Ah, ever since the illustrious Bitcoin has tumbled beneath the hallowed threshold of $100,000-an event that sent tremors through the collective psyche of crypto enthusiasts-the atmosphere has shifted from a mild curiosity to a full-blown existential crisis. The fall below $90,000 has not merely nudged sentiment; it has catapulted it into a state of palpable dread. Traders, those gallant souls with their unwavering optimism, are now donning the cloak of pessimism and murmuring dark prophecies of an impending abyss.

As volatility dances like a madcap performer at a village fair, confidence evaporates like morning dew, and we find ourselves once again drawing eerie parallels to the infamous nadir of 2022. Gather ’round, dear reader, for I present to you the key reasons why our beloved crypto market may well be sauntering toward yet another episode of dramatic decline.

The Great Exodus of Capital

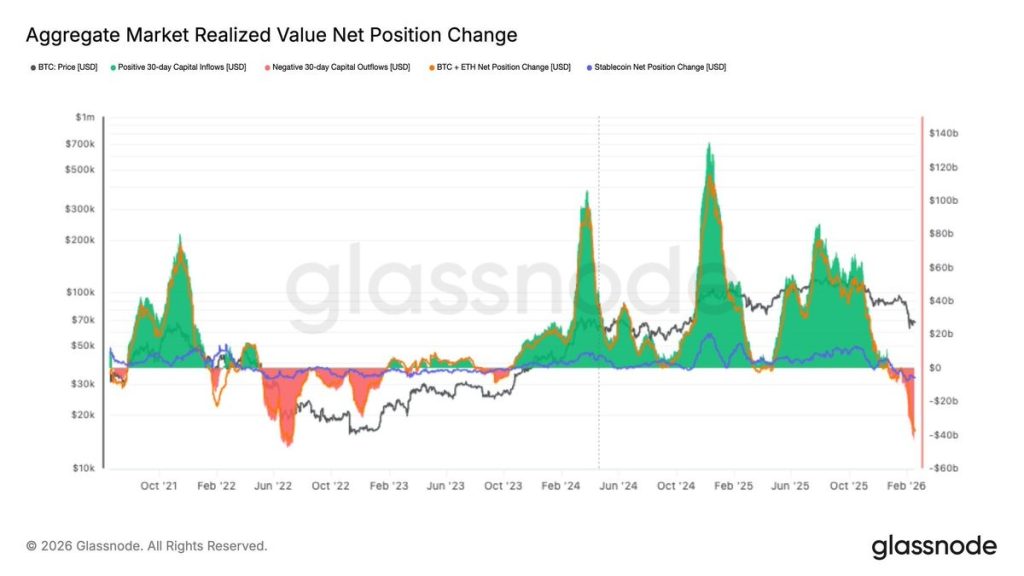

While the BTC price has plummeted nearly 50% from its glorious peak above $126K, many still refuse to accept this as the dawn of a bear market. Indeed, some optimistic participants entertain the fanciful notion that a swift recovery lurks around the corner, perhaps just behind that bush over there. Yet, the wise sages at Glassnode proffer data suggesting an uncanny recurrence of the patterns reminiscent of 2022.

The chart above illustrates a familiar lament: a persistent outflow that echoes the somber tones of the 2022 bear market. Since the month began, BTC has taken a downward turn, while inflows have dwindled to levels reminiscent of a bygone era of despair. Even the stablecoin inflows have decided to take a vacation, leaving us all wondering where they might have gone.

The Altcoin Sell-Pressure Reaches a Melodramatic Climax

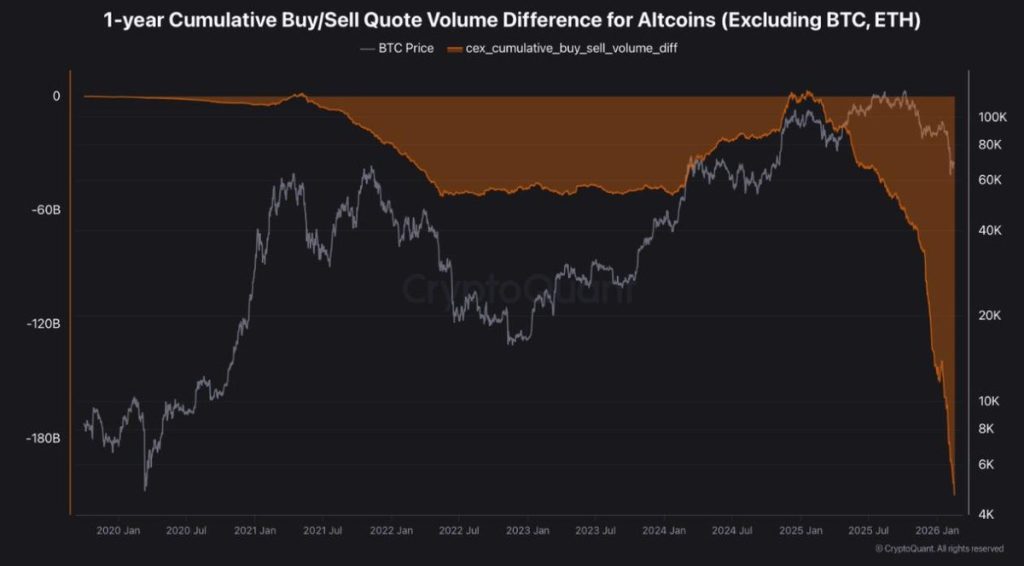

This particular chart reveals the one-year cumulative buy/sell volume difference for altcoins, with Bitcoin and Ethereum seeking refuge in the background. The orange hue denotes the net buying versus selling pressure on centralized exchanges, and as it trends southward, we are treated to the delightful spectacle of sustained net selling in altcoins.

Recently, the metric has dramatically nosedived into the depths of negativity, marking this as one of the more theatrical sell-offs of recent years. It hints at heavy distribution or possibly a dramatic surrender across the altcoin market. Curiously, similar readings in the past have coincided with broader market bottoms, or perhaps late-stage dramatic farewells. This sharp descent invokes a sense of risk aversion, a withdrawal of liquidity, and a surge of fear-conditions which seem to flourish during periods of significant market resets.

The Burning Question: When Will the Crypto Markets Experience Their ‘Reset’?

This charming chart showcases Bitcoin’s long-term price cycles juxtaposed against the revered 200-week moving average (that green line we all adore), a bastion of support throughout every major bear market. The shaded red zones serve as markers for the tumultuous years of 2011, 2014, 2018, 2022, and the potential melodrama of 2026.

Historically, Bitcoin has shown a penchant for retracing towards-or even daring to dip slightly below-the 200-week MA during tumultuous corrections before establishing a macro bottom. Each encounter with this sacred level has signaled high-probability accumulation zones for the long-suffering traders. Current indications suggest we are once again approaching this critical support region. Should the 200-week MA hold, we might just witness the groundwork for the next grand expansion phase. However, should it falter, we could very well see a deeper structural upheaval, heralding a spectacular ‘reset’ of the crypto market, followed by the inevitable phase of recovery.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- PUMP Pumped or Plundered? Traders Beware the Bull! 🤦♂️

- Tina Fey’s Take: Crypto Prices Dive Before Powell’s Big Speech 📈💰

- Crypto Chaos Calms Down, Congress Prepares for “Crypto Week” – Get Ready for Some Serious Coin Talk! 💸📈

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Silver Rate Forecast

- Bitcoin’s Golden Quest: 20 Years or a Midnight Snack?

- ALGO PREDICTION. ALGO cryptocurrency

- LINK Soars Higher: Whales Go Wild, Market Goes Bananas! 🐳🚀

2026-02-18 17:07