Since the beginning of June, Solana has been as exciting as a wet weekend in Wiltshire, trading sideways and consolidating within a narrow range. The altcoin has faced strong resistance at $158.80 and found support at $141.97, making several unsuccessful attempts to break out in either direction. 🤷♂️

However, this period of price stagnation has presented a buying opportunity for long-term holders (LTHs), who are taking full advantage, much like a second cousin at a buffet. 🍽️

Solana Long-Term Holders Shrug Off Weak Price Action with a Yawn

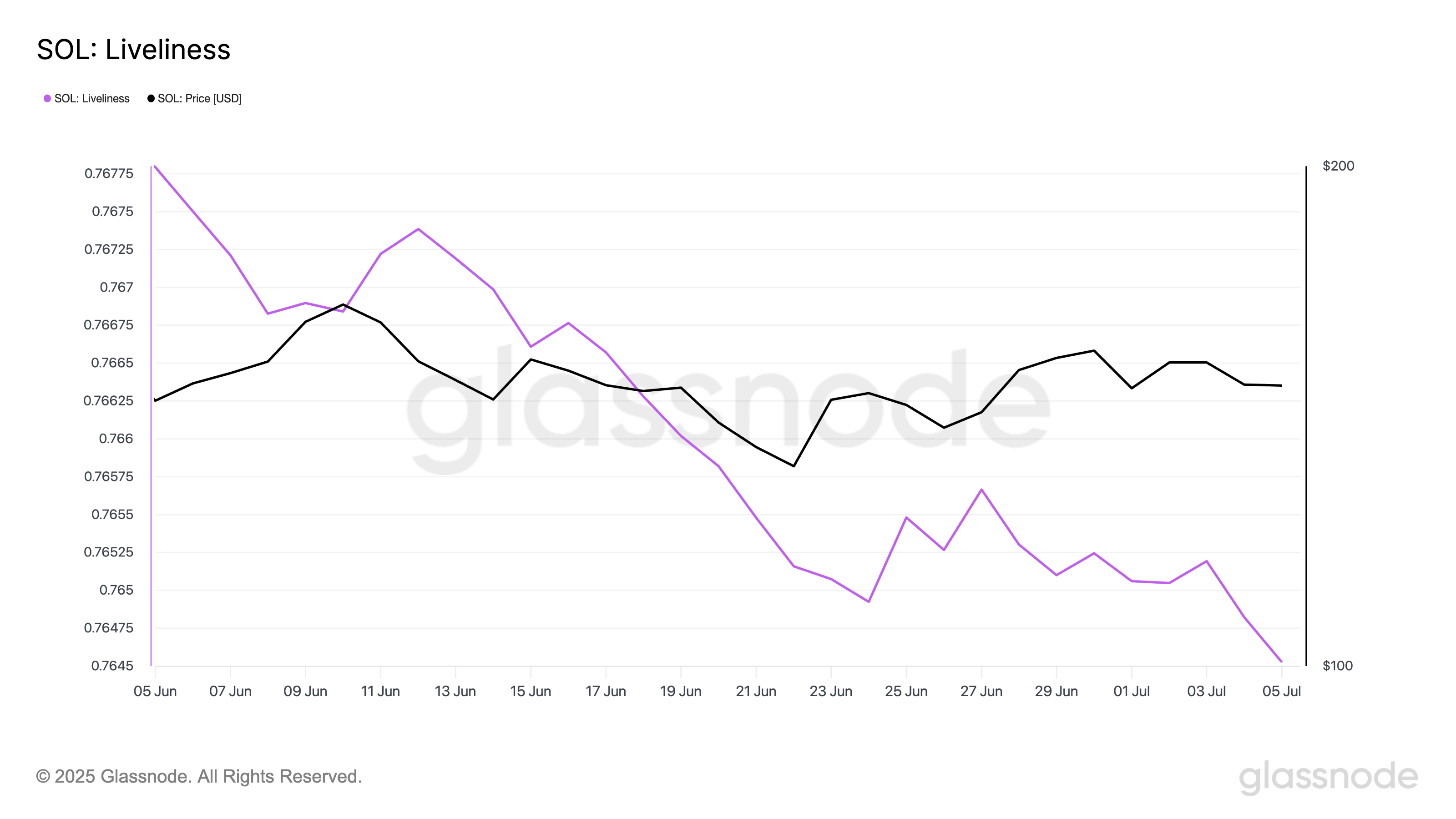

Glassnode’s data shows that SOL’s Liveliness has trended downward since climbing to a 90-day high on June 4. This metric, which tracks the movement of previously dormant tokens, fell to a 30-day low of 0.764 yesterday, indicating a notable decline in sell-offs among SOL’s LTHs. It’s as if they’ve all decided to take a collective nap. 😴

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it climbs, it suggests that more dormant tokens are being moved or sold, often signaling profit-taking by long-term holders. Conversely, when Liveliness declines, it indicates that LTHs are moving their assets off exchanges and opting to hold, much like a miser guarding his gold. 🏦

For SOL, this trend suggests that long-term holders remain confident in the prospect of a near-term rally and show little concern over the coin’s current lackluster performance. They’re as unperturbed as a cat in a sunbeam. 🐱

Continued accumulation from these investors could build the foundation for a bullish breakout once market sentiment shifts in a more favorable direction. Or, as they say, when the stars align and the moon is full. 🌕

Solana Holders Remain “Hopeful” Despite the Doldrums

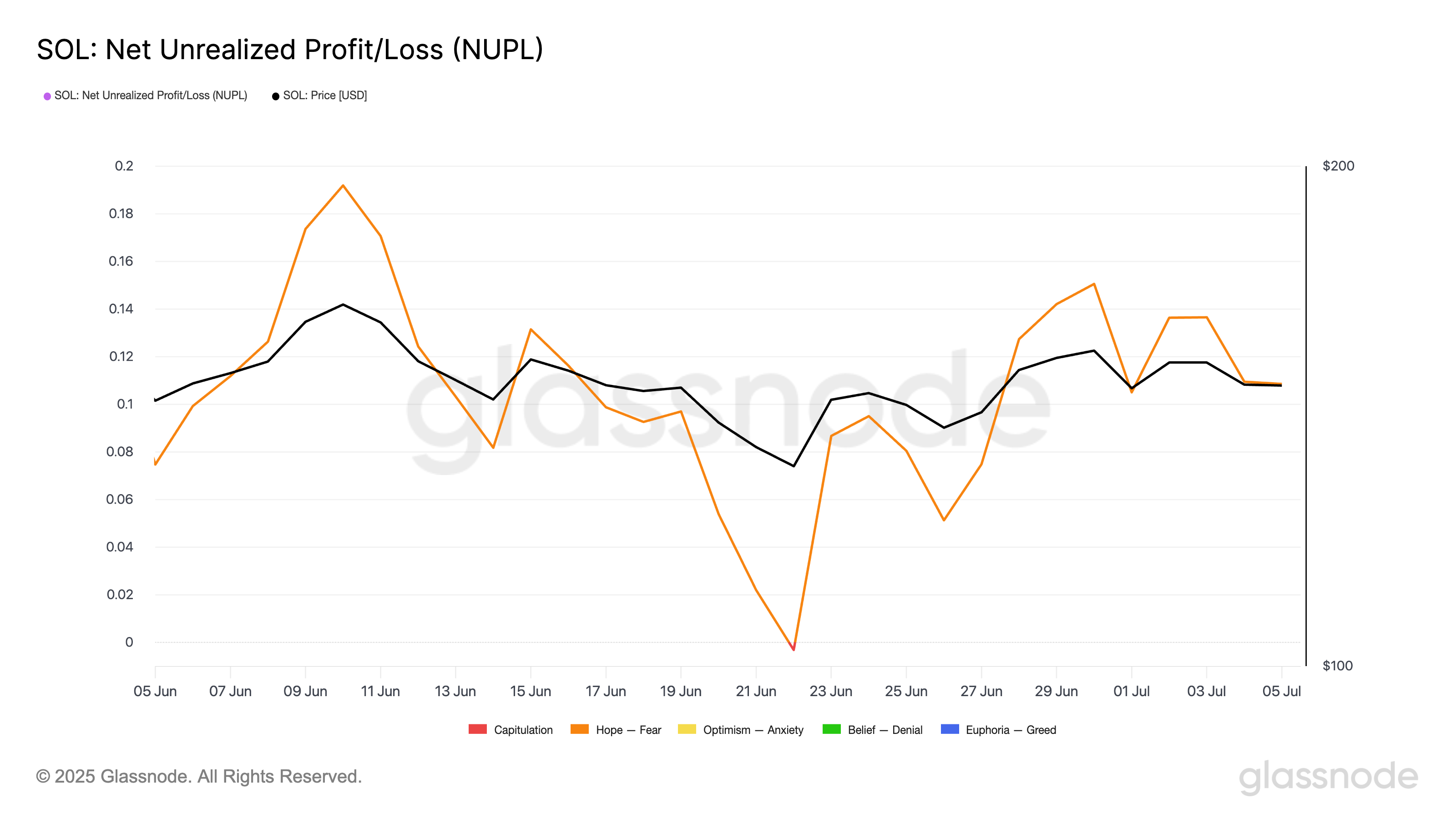

Moreover, readings from SOL’s Net Unrealized Profit/Loss (NUPL) confirm the likelihood of a bullish breakout. According to Glassnode, the metric has remained within the “hope” zone over the past 30 days. At press time, it is at 0.108. It’s as if they’re all holding their breath, waiting for the next big thing. 🤞

The NUPL tracks the difference between the total unrealized gains and losses of investors based on the price at which coins were last moved. It indicates whether holders are, on average, in profit or loss and how likely they are to sell. The “Hope” zone suggests that while many investors are back in profit, they have not yet begun taking profits aggressively. Instead, they are holding with the expectation of further upward momentum. It’s a bit like waiting for the bus that’s always five minutes late. 🚍

This trend signals cautious optimism among SOL coin holders and often marks the early stages of a potential bullish trend. Or, as they say, the calm before the storm. 🌩️

SOL Bulls Eye $170 as Long-Term Holders Tighten Their Grip

At press time, SOL trades at $148.06. If the coin’s LTHs double down on their accumulation and historical patterns hold, this could propel SOL’s price above the resistance at $158.80. It’s like a game of chess, where the long-term holders are the grandmasters, and the short-term traders are the pawns. 🏦♟️

A successful breach of this long-term resistance zone could lay the groundwork for a rally toward $170. However, if selloffs strengthen, SOL eyes a break below the support floor at $141.97. In this case, its price could fall to $123.49. It’s a bit like a rollercoaster, but with less excitement and more nausea. 🎢🤢

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Brent Oil Forecast

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 🚀 Ethereum’s Grand Farce: Developers Flock, Bitcoin Yawns, Solana Whirls! 🎭

- ARB PREDICTION. ARB cryptocurrency

- Is OKB’s Price Surge Just a Mirage? Find Out Why It Might Plummet to $65! 😱

- Solana’s $200 Gambit: Will This Blockchain Darling Finally Deliver? 🚀

2025-07-06 14:42