In a market that resembles a crowded bazaar where the cobbles tremble from too much speculation, a sharp wave of bitcoin losses rattled the traders as if a wind from a bureaucratic ledger blew through the doors. Yet Cryptoquant, that stern clerk of numbers, asserts that the data reveal a market still wandering in search of a genuine bear-bottom, like a peasant hunting for a pension in a foggy alley.

Bitcoin Downturn Deepens, but Cryptoquant Says Capitulation Isn’t Complete

Cryptoquant’s latest Institutional Insights report, published Feb. 12 and titled “Patience: Bear Market Bottoms Take Time to Form,” argues that recent volatility has not yet produced the structural reset typically seen at cycle lows.

According to researchers at cryptoquant.com, bitcoin holders realized $5.4 billion in daily losses on Feb. 5, the largest since March 2023 and larger than losses recorded after the FTX collapse. The analysts note that while the headline number looks dramatic, monthly cumulative realized losses in BTC terms sit near 0.3 million BTC – far below the 1.1 million BTC recorded at the end of 2022’s bear.

In other words, Cryptoquant’s researchers contend the washout may not be complete yet, as if the city radiator refuses to cool and the steam refuses to vanish from the street.

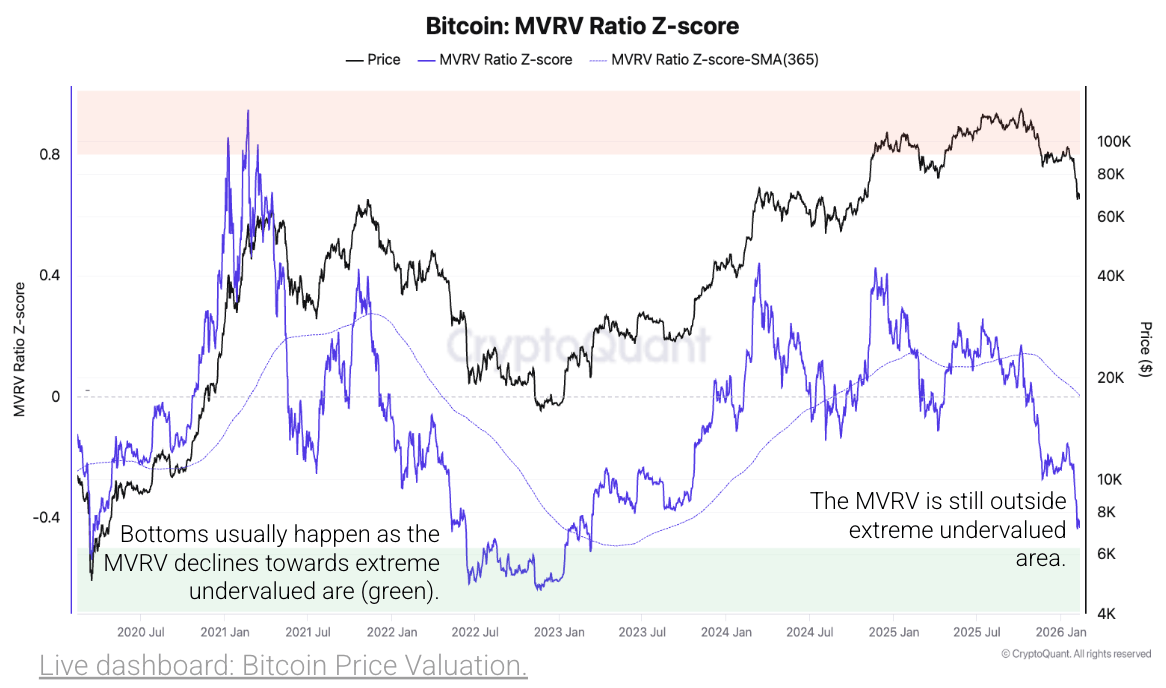

The analytics firm’s valuation metrics reinforce that view. The MVRV ratio, a key fair-value gauge, remains outside the “extreme undervalued” zone historically associated with durable bottoms. Cryptoquant’s report adds that when MVRV does enter that zone, markets typically require four to five months of base-building before a sustained recovery begins.

Researchers also highlight the NUPL indicator, which measures unrealized profit and loss. Historically, the market strategists say, price bottoms form when holders face roughly 20% unrealized losses – a threshold not yet reached.

Long-term holder behavior tells a similar story. The report’s data show long-term holders are currently selling near breakeven, or 0% profit, down from triple-digit gains in October. Prior bear market lows, researchers note, coincided with long-term holders enduring 30% to 40% losses.

Even Cryptoquant’s proprietary Bull-Bear Market Cycle Indicator remains in the Bear Phase rather than the “Extreme Bear Phase” that historically marks the start of prolonged bottoming periods. Researchers emphasize that extreme bear conditions often persist for several months before price stabilizes.

Perhaps most notably, the analysts estimate bitcoin’s realized price near $55,000 – a level that has served as major support in prior cycles. Bitcoin currently trades roughly 18% above that mark, while past bear markets saw prices fall 24% to 30% below the realized price before forming a base.

Cryptoquant’s conclusion is blunt: bear market bottoms are rarely one-day events. According to the Institutional Insights research team, durable lows are time-intensive processes, not single-session capitulation spikes.

For traders hunting a dramatic “all clear” signal, the report’s message is less cinematic and more patient: Markets may still need time to finish the job.

FAQ

- What did Cryptoquant say about recent bitcoin losses? Cryptoquant reported $5.4 billion in daily realized losses, but said cumulative data do not yet reflect full capitulation.

- Is bitcoin in an extreme bear phase according to Cryptoquant? No, Cryptoquant’s Bull-Bear Market Cycle Indicator remains in the Bear Phase, not Extreme Bear.

- What level does Cryptoquant identify as key support? Cryptoquant estimates bitcoin’s realized price near $55,000.

- How long do bear market bottoms usually take, per Cryptoquant? Cryptoquant says historical bottoms typically require several months of base formation.

Read More

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2026-02-13 01:47