility of $LIQUID within this ecosystem. It’s not just another speculative asset; it’s the fuel for transactions in the Cross-Chain VM and a way to stake liquidity. LiquidChain is here to save you from the user experience nightmare of juggling multiple wallets and gas tokens. It’s basically the back-end superhero for the next wave of DeFi apps that regular folks can actually use.

The main risk? Adoption velocity, of course! But hey, the presale metrics look promising. As the macro scene shatters further under China’s de-dollarization push, the need for a protocol that unites the biggest liquidity pools is sharper than ever.

Get your $LIQUID fix here!

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

2026-02-09 16:44