Bitcoin, ever the drama queen, has once again decided that $100,000 is a number too big to handle. It slipped below that mark with the grace of a toddler in a tutu, and suddenly the entire crypto market is a group chat of doomscrolling. “Neutral” sentiment? That’s what you say before you accidentally sell your house for $200. Now we’re all just sitting here, sipping lukewarm coffee and wondering if our portfolios are auditioning for a role in Breaking Bad.

Volatility, our new best friend (or nemesis, depending on your caffeine intake), has ramped up to levels that make a rollercoaster look like a nap. Comparisons to 2022 are popping up like dandelions in a hurricane. Why? Because nothing says “reassurance” like watching history repeat itself while clutching a bag of Skittles. Here’s why the market might be prepping for its next identity crisis.

Money’s Gone to Paris (And Left Without Saying Goodbye)

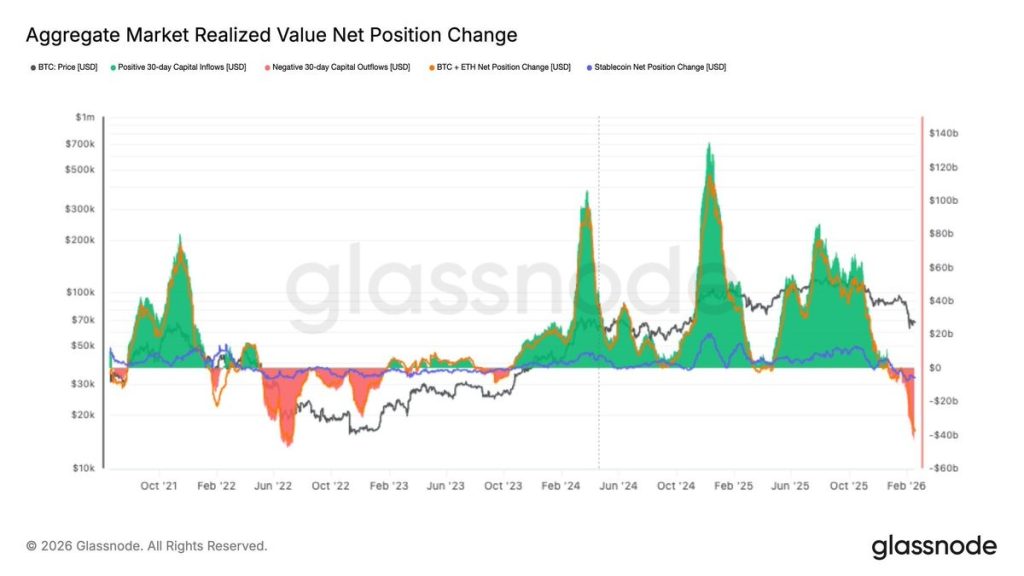

Bitcoin’s price drop of nearly 50% from its all-time high is being called a “bear market” by people who’ve never owned a bear. Meanwhile, Glassnode data insists we’re reliving 2022 like it’s a rom-com we’ve seen 17 times. The chart shows crypto capital fleeing faster than a vampire in daylight. If you blinked, you might’ve missed the 30-day inflow plummeting to levels that make a black hole look like a savings account.

Stablecoins, those supposed paragons of stability, are now flowing out with the enthusiasm of a teenager avoiding their parents’ questions. It’s a party, and everyone’s bringing their bags-and leaving them at the door.

Altcoins: The Original Sell-Off Sensation

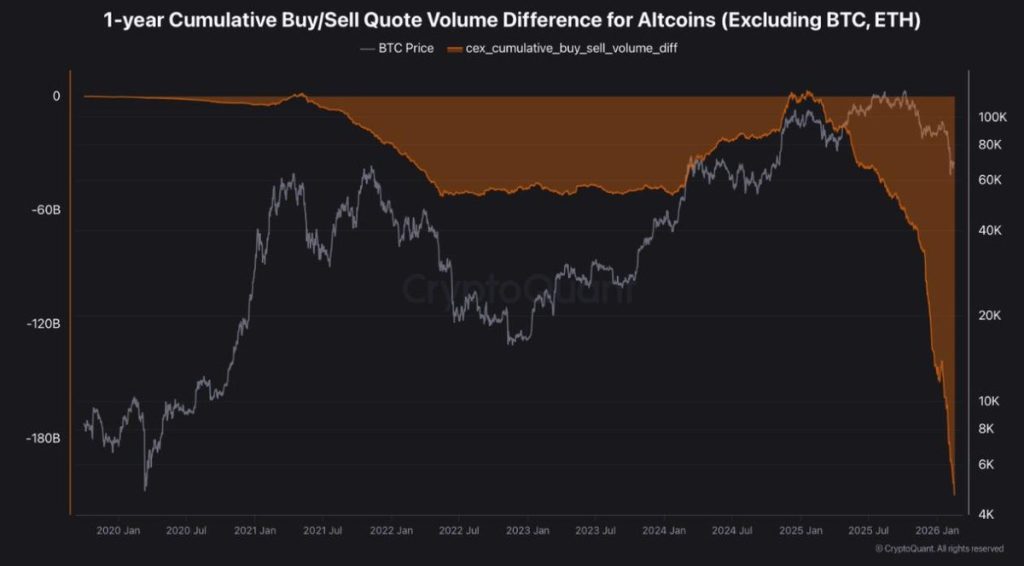

This chart, which I’m sure was drawn by a sleep-deprived intern, tracks altcoins’ buy/sell volume. The orange area, which could double as a traffic cone, shows net selling pressure. And lately? It’s plunged into negative territory so deep it could use a ladder to climb out. It’s like watching your ex’s new partner’s Instagram stories-chaotic, brief, and best viewed with a sense of dread.

Capitulation, they call it. Or maybe it’s just the market admitting defeat after a long day of pretending it’s not broke. Either way, it’s a sign that even the most optimistic investor now sounds like a therapist: “Let’s talk about your expectations.”

When Will the Reset Party Start?

Bitcoin’s long-term cycles, plotted against the 200-week moving average, look like a connect-the-dots puzzle drawn by a drunkard. The red zones mark past bear markets, including 2022 and the upcoming “2026 bear phase” (a phrase that should be trademarked). Historically, Bitcoin has always stumbled toward this line like a drunk sailor, only to bounce back and pretend it never fell.

If the 200-week MA holds, it’ll be the crypto market’s version of a standing ovation. But if it breaks down? Well, that’s when we all get to play “What If?”-a game I’ve never been good at, but here we are.

So, is this the reset we’ve been waiting for? Or just another episode in crypto’s ongoing soap opera? Either way, I’m packing my popcorn and hoping someone remembers to cash out before the next plot twist.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- PUMP Pumped or Plundered? Traders Beware the Bull! 🤦♂️

- Tina Fey’s Take: Crypto Prices Dive Before Powell’s Big Speech 📈💰

- Crypto Chaos Calms Down, Congress Prepares for “Crypto Week” – Get Ready for Some Serious Coin Talk! 💸📈

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Silver Rate Forecast

- Bitcoin’s Golden Quest: 20 Years or a Midnight Snack?

- ALGO PREDICTION. ALGO cryptocurrency

- LINK Soars Higher: Whales Go Wild, Market Goes Bananas! 🐳🚀

2026-02-18 18:12