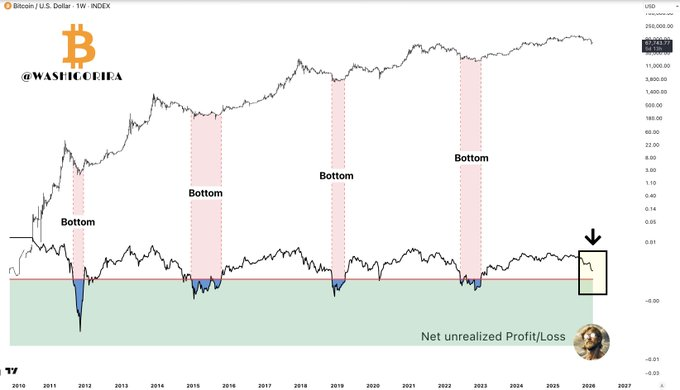

So, here we are again, folks, watching Bitcoin do its best impression of a high-stakes game of tug-of-war between the cautious on-chain crowd and the corporate big shots who seem to be buying in bulk like it’s the last day of a big clearance sale. According to our buddy NUPL, most folks haven’t hit rock bottom yet, but let’s be honest, they’re probably feeling like they just lost a game of Monopoly.

NUPL Says Capitulation Incomplete

Historically speaking, the real fun starts when most holders are buried in unrealized losses, which is basically financial purgatory. That’s when fear runs rampant and people start selling their prized possessions-like that limited edition Beanie Baby you thought would fund your retirement. But based on current NUPL readings, it looks like we’re not quite there yet, so hang tight!

Compared to past cycles, NUPL is still strutting around with its head held high. In non-technical terms, this means we’re likely still in the “I’m fine, everything’s fine” phase before reality hits like a ton of bricks. The Bitcoin price chart suggests we’re still waiting for that sweet, sweet moment when profitability takes a nosedive and everyone panics. Spoiler alert: we’re not there yet.

Sure, sentiment might feel like a soggy bag of chips right now, but structurally, most holders haven’t hit the panic button just yet. Good news for them.

Saylor’s Strategy Buys the Dip

Meanwhile, in the land of corporate bravado, Michael Saylor is out here making moves like he’s buying Pokémon cards at recess. He just scooped up 2,486 BTC for a cool $168.4 million at around $67,710 each. That brings his total to 717,131 BTC, acquired for approximately $54.52 billion at an average of $76,027 per coin. Yes, that’s billion with a “B.” If that doesn’t scream confidence, I don’t know what does!

Strategy has acquired 2,486 BTC for ~$168.4 million at ~$67,710 per bitcoin. As of 2/16/2026, we hodl 717,131 $BTC acquired for ~$54.52 billion at ~$76,027 per bitcoin. $MSTR $STRC

– Michael Saylor (@saylor) February 17, 2026

So, it seems like someone out there really believes in the long-term potential of Bitcoin, even if the rest of us are just trying to figure out how to buy groceries without crying. But hold your horses! Just because one big player is diving in doesn’t mean we’ve reached the magical market bottom. Remember, institutional buying can happily coexist with extended drawdowns-kind of like that friend who always insists on ordering the most expensive thing on the menu.

Meanwhile, the BTC/USD structure is still giving off major “uncertain vibes,” like a first date where neither party knows if they should go in for the handshake or the hug.

Bitcoin Price to $50,000 in Play?

And just when you thought the drama couldn’t get juicier, there’s chatter about the monthly RSI dipping below 40. Under the four-year cycle theory, that could set the stage for a thrilling potential bottom of $50,000 by 2026. Because who wouldn’t want to relive the thrill of watching their investment value plummet?

Now, let’s be clear: just because the monthly RSI is looking a little weak doesn’t mean we have a guaranteed ticket to a specific downside target. It’s more like a warning sign for trend fatigue, which usually signals a prolonged corrective phase rather than a quick bounce-back like my New Year’s resolution to hit the gym (spoiler: it didn’t last).

So, where does that leave Bitcoin? On one hand, NUPL is waving its flag, insisting that true capitulation is still playing hard to get. On the other, we have big-time buyers stepping in around $67,000 while some analysts are throwing around $50,000 as a potential support zone. Basically, Bitcoin is caught in a classic tug-of-war between cautious accumulation and incomplete pain-a thrilling phase where conviction and caution are stuck in a dance-off.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Tina Fey’s Take: Crypto Prices Dive Before Powell’s Big Speech 📈💰

- PUMP Pumped or Plundered? Traders Beware the Bull! 🤦♂️

- Crypto Circus Escalates: The Wild Ride After Ethereum’s $4.5K Breakout 🎢🚀

- Crypto Chaos Calms Down, Congress Prepares for “Crypto Week” – Get Ready for Some Serious Coin Talk! 💸📈

- Silver Rate Forecast

- EUR VND PREDICTION

- Pump.fun’s $615m Shakedown: Crypto’s New Gold Rush!

- XRP’s Wild Thrilling Orphan Adventure to $70? Find Out!

2026-02-17 17:18